3.2 Human Capital - How to Turn Your Income Into Financial Freedom

The most important ignition key to your escape - you

Missed last week? Read it here, or see the full escape map here

TL;DR:

Your next greatest asset is your income. Every pound you invest earlier compounds far more powerfully than one invested later.

Small boosts matter. A one-off lump sum (£10K) or just £100 extra per month can add tens of thousands to your nest egg over 30 years.

Inflation eats returns. Always convert future values into today’s money, or use real return growth rates (E.g a 8% nominal rate is about 5-6% real)

Real income → real freedom. Even modest raises, side gigs or expense cuts fuel exponential growth if invested consistently.

How did the Allies overcome the might of the German war machine during the D-Day operation of 1944?

It was the largest amphibious invasion in history - a bold move that positioned the Allies as underdogs, coming from a vulnerable position (on the water) and facing a deeply entrenched Nazi regime along the heavily fortified French coastline.

Success came partly from the meticulous execution of one of the most complex military operations ever devised: the coordinated transport of huge numbers of troops, weapons, supplies, and fuel across the volatile English Channel under constant threat.

But the true turning point? Sheer numbers.

The Allies didn’t just match the German forces - they overwhelmed them with men, machines, and firepower.

The allies threw

156,000 troops

5000 ships

96,000 aircraft

at the German war machine. 1

Compare that to enemy forces numbering just 50,000 troops, 138 ships and 13,983 aircraft. 23

They won not just by being better - but by bringing more.

Bringing More Capital To Grow Wealth

In the same way, you don’t need the most intricate financial plan ever devised.

You don’t need the perfect plan. You need scale.

You need numbers. Early and often.

The more money you can give to your plan, as early and as regularly as possible, the faster your wealth engine will compound and accelerate. It’s not magic. It’s mathematics.

And it works given enough time, your other key asset.

But where does that money come from?

For most of us, there’s only one source:

Us. Our ability to work, earn, and create income.

That’s your most underrated asset - your human capital.

Sending More Troops to the Financial Front Line

Building your wealth and how soon you can escape the money trap will depend in large part on how much you fund the earlier in your journey.

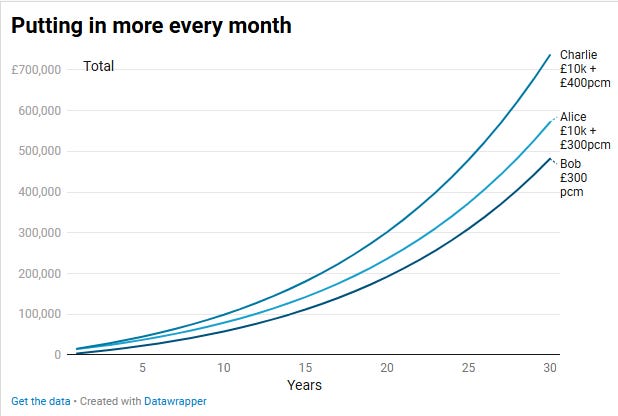

Consider two people - Alice, and Bob. They are both 30 years old. They both have the same job, on the same salary. Both decide to start buying the same asset, a global index fund (more on what this is in upcoming posts).

Initially they both invest £300 a month. Then every year, they increase that amount by 3% in line with inflation. They expect a small pay rise of 3% each year.

So the next year they invest

Even a small 3% increase each year can fuel exponential growth.

The fund gives average yearly nominal (before inflation) returns of 7%. (Although there will be lots of big rises and falls - more on this later).

Alice decides to buy an initial £10,000 that she had in cash savings.

Bob hesitates - £10,000 feels like a lot to hand over, so he starts from zero, not wanting to risk too much.

How much would each have after 30 years?

Alice: £571,211

Bob: £481,438

These are absolutely astonishing amounts. All from what boils down to a few hundred pounds per month.

That’s the power of compounding.

But how do they compare with each other?

Alice is not £10,000 ahead because of her initial investment - she is nearly £90,000 ahead.

Why?

Because that initial £10,000 was left to compound and accelerate for 30 years.

How could you supercharge the growth even more?

Charlie Enters the Fray

Charlie decides he wants in. He puts in £10,000 of savings at the start,

and he invests a little more, £400 a month. What happens with just £100 more?

Alice: £571,211

Bob: £481,438

Charlie: £736,241

Charlie’s extra buys of just £100 per month, over 30 years gets him

£165,030 more than even Alice,

and over £250,000 more than Bob.

That’s the power of compounding and time.

Adjusting for Inflation: The Real Value of Wealth

Inflation is a cunning enemy.

It doesn’t crash through the door — it lurks behind you at every turn, quietly chipping away at what wealth you’ve built.

The numbers above feel big. They should.

But they’re future numbers. Not today's.

And the future doesn’t spend the same.

Take Charlie. He’s projected to have £736,241 in 30 years. But what if inflation ticks along at 3% a year? That will erode it’s value.

In today’s money, that money will feel like:

This is Charlie’s real value - what that money is worth today.

That’s the number that matters.

That’s how you need to think about the future — in terms of today.

On the 4% rule, Charlie could draw down:

Each year, every year, in real terms - today.

What would our real returns and 4% withdrawal look like for our three escapees?

Real Returns and Income after 30 years

With an earlier lump investment, and slightly higher regular amounts, Charlie is able to take 53% more income each year than Bob from his assets (£12,133 vs £7,934). A huge difference from a few seemingly small changes.

The Early Bird Escapes the Trap Sooner

When you buy assets at the beginning of your journey, they get more time to compound. And compounding is a strange thing - it’s slow at first… then sudden.

So how do you bring more firepower to the front lines?

Think about ways to increase your income, even slightly. That extra fuel now can bring your escape date forward by years. Could you:

Go for a promotion at your current job?

Move companies and negotiate a higher salary?

Pick up freelance or consulting work?

Use a hobby or skill to earn something on the side? (Tutoring, design, writing, fitness coaching…)

Even temporary boosts like bonuses can be reinvested and compounded over time.

Of course, spending less is part of the picture too. Could you trim a few expenses to free up £25 or £50 a month? Small amounts, invested consistently, become thousands.

It just takes time.

This doesn’t have to be huge. Working more hours can risk dragging you back into the Work Trap.

Balance is key.

We’ll talk about budgeting soon — and we haven’t even picked our financial weapons yet. But for now, just remember:

It’s not about brilliance. It’s about consistency.

Every early pound is extra firepower.

And every extra month is more time to let compounding do the work for you.

Because this isn’t just about saving money.

It’s about building an arsenal strong enough to buy your freedom.

Recap

Your ability to earn money is a massive asset.

Every pound you invest early works harder than one invested later.

Even modest increases in monthly contributions (or small lump sums) can lead to massive long-term gains.

The key: use your income to buy assets that work for you.

But what actual income earning assets can we buy? Time doesn’t earn anything, we need assets that actually go up in value…

Up Next: Financial Assets Overview: A Complete Guide to the Main Asset Classes

We do an overview of what assets you can buy, what they are good for, and how they help us escape

Looking Ahead

How much are you bringing? We will model more accurately our regular investing plan in post 4.6 with the escape calculator. But for now:

If you haven’t already - go back and fill out your Asset Map and Pension Mapper

How much is your employer putting into a pension? Both as a percentage and as a real £ amount?

How much are you contributing? Are you buying assets in any other accounts? an ISA? A general investment account?

What is it invested in? Stocks? Bonds? Cash? Property? A mixture?

If it’s a defined benefit pension, how much are you and your employer putting in? Can you get a projection of your expected annual income? Ask them — it's your money.

Now take a moment:

Open up the investment calculator and model the impact of regular investing over 10, 20, 30 years.

Use your current employer and employee contributions to a pension. How much extra could you invest?

Use real numbers (stocks return around 5-6% real per year, bonds 2-3%)

How close would that get you to your escape number using a 4% rule?

Can you now see the power of using your human capital — your income, your effort, your time — to fuel the escape?

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources - calculators, mappers, and guides to help you escape the money trap.”

https://www.dday.org/learn/

https://apnews.com/article/d-day-invasion-normandy-france-nazis-07094640dd7bb938a23e144cc23f348c

https://www.history.navy.mil/research/library/online-reading-room/title-list-alphabetically/g/gaf-invasion-normandy.html#:~:text=9%2C151%20day%20fighters%2C%20fighter%20bombers,allied%20total%20of%2096%2C000%20planes.

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.