3.3 Financial Assets Overview: A Complete Guide to the Main Asset Classes

What you can buy, and what it's good for

Missed last week? Read it here, or see the full escape map here

TL;DR?

Download the asset classes top trumps pack here and get a quick view of how each asset works! Which ones do you need in your escape plan?

I played a lot of Top Trumps in my youth - cards of footballers, tanks, sharks or cars, each ranked by attributes like speed, power, skill etc.

Highest stat wins. Simple.

Financial assets work in the same way.

Each one has its own stats.

The best choice? Depends on the game you're playing - and which attributes matter most to you.

The main asset classes are:

Cash

Equities

Bonds

Property

Gold

Crypto

The stats:

Growth

How much can it grow your money?

Can it beat inflation? By how much? Some assets offer slow, steady growth. Others have the potential for big gains (and big losses).

Volatility

How wild is the ride?

Does the value hold steady or are there wild fluctuations? Higher volatility can mean higher potential rewards - but also more anxiety.

Liquidity

How easy is it to buy, or sell quickly?

Some assets can be sold instantly with a few clicks. Others take time - and may come with fees or waiting periods.

Accessibility

Is it easy for everyday people to invest in, or does it require more capital or complexity?

Use

What is this asset best suited for in your escape plan?

Short-term security? Long-term growth? Income in retirement?

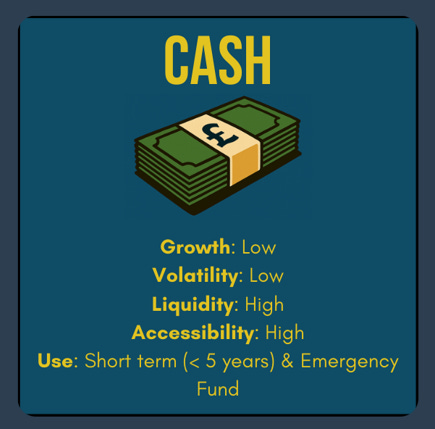

Cash - Short Term Safety

Cash is literally what you think it is. Money in a savings account, earning a rate of interest.

Growth: Your seawall against inflation. At best, it matches inflation. Often, it lags behind - meaning your savings slowly lose value over time, even if the number in your account is rising.

Score: LOW

Volatility: Interest rates can be fixed or variable, but the change is slow, and you rarely get caught out by sudden changes with rates. You know what you are getting, it’s safe and steady.

Score: LOW

Liquidity: Some accounts are instant access, others lock away your money for a set time (6 months to 2 years).

Score: MEDIUM

Accessibility: Accounts are easy to open and there are literally thousands on the market

Score: HIGH

Use: Best for expenses that you need in the next 5 years, or an emergency fund. Cash might look safe on the surface - the number on paper will never drop. But underneath, inflation silently erodes away its value. One wave at a time.

Equities (Stocks) - The Wealth Growing Engine

When you buy a stock, you are literally buying a tiny sliver of ownership of that company.

Growth: The best performing asset class over the last 100 years. They have grown more than cash, bonds, golds and commodities. It is equity that will grow your wealth the fastest.

Growth comes in two ways:

increase in the price of the stock

dividends paid out to you which come from their profits (your reward for investing in them)

Score: HIGH

Volatility: In the long term, stocks are an elevator - compounding their way out of the money trap.

In the short term, they’re a yo-yo: up 20%, down 30%.

Zoom out, and the chaos fades to just background noise.Score: HIGH

Liquidity: Most can be bought and sold easily online with your investing/brokerage platform.

Beware though of niche smaller stocks that you might find it hard to sell.

Score: HIGH

Accessibility: You can access stocks through index funds, ETFs, or individual purchases. Super easy via investing platforms.

Score: HIGH

Use: Have money that you don’t need for the long term (5+ years) that you want to grow your wealth?

Equities *should* grow it the most.

It’s never a guarantee, but historically, there has never been a 20-year period where a broad basket of US or global stocks has lost money. Not one.

Bonds: The Slow and Steady Companion

When you buy a bond, you're lending your money to a government or company in return for regular interest. At the end of the term, they pay you back - if all goes well.

Growth

Bonds typically offer modest returns - higher than cash, lower than equities. They don’t make you rich, but they can keep you moving forward without wild swings.Score: MEDIUM

Volatility

More stable than equities. Bond prices do move - especially if interest rates change - but they tend to drift rather than bounce.Score: LOW

Liquidity

Most government and large corporate bonds are easy to sell, especially when held in bond funds. Individual bonds may be less liquid.Score: HIGH

Accessibility

You can access bonds through index funds, ETFs, or individual purchases. Very easy via investing platforms.Score: HIGH

Use

Good for the medium-term part of your escape plan. Add ballast to your portfolio. Ideal when you're closer to needing the money, have a fixed cost coming up, or just want less of an emotional rollercoaster.

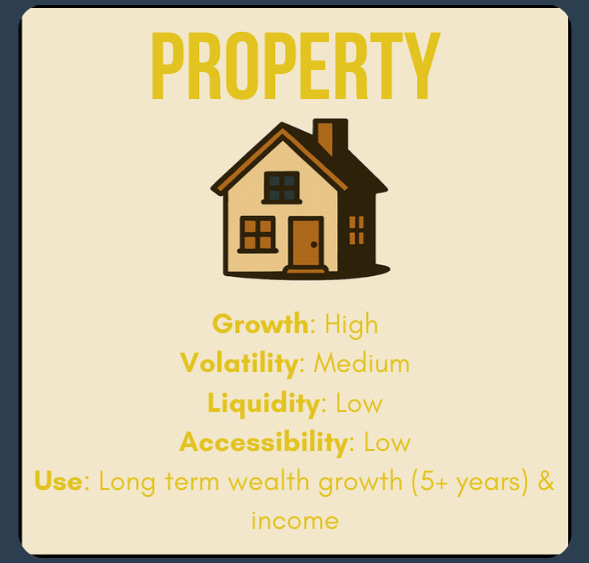

Property – The Tangible Wealth Builder

Property is one of the most familiar assets - bricks and mortar. You can live in it, rent it out, or sell it later. It can create capital growth (the price) and income (rent), but it’s far from passive.

Growth

Over the long term, UK property has historically risen around 5–7% per year, depending on the region. Growth can be strong - but it can also stall or drop during downturns.Score: HIGH

Volatility

Not as visible as stocks (because prices aren’t updated every second), but property values do swing - especially during financial crises. It just feels smoother because it's not in your face.Score: MEDIUM

Liquidity

Property is slow and clunky to sell. It can take weeks or months, and comes with big transaction costs. Not ideal if you suddenly need cash.Score: LOW

Accessibility

This is the biggest hurdle. You’ll need big upfront capital, legal fees, stamp duty, and patience. But once you’re in, it’s a powerful wealth engine.Score: LOW

Use

Property works well as a long-term growth asset or income source through renting. Great if you’re willing to commit capital and manage hassle. Less ideal for flexibility.Your main residence needs special consideration. While it has value, it’s not easily turned into spendable cash - unless you downsize or take on debt. When we talk about property as an asset class, we usually mean rental or investment properties.

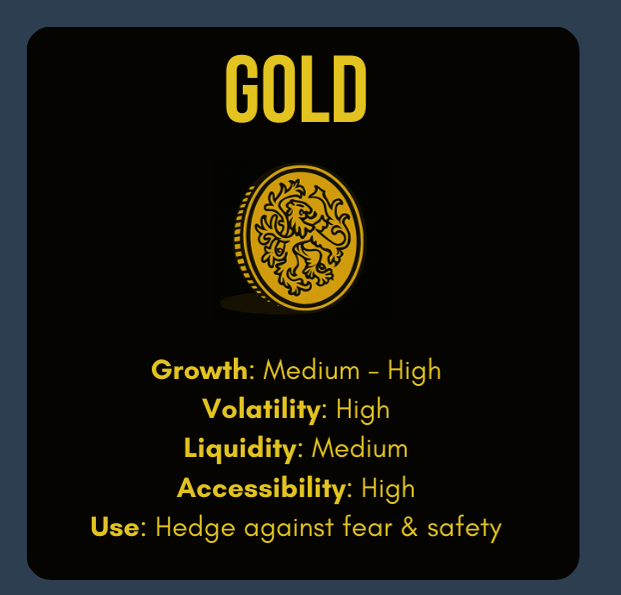

Gold – The Ancient Hedge

Gold is the OG asset - prized for thousands of years. It's not about income or growth. It's about stability and fear insurance.

Growth

Gold doesn’t grow in the traditional sense - no interest, no dividends. Its value rises mainly when people get nervous. They buy it, demand for it goes up, as does the price. It can hold its own in inflationary times, but don’t expect fireworks.Score: LOW–MEDIUM

Volatility

Surprisingly high. Gold might feel safe, but its price can jump or drop wildly based on news, fear, or speculation. It’s emotional, not rational. People love gold when they are fearful of recessions or market crashes, so expect it to soar in those times.Score: HIGH

Liquidity

If you own gold ETFs or digital gold, it’s very liquid. Physical gold? Not so much - harder to store, sell, or value instantly.Score: MEDIUM

Accessibility

Gold ETFs are easy to buy through most platforms. Physical gold is a bit more niche (and you have to store it).Score: MEDIUM

Use

Gold is about mood, not markets. When people are afraid, they want something safe. Something shiny. Gold scratches that itch. The gold price tells us more about us than it does about gold itself

Crypto – The Wild Card

Cryptocurrency (like Bitcoin or Ethereum) is a digital form of money, built on blockchain tech. Some see it as the future of finance. Others see it as digital gambling. Either way - it’s the most speculative asset in the deck.

Growth

Crypto has delivered some eye-watering returns… and equally painful losses. Some coins have soared 1,000%+. Others have gone to zero. Big gains are possible, but so are wipeouts.Score: VERY HIGH (but unreliable)

Volatility

Off the charts. Prices can double or halve in a matter of days based on tweets, news, regulation, or vibes. Great for adrenaline. Terrible for sleep.Score: EXTREME

Liquidity

Most major coins (like Bitcoin and Ethereum) are very liquid - easy to buy and sell 24/7. Smaller coins? Not so much.Score: HIGH

Accessibility

Crypto is easy to access now via apps like Coinbase, eToro, or even PayPal. But wallets, passwords, and platforms still come with a learning curve - and some risk.Score: MEDIUM

Use

Crypto is not for wealth preservation - it’s for speculation. It’s like adding hot sauce: a little might add flavour. Too much, and it burns. If you include it at all, it might be a very small slice of your portfolio. Crypto shouldn’t be the ladder - it’s the trampoline. Fun, risky, and occasionally useful - but probably not your main escape plan.

Choose Your Deck

Your escape plan will be a mixture of some of (not necessarily all) of these asset classes. Depending on your target (Escape number), your risk appetite (how much you can stomach volatility), and your timescale. You get to choose.

As Warren Buffet once said

Don’t invest in something you don’t understand

It’s vital that you know what you are buying, and how it might behave. If you are unsure, seek professional advice.

The goal isn’t to collect every card.

It’s to choose the ones that match the game you’re in.

Just the ones that get you out of the traps - at the right time.

Recap

Each asset class has its strengths and weaknesses - like a financial Top Trumps deck:

💵 Cash – safe, short-term, inflation-prone.

📈 Equities – high-growth, high-volatility, long-term wealth builders.

📄 Bonds – steady income, lower risk, lower return.

🏠 Property – tangible, long-term growth, less liquid.

🪙 Gold – fear hedge, not really a growth asset.

🧬 Crypto – speculative, volatile, not for everyone.

Pick the right mix for your goals, time horizon, and risk tolerance.

Up Next - Equities Explained: Why Stocks Are Your Wealth‐Building Engine

We do a deep dive into each asset class, looking at what it is, how it works, and if you might need it. We start with Equities, aka stocks & shares..

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources - calculators, mappers, and guides to help you escape the money trap.”

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different - if in doubt, speak to a qualified, regulated financial adviser.

Good simple explanation of each.