2.2 - How Much Do You Really Need to Escape Work Forever?

Forget Ronald Reid's $8 million. Here’s what you really need — and why you’re probably closer than you think.

Missed last week? Read it here, or see the full escape map here

Everyone has a plan, until they get punched in the face

Mike Tyson

When it comes to money, it’s hard to start planning until we know how much we’ll actually need — or how far behind we are.

That’s why this step is so important.

How Much Do You Need to Live Off Your Assets Forever?

Answering this question is a crucial first step in escaping the money traps that ensnare us. If we don’t have a goal, then we don’t have a path to get there.

But before we dive into spreadsheets and budgets, we just need a number — something realistic enough to aim for.

The 4% Rule: Your Starting Point for Financial Freedom

In 1994, financial advisor William P. Bengen analysed 75 years of financial data and concluded that you could withdraw 4% annually from a mixture of stocks and bonds for between 30 and 50 years, without ever running out of money.1

For most people, that will be their entire retirement, just living off what they own, not what they earn.

The “4% rule” has its fans, and also its critics. It’s not perfect (it doesn’t take into account taxes for one thing), but for us, it’s a start.

A more conservative figure would take 20% basic rate tax into account:

If you pay 20% tax, you take home 80%, which has a multiplier of 0.8. So:

But for now, let’s use 4%. So how much do we need?

Calculate Your Escape Number

Spend a few minutes thinking about how much money you’d need to live on each year. It doesn’t have to be exact — just a figure that reflects the kind of life you’d be happy with.

You could base it on your current lifestyle, a detailed budget, something you worked through previously with a financial planner, or a rough plan.

The goal isn’t precision — it’s clarity.

We’re simply aiming for a starting number that helps define the destination.

If you are struggling to think of one, in 2025, the Pensions and Lifetime Savings Association in the UK (PLSA) estimated the following annual incomes for a different standards of retirement2:

Using the 4% Rule, that amount is now 4% of your portfolio, every year.

So, how big is your portfolio?

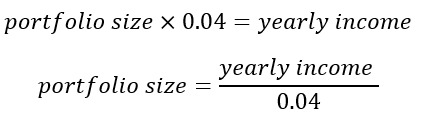

We can use some simple maths to calculate this:

So, if you want to live off £40,000 per year, you need assets worth

So, with £1,000,000 (in assets), you could live off £40,000 a year for 30 years (and in many cases more).

It’s a rough number - but this is good starting point for an amount that makes you free.

Call this your “Escape Number”

What’s more, that amount will grow more than inflation. So as costs go up, you could withdraw more each year to keep up with those costs.

That’s how the 4% rule helps you escape both the inflation trap — and the work trap.

How would those PLSA numbers translate to asset values on the 4% rule?

These numbers might look daunting — but don’t panic. This assumes you’re covering your entire lifestyle from your portfolio alone, with no help. You might not need to, and as we’ll see, you’re probably already further ahead than you think.

Your Escape Number

Now take a few minutes to play around with this maths, and your own number (it could be more or less), and see what you might need.

Some examples using the 4% Rule:

To spend £30,000/year, you’ll need £750,000 (in today’s money)

To spend £40,000/year → £1,000,000

To spend £50,000/year → £1,250,000

To spend £60,000/year → £1,500,000

To spend £100,000/year → £2,500,000

Why does this work?

Without getting too bogged down, it works because these assets:

Grow faster than inflation

Grow faster than 4%

So even if you take out 4%, the assets may grow by 6%, 10%, 15% or even more, meaning you still make more money even though you took some out.

They may of course go down, so we are not quite home and dry just yet.

There is also another reason we are not done..

Inflation’s Hidden Punch in the Face

We learned in Trap 1 - Inflation, that our money loses its value over time.

Take our example of £1,000,000, that gives us £40,000 of buying power today.

But we don’t need this figure today. We need this in the future, when costs will have gone up.

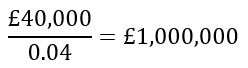

Let’s say we would like to start living off our assets in 20 years time. We need £1,000,000 in today’s money.

If Inflation is 3% (things get 3% more expensive each year), how much money will we actually need in 20 years?

Nearly £2m in assets to have the same buying power.

Ouch.

Turns out, Mike Tyson was right.

£1.8m would be your escape number in nominal terms (future value), and £1m in real terms (today’s value)

Four Reasons You’re Closer Than You Think

Before you throw our hands in despair (as I did when I first saw this number) and give up before starting, remember four things:

You don’t need this money now, we need it in the future. You have potentially many years to get there.

Your assets will grow exponentially, not in a straight line.

You’ve probably already been building up assets without realising.

You may have

savings

investments

pensions

and a state pension

You may not have to do this alone. Couples and families can invest and grow wealth together.

The Magic of Exponential Growth

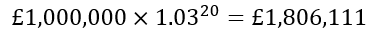

If you are unsure exactly what this means, a picture says a thousand words:

Here is the growth of some assets growing at 7% a year (this is possible in a simple global index fund, we’ll learn about these in Part 3), as someone buys them regularly - just like Ronald Reid did.

It takes 8 years to grow to £250,000

It takes 5 more years to grow to £500,000

It takes 4 more years to grow to £750,000

It takes just 2 more years to hit £1,000,000

This is the wonder of compounding. It takes less time to make the next lot of £250,000. More about this later, but for now we just need to see that the growth accelerates towards our goal. The more time we give it, the faster it grows.

Why Starting Early Matters More Than Perfect Planning

So we have a number in mind. It’s probably bigger than you expected.

And that’s okay — because right now, what matters most isn’t having the perfect plan. It’s that you’ve started thinking, shifting, moving to owning rather than earning.

The number isn’t the most important thing right now.

For most of us, this number is overwhelming at first. But the chances are, you’re not starting from zero — you’ve already made more progress than you think.

The key thing is that you start doing something. Just by realising this you are ahead of most people. You can work out the finer details later.

The earlier you start, the more time you give yourself for compounding to work.

I didn’t have a perfect plan initially. I started investing, and refined my plan as I got more comfortable with it and learned what suited me, and what didn’t. And whilst I was refining, the value of my assets was increasing.

The clarity didn’t come before action. It came from action.

You might feel your "escape number" is daunting, almost impossible from your current position.

I felt the same.

But don't give up yet—there’s good news. You might already be closer than you think.

Recap

The 4% rule is a useful starting point: withdraw 4% of your assets per year and potentially live off them for 30+ years.

Your Escape Number = the amount of assets needed to generate your ideal annual income.

If you want £40,000/year → you need around £1,000,000 in assets (in today’s money).

But thanks to inflation, you’ll likely need more in the future — e.g. nearly £2m in 20 years at 3% inflation.

Don’t panic — compound growth accelerates over time, and you may already be closer than you think.

The key is to start early, even if the number feels big. Clarity comes from action, not waiting.

Up next: You Might be Richer than you Think

Find out what you own with the free Asset Map tool.

You may be closer to freedom than you think.

Looking Ahead

How Quickly Your Assets Can Grow

Now that you have a rough idea of how many assets you might have and what they return, what would happen if you added to those periodically?

Have a play with This investment calculator

Play with the inputs:

Monthly contributions

Time (in years)

Expected annual return

Then ask yourself:

How much could you have in 10 years? 20? 30?

This is the magic of compounding — your money earning more money, over time.

You can even run your own "Ronald Reid" scenario:

What happens if you just invest steadily, for decades?

For reference, here are some long-term average returns:

Global Stocks: 7-9%

UK Bonds: 3–5%

Cash: 2–4%

UK Property: 5-7%

These are before inflation. More on “real” returns later.

Don’t worry about being exact — the point is to see the power of time + growth.

Start imagining what’s possible.

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources — calculators, mappers, and guides to help you escape the money trap.”

https://web.archive.org/web/20120417135441/http://www.retailinvestor.org/pdf/Bengen1.pdf

https://www.retirementlivingstandards.org.uk/

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.