2.3 Mapping your Assets: You Might be Richer than you Think

Track your forgotten pensions, savings, and investments. Find out how close you already are to freedom

Missed last week? Read it here, or see the full escape map here

TL;DR?

Download the Pension Mapper (PDF) and Asset Map (Excel) here, and watch the video tutorial on how to fill them in and map out your assets

So Far, Yet So Close to Financial Freedom

In the late 1800s, insurance salesman R.U Darby was contacted by his uncle, a gold prospector, who claimed that he had discovered one of the richest gold mines in Colorado.

Buoyed by the prospect of unimaginable wealth, the pair scraped together enough money for machinery, and began shipping off cartloads of gold for smelting.

But just when they were getting started, the gold seemingly ran out. They continued to dig, searching frantically for the next deposit, but to no avail.

Eventually, out of money and out of hope, they gave up. They sold their machinery to a junk man for a few hundred dollars.

Curious of what had happened, the junk man hired a mining engineer to survey the sight.

Realising that Darby had not been using fault lines to locate gold deposits accurately, they dug again.

They struck gold, just three feet away from where Darby and his uncle had quit.

They thought they were miles away. But they were closer than they ever realised.

How Close Are You to Escaping the Money Trap?

Many people think they are miles away from escaping the money trap.

But you might be closer than you realise.

Everyone wants freedom.

But no one gets there without a map.

And no map works without a starting point.

That’s where the Pension Mapper and Asset Map come in.

We’ll map every asset you already have — pensions, savings, investments — and get a clear view of your starting point.

Darby and his uncle were closer to escaping the money trap than they ever realised.

Just three feet away.

You might be too.

The UK State Pension

As of 2025, the full UK State Pension pays around £12,000 per year.

But you don’t get it until age 68 — and even that number has a habit of creeping upward.

That’s not a golden ticket. That’s a safety net.

Just enough to cover the basics of life: Food, energy, council tax, transport, bills.

And nothing more.

For a long time, I thought the state pension was all I needed.

It’s not. It gets you survival - not escape.

And now it only serves as a reminder:

If you want freedom before 68 — you’re going to need something more.

But what if you already had the missing pieces sitting in old pensions, forgotten ISAs, or silent savings?

That’s where the Pension Mapper and Asset Map come in.

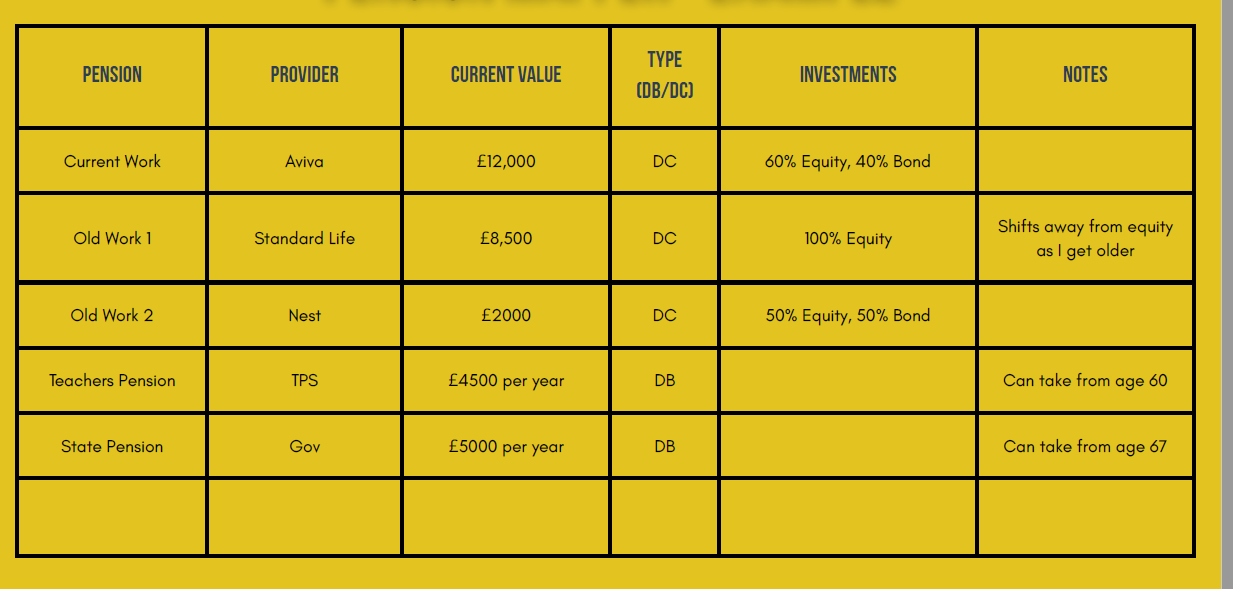

Step 1: Track Your Pensions (Use the Pension Mapper)

Download the Pension Mapper here:

In it, list:

Each pension you know about

Whether it's a Defined Contribution (DC) or Defined Benefit (DB) pension

The current value or pot size (if DC) or expected future annual income (if DB)

See the pensions section below on the difference between the two types of pension

Start with the State Pension

Visit: www.gov.uk/check-state-pension

You’ll get a forecast of what you’re entitled to — and when.

In the Pension Mapper - write down the annual amount (not the weekly or monthly)

Then… Do Some Detective Work

Track down the rest of your pensions. Be tenacious. Use every tool you’ve got:

📞 Contact old employers — ask who your pension provider was

🧾 Check past payslips and old pension statements

🔍 Use the Pension Tracing Service: gov.uk/find-pension-contact-details

🗂️ Group pensions by type: DB (Defined Benefit), DC (Defined Contribution), SIPP

Contact Each Provider

Once you’ve identified them:

Ask for online access or a recent statement

Look at what the money is invested in

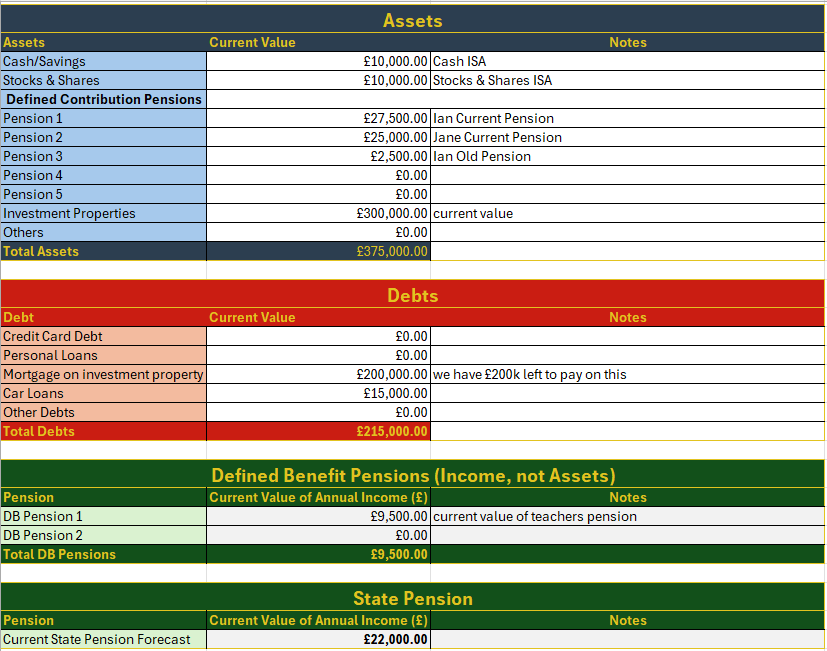

Step 2: Map All Your Assets (Use the Asset Map)

Download the Asset Map spreadsheet:

In it, list:

Cash and Savings

ISAs and General Investment Accounts

Workplace, Private and State Pensions (from the Pension Mapper)

Rental properties (current value)

Debts (credit cards, car loans, investment property mortgages)

Other assets like premium bonds

Don’t worry about cash flow like salary, rental income, or interest from savings. Those aren’t assets. We can deal with those later. It will just blur the picture of what assets you have.

Your Main Residence

Note: We’re not including your main residence here. Even if it has value, it’s not something most people can or want to draw on for retirement — unless downsizing is part of your plan.

Video tutorial

Tracking down assets can be confusing and frustrating. Sometimes it’s hard to know where to start looking.

Here’s a video tutorial where I track down my pensions and assets - to show you it can be done.

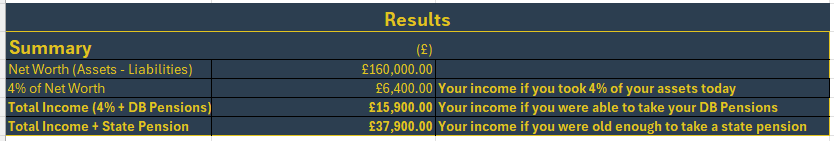

Step 3: See Your Escape Snapshot

The Asset Map will automatically:

Calculate your current Net Worth (Assets minus Debts)

Apply the 4% Rule to estimate the annual income your assets could generate today

Add any future Defined Benefit Pensions if relevant

Add your future State Pension if relevant

You now have your first escape snapshot. Ask yourself:

How close are you to your escape number?

How much could 4% per year pay you now?

Are you happy to work till age 68, or would you like to escape sooner?

How could you increase this figure?

Here to Help

If you have any questions - feel free to ask in the comments section, or email me with questions.

I’m here to help. I’ve been through this process and understand it can be confusing. The clarity comes from action - from doing it.

Understanding your other pensions

Pensions can be tricky: there are two main types of pensions in the UK — and they work very differently.

1. Defined Contribution (DC) Pension

You pay into a pot. It’s invested. The pot grows. Most companies will only offer these. When you retire, the amount you’ve built up is yours to draw down.

Include these in the Assets section

You’ll usually see a value like: “Current value: £100,400”.

2. Defined Benefit (DB) Pension

It’s not a pot of money. Instead, your employer promises to pay you a fixed income when you retire — often based on your salary and years of service.

If you have ever worked in the following areas then you will probably have a DB Pension:

Teachers (Teachers' Pension Scheme)

NHS staff (NHS Pension Scheme)

Civil servants (Civil Service Pension Schemes)

Police officers (Police Pension Schemes)

Firefighters (Firefighters' Pension Schemes)

Armed forces (AFPS - Armed Forces Pension Scheme)

Local government employees (Local Government Pension Scheme - LGPS)

Universities - (Universities Superannuation Scheme) — for many university lecturers and researchers (it’s a hybrid: part DB, part DC now).

Older DB schemes at big companies like:

BT (British Telecom)

Rolls-Royce

Shell

Unilever

Lloyds Banking Group

HSBC

BUT: these private schemes are usually closed to new members and only kept for existing or retired employees.

Include the expected annual income in the Defined Benefits Pension Section

Unlike DC pensions, DB pensions don’t show up as a lump sum — they’re more like a guaranteed future salary. So just record the annual income they’ll pay you when the time comes

You’ll usually see something like: “Projected income: £12,400/year from age 67”

If you’re not sure which type you have, check:

The provider’s name (NEST, Aviva, Standard Live = usually DC / Teachers’, NHS = usually DB)

The paperwork — does it mention a “pot” or an “annual income”?

If you have a SIPP = DC (More on this later)

Defined Benefit vs Defined Contribution Pensions

Asset Map Examples

If you are struggling to get started or where to put things - below are a couple of examples from 2 people with different circumstances.

Their figures are in the 2nd and 3rd tabs of the Asset Map.

Example 1 - Young and Just Starting Out

Chris is 30 years old, and has been working as a civil engineer since he was 22. He doesn’t own his home, but he has some savings, and 2 old workplace pensions.

Example 2 - Older and Married

Jane and Ian are married and 40 years old, have two young children. They have both been working since graduating from university, although Jane hasn’t worked for the past few years whilst she was having children.

They have a single home, and each have several workplace pensions. Ian quit corporate life 10 years ago to become a teacher.

They also have two rental properties.

Takeaways from the Examples

Both examples have a current income which is respectable at their ages, but is masked by the fact that most of it will come via the state pension at aged 68.

All three would like to start living off their assets sooner than that, so need to start accumulating more assets now.

Ian and Jane also have an option with their rental property. When they want to live off their assets, they could sell the property and apply the 4% rule to the proceeds. Or they could keep renting it out and live off the rental income. Either way, that rental figure is likely to not too far from 4% of the property’s value — they just apply 4% to the home’s value for now. The exact figure and path doesn’t matter yet. What matters is knowing they have options.

The good news? They all have the same thing going for them - time.

Time to accumulate.

Time to build momentum.

And time to compound their wealth.

If you’re unsure how to track down or value any of your assets — especially old pensions or investments — it’s okay to get help.

A regulated financial adviser can help you piece it together, or give you a one-off session to make sure you’re on the right track.

The important thing is not perfection — it’s clarity. Once you see the full picture, everything else starts to make more sense.

Your Financial Escape Kit

Now you know where you are right now. You also have an idea of the end game - the escape number.

And yes — there’s a gap between the two.

But if you feel like you're behind, if you wish you'd started earlier, or had more — the surprise of Part 3 is this:

You may be exactly where you need to be.

Recap

You might be closer to financial freedom than you think — you just need to map your assets.

Use your Pension Mapper and Asset Map to see how much income your current assets could generate (using the 4% rule).

Once you see the full picture, you’ll likely realise:

You’ve made more progress than you thought.

You’ve got options — and time.

Up Next: Time and Compounding: The Ultimate Wealth-Building Duo

You’ve seen your number.

You’ve mapped your assets.

Now it’s time to gather your tools — and start building your escape.

The first two assets? Time and You.

Looking Ahead

Think back to post 2.2 - “How Many Assets do we Need?” and reflect on the following now that you have discovered what assets you have:

What is your current income from your assets compared to your escape number? How close are you? How far away are you?

When would you like to start living off your assets? Earlier than aged 68?

How much time do you have to accumulate?

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources — calculators, mappers, and guides to help you escape the money trap.”

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.