3.1 Time and Compounding: The Ultimate Wealth-Building Duo

The tools you need to Escape the Money Trap begin with the one resource that's free..

Missed last week? Read it here, or see the full escape map here

“The magic of compounding returns is the biggest mathematical discovery of all time”

Benjamin Graham

You Might Be Behind. That Doesn’t Mean You’re Out

You’ve seen your starting point, and you might feel like you’re behind.

In the 1972 Olympic 800-meter final, Dave Wottle looked like a man out of his depth.

At 200 meters, he was dead last. At 400, still trailing. With just one lap to go, commentators had written him off.

But Wottle knew something the others didn’t: the race wasn’t won in the first half. It was won by how you finished.

He didn’t panic. He didn’t sprint too early. He trusted his strategy.

He knew he still had time.

And then - in the final 200 meters - he surged. Not in desperation, but with precision. He passed one runner, then another. And with just meters to go, he edged into first, winning Olympic gold by 0.03 seconds.

It wasn’t flashy. It was perfectly timed.

In finance, as in running, you don’t have to lead from the start to win. You just need a plan - and to stick with it long enough for compounding to kick in.

Many people feel behind. Too late. Too far back.

But compounding has a strange power: it’s not linear. It’s exponential. The most important returns come at the end - when momentum takes over.

So if you’re still trailing… don’t despair.

Sometimes the winners are the ones who finish strong.

You already own two of the most powerful assets in the wealth-building world.

They didn’t cost you a penny.

And they’re working in your favour — right now.

Why Time Is on Your Side

Assuming you want to live more off your assets than from your income sometime around age 60 (or earlier, or later if you decide), if you are already 40, then you have at least 20 years of potential compounding ahead of you. If you are 30, then that’s 30 years.

Both of these time periods are long enough for some phenomenal things to happen, with the wonder of compounding.

What can happen over such periods? Let’s take an example from technology.

Computing Power

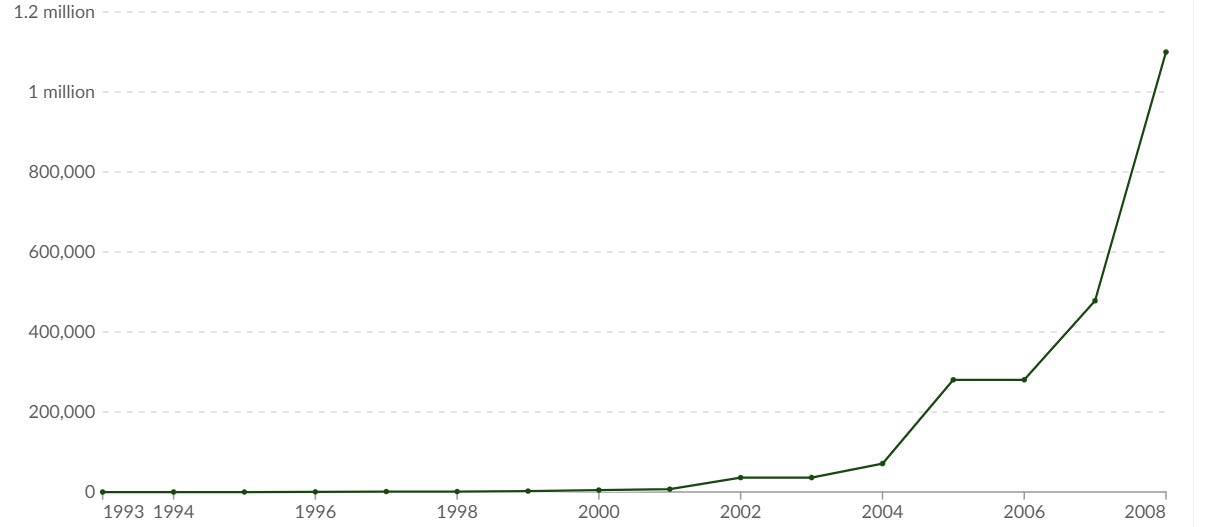

In 1993, the fastest supercomputer in the world could perform 124 billion operations per second.

By 1998, it was over 1.3 trillion - a 10x leap.

By 2003: 35.9 trillion, a 27x jump

By 2008: 1.1 quadrillion - a further leap of over 800x in just 5 years.

This wasn’t linear growth. It was exponential.1:

At first, it looks like nothing is happening.

Then suddenly - the graph explodes.

That’s how compounding works.

Investing Works the Same Way

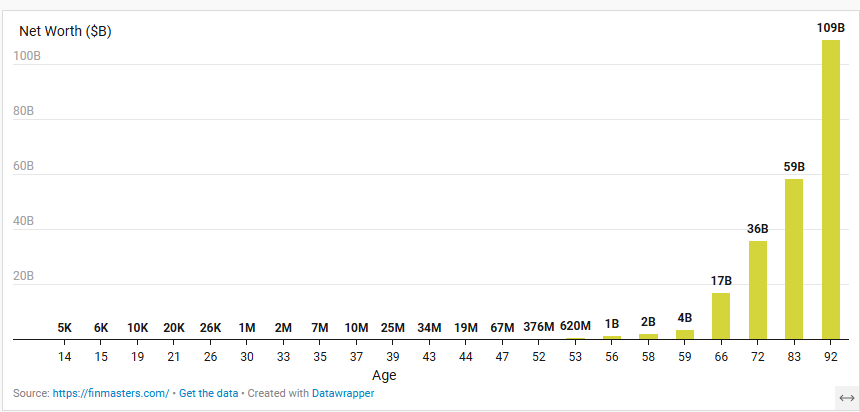

Take Warren Buffett - the world’s most famous investor.

He started investing as a teenager with just a few thousand dollars.

By age 30, he made his first million

By age 56, he had over $1 billion.

Ten years later: $17 billion.

By age 92: $109 billion.

Almost 90% of Buffett’s net worth came after his 50th birthday. 2

His edge? Not magical stock picking or hedge fund wizardry.

Just this: He started early - and he never stopped. More than 75 years of staying invested meant that his wealth eventually soared into the financial stratosphere.

The key isn’t perfect timing. It’s time itself.

As his partner Charlie Munger put it:

“The first rule of compounding: Never interrupt it unnecessarily.”

Whatever assets you end up owning - if you leave them to grow, the wonder of compounding will mean you get a supercharged burst at the end that will leave others trailing in your wake.

You may feel like you’re behind the curve most of the time. But owning assets gives you access to the acceleration of compounding.

The Snowball effect of Compounding

Picture a snowball tumbling down a snowy hill. In the beginning, it grows slowly - just a handful of snow clinging to its sides. But the farther it rolls, the more snow it picks up - and before you know it, it’s an unstoppable avalanche.

Money works the same way. Start with £100 at 10% a year, and you get:

Say I have £100 growing at 10% per year.

After 1 year, I have £100 × 1.10 = £110 (£10 growth)

After 2 years → £110 × 1.10 = £121 (£11 growth)

After 3 years → £121 × 1.10 = £133.10 (£12.10 growth)

Each year you’re not just earning 10% on your original £100 - you’re earning 10% on all those little growth bits you already pocketed. It’s growth on growth on growth - exactly why your balance really starts to roar after several years of doing… nothing.

Earning money from work? That’s linear: the same paycheck each and every month. But compounding is exponential: show up, stay invested, and watch small, consistent gains turn into a tidal wave of wealth.

The trick is simple: fuel your compounding engine early and often. Once it’s humming, time does the heavy lifting—so by the finish line, you’re sprinting past everyone still working linearly.

Recap

Compounding is slow… then sudden.

Time is a wealth-building superpower - use it

Earning money grows money linearly, but owning assets grows it exponentially

Next up: Human Capital - How to Turn Your Income Into Financial Freedom

You now understand the power of time - and why starting early, even with small amounts, creates exponential results.

But if time is your engine, you still need fuel. That’s where your income comes in.

In the next post, we’ll look at your human capital - the asset you already own, the one you control most directly, and the one that can accelerate your escape if you use it wisely.

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources - calculators, mappers, and guides to help you escape the money trap.”

https://ourworldindata.org/moores-law#:~:text=Exponential%20growth%20is%20at%20the,rapid%20increase%20of%20computing%20capabilities.&text=The%20observation%20that%20the%20number,in%20how%20technology%20is%20changing.

https://bloomsbury.co.nz/blog/2024-06-30-warren-buffett-miracle-compound-wealth.html

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.