3.4 Equities Explained: Why Stocks Are Your Wealth‐Building Engine

Equities (or stocks) have created more wealth than any other asset in history. But what are they really - and how do they set you free?

Missed last week? Read it here, or see the full escape map here

TL;DR:

Equities - aka stocks - are slices of real businesses driving our world forward. By owning them, you:

Participate in human progress: From healthcare to tech, equities funded the Industrial Revolution and beyond.

Escape the three money traps: They outpace inflation, enjoy favourable tax treatment, and grow without extra time input.

Get inflation-beating returns: The US stock market has averaged ~9% p.a. for nearly a century - with no 30-year period of real losses. Global Stocks have averaged around 7-8% per year.

Weather short-term storms: Expect periodic crashes (10% – 40% drops), but patience has historically rewarded investors with life-changing gains

(e.g. £1k → £7.5m over 120 years).

How do you Own the World?

In his book How to Own the World1, Andrew Craig writes:

“Without their invention, the Industrial Revolution and the enormous technological and social developments of the last few centuries, which have made us all substantially better off, would have been impossible.”

He’s talking about equities - also known as stocks or shares.

We often think of stocks as tickers on a screen or lines on a chart.

But at their core, equities are something much bigger:

They’re ownership in human progress — slices of businesses building the world we live in.

In the early 1800s, the concept of a “share” emerged to fund trading voyages to India and the Far East.

Companies couldn’t afford the risk alone — so they offered investors a deal:

Put in 1% of the cost, and you’ll own 1% of the venture — and 1% of the profits.

And just like that, the stock market was born, and it built the modern world.

For 200 years, companies have been using the same idea to fund their ideas, products and services.

It’s what has given us exponentially better:

Healthcare

Transportation

Communication

Technology

Food production

Energy

Equities built the world we see around us today.

What is a Stock?

When you buy a stock, you become a part-owner of a company. As that company grows:

Your slice of the business grows in value (stock price rises)

You receive a share of the profits (dividends)

But you’re not just buying ownership.

You’re buying into the march of human progress - into companies aiming to profit (on the whole) by making life better.

Stocks: Smashing through the Money Trap

For most investors, equities have been the main tool in their escape from the money trap.

They escape all three traps:

They beat inflation in the long term

They are generally taxed at lower rates than other assets

They grow your wealth without requiring more of your time

And the returns?

Equities Work - Long Term

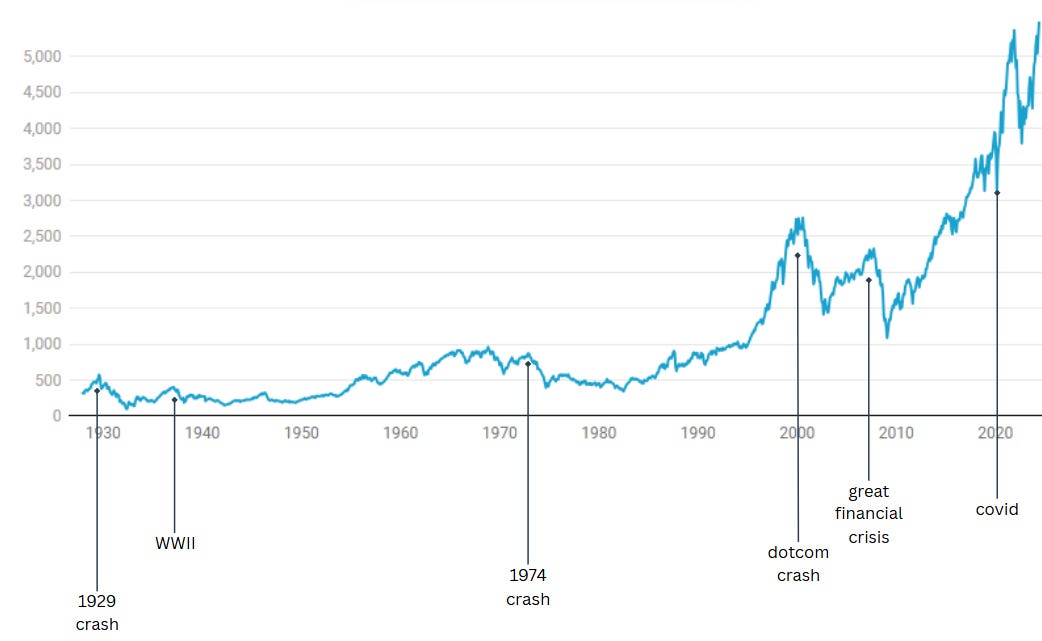

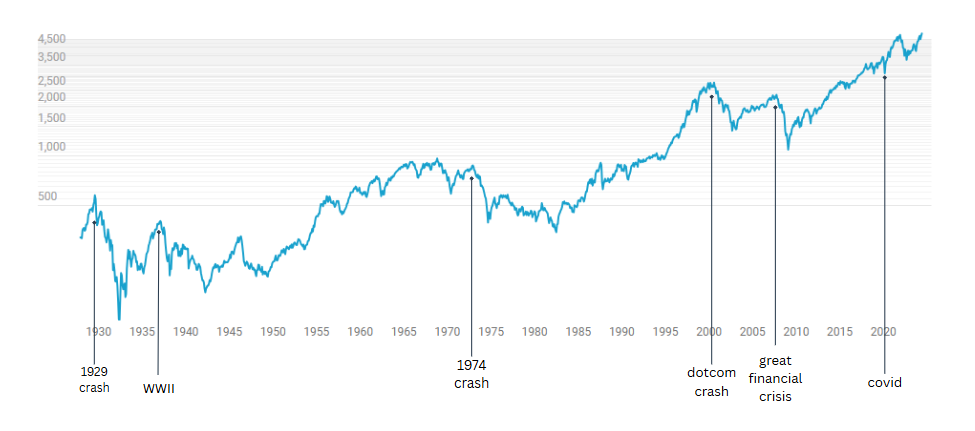

Here is the performance S&P500 index (the broad US stock market) since 1929.

On average, it has returned around 9% per year for over 100 years2.

But those returns don’t come in a straight line.

Stock markets go up over time - but not every year, and sometimes not even every decade. The price of long-term growth is short-term pain.

The log graph accentuates earlier crashes - showing their severity:

📉 The average intra-year drop in the US stock market is around 14% - even in years when it ends up.

🪂 There have been crashes of 30%, 40%, even more.

🧠 This is where many investors lose - not because the market fails, but because they panic and sell at the wrong time.

Equities are not for your short-term money.

They are for your escape fund. Your long game. Your future self.

The road can be rocky, but the long term upward trajectory is undeniable.

There has been no 30 year period where investing in a diversified set of US stocks (for example) has lost you money.

Not one.

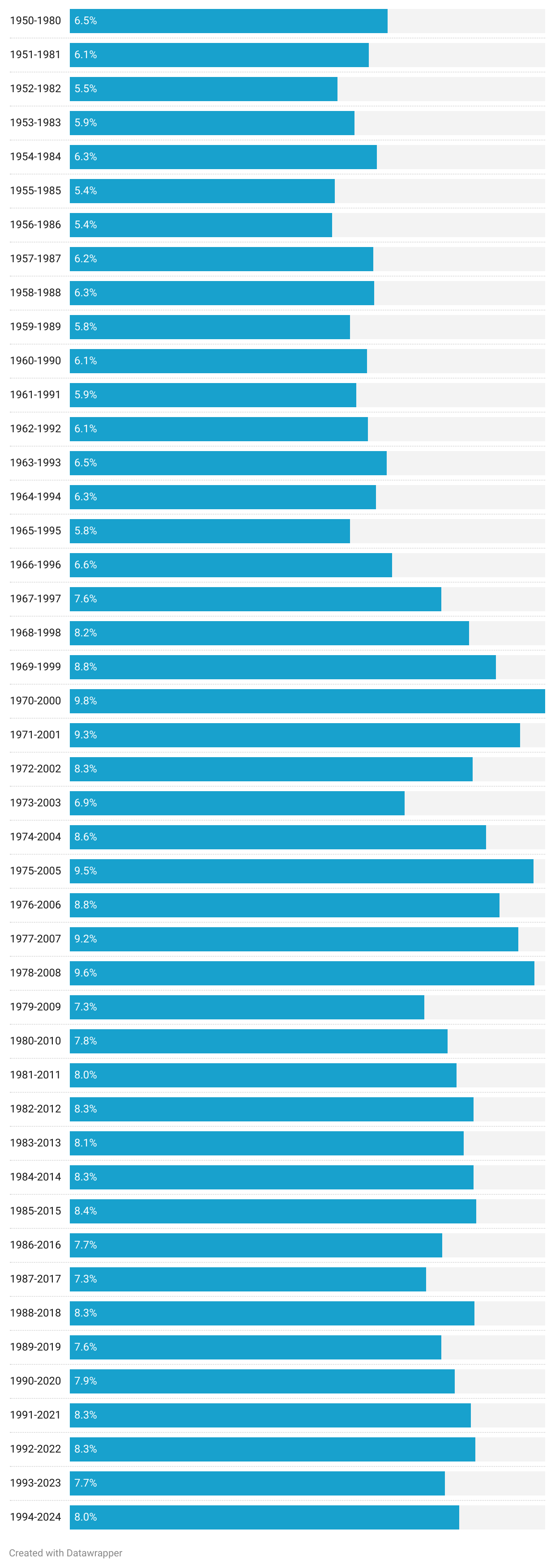

Have a look at the nominal average yearly return on every 30 year period since 1950.

The numbers speak for themselves. Over 30 years, stocks always beat the safety of cash. And don’t let anybody else tell you otherwise.

You just need to do it right.

These returns were achieved by buying and holding for 30 years, ignoring all the noise and not panic selling during crashes and recessions.

The Easiest £7m You Ever Made

If my great, great grandfather had invested £100 in the broad US stock market in 1905 (the equivalent of £10,400 in today’s money3) in 2025 it would be worth a staggering

£7,573,8624

Most of us don’t have that investment timeline, but these numbers show the power of equities, time and compounding.

And these staggering returns have come despite

2 world wars,

2 global pandemics,

dozens of crashes and recessions.

Recap

When you buy stocks, you're buying slices of real companies — and a share of their profits.

Global Equities have delivered ~7%→9%+ annual returns over the long term - better than any other major asset class.

You earn through capital growth (rising prices) and dividends (profit sharing).

Equities beat inflation, are tax-efficient in wrappers, and grow wealth over time - but only if you give them time.

But how do you invest in equities without getting burned by the latest youtube viral stock pick that goes south as soon as you buy it, or without needing a degree in economics?

Up Next: Why Picking Stocks Fails 90% of the Time - And How to Invest Safely with Index Funds

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources — calculators, mappers, and guides to help you escape the money trap.”

Looking Ahead

Model investing a regular amount every month for 20, 25 and 30 years. Use a 9% return. This will give you the money in the future

Now model the same amount but at 6% - this will give you what that money will feel like today (Its real value)

Work out 4% of both amounts to see what income you could live off.

Play around with the numbers - see what outcomes you could model

Are you surprised at how much the money could grow?

How did you feel about the stock market and equities before reading this?

How do you feel about it’s potential now?

Andrew Craig, How to Own the World, 3rd ed., 2019.

https://www.macrotrends.net/2324/sp-500-historical-chart-data

https://www.bankofengland.co.uk/monetary-policy/inflation/inflation-calculator

https://ofdollarsanddata.com/sp500-calculator/

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different - if in doubt, speak to a qualified, regulated financial adviser.

The explanation is easy to understand. Thx for the article. Curious, what does the average person need to do to get started?