3.5 Why Picking Stocks Fails 90% of the Time - And How to Invest Safely with Index Funds

Index Funds may be your cheap and easy way to inflation busting returns in the long run

Missed last week? Read it here, or see the full escape map here

TL;DR?

Picking individual stocks without deep expertise is gambling, not investing - even 90% of pros underperform.

Instead, buy the whole market via low-cost index funds to capture average returns (7–9% nominal), ride out crashes, and beat most active managers.

Use index funds for your core allocation and, if you enjoy it, reserve a small “fun” pot for your own picks.

Burned By the Stock Market

When I was 22, I got my first full time job - on the technology graduate scheme of a global investment bank. I’d made it. I was smart, I was qualified, and I was working for one of the most prestigious companies in the world.

After a few years, I thought “I work for a bank, I should be buying stocks.”

“It’s what we do right?”

But which stocks? I had no idea which ones to buy. I needed something which was undervalued, and that I could own while it went to the moon, and made me rich.

Enter Solomon Gold. A gold exploration company operating in the Pacific Ring of Fire region. The online message boards were buzzing:

“It’s trading for pennies! They’re literally sitting on a gold mine! This is a multibagger, guaranteed!”

A tiny company, operating off razor thin margins and still in debt, trying to extract gold from a region plagued by earthquakes and volcanoes.

What did I think was going to happen?

But my eyes glinted with dollar signs, deliberately ignoring the risk.

I was in.

Two years later, having seen my £15,000 investment drop to £3,000, and with no gold in sight,

I was out.

Picking Stocks is extremely difficult

You may laugh at my naivety. And honestly, you should. I did no research into company earnings, debt, gold prices, rival companies, other sectors to invest in, price valuations, or any other metric. I didn’t have the time, or the knowhow.

I was simply gambling.

As Warren Buffet said:

Never invest in something you don’t understand

But what else could I do? I didn’t have months or years to learn how to value companies, or how market cycles work.

If you’re like me, you have a full time job, and learning how to navigate the stock market with all its complexity and pitfalls doesn’t seem worth the risk, or the time.

How do we know which stocks to buy?

But what if you just bought all of them?

Index Funds - the safer way

The index of a book is just a list of the most important keywords of that book.

In the same way, a stock market index is just a list of companies in a particular market. You may have heard of some of these indexes:

S&P 500 - a list of the 500 largest companies in the USA

FTSE 100 - a list of the 100 largest companies in the UK

FTSE All World Index - A global stock index that includes over 4,000 companies across 50 developed and developing countries (Emerging Markets)

MSCI World Index - A global stock index that includes over 1,500 companies across 23 developed countries

In each index, you can work out its annual growth (return) by working out the average return of all the companies in it. Some companies will grow in value, some will shrink.

If you just bought the index (bought all the stocks in it), you would get the average return of the index.

Average.

Sounds so dull, so mediocre. Why not just pick the winners and bin the losers? That sounds more lucrative.

But how easy is it to actually pick the winners?

Beating the average is hard

In 2024, a study from research firm S&P showed that 90% of active fund managers underperformed their benchmark index average over a 10 year period. 1

With all that knowledge, time and resource, only 10% of professionals got more than “average”. If they had just bought the index, without any thought whatsoever, they would be streets ahead of the majority of their peers, without having to do any of the work.

Even They Can’t Predict the Future

There are many reasons for this widespread underperformance, but the two that I come back to time and again are:

No-one can predict the future

As humans, we want certainty, we crave it for stability.

But human beings are complicated.

So are markets.

Both are irrational. They change their minds. They overreact. Things happen which no-one, not even experts with complex models could predict - pandemics, wars, natural disasters, political earthquakes.

And just when we think we have covered everything, the market will surprise us with something that’s never happened before.

Everyone is playing by different rules

You may be trying to buy your assets for the long term. You have your rules of the game.

But the stock market has literally millions of participants and variables. And each is playing by their rules.

Some are just waiting for a short price rise before selling.

Some are playing the long game. Some want prices to go up, some actually want them to fall.

They all make decisions based on a myriad of different criteria and rules.

Which really means that there are no rules. And the market certainly doesn’t care about yours.

The two things we do know (sort of)

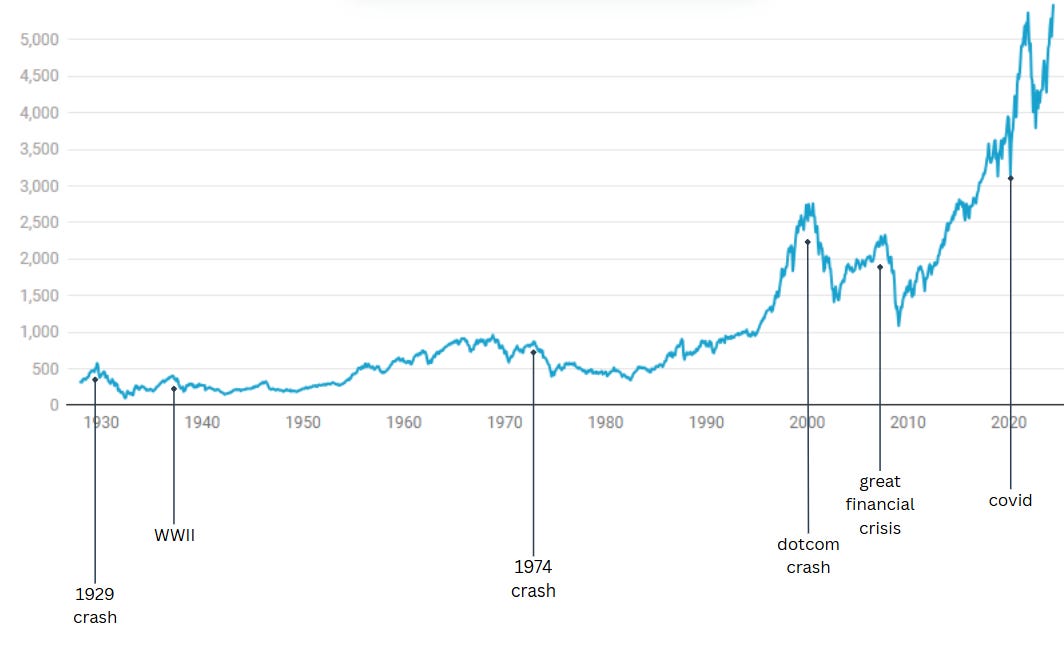

Markets can crash. And big time. The great depression (1929), World War 2, the Dot Com crash (2000), The great financial crisis (2008), the Covid-19 pandemic (2020). These were all significant crashes. This sounds like a huge risk to buying stocks.

The second is that they recover quickly, and grow more quickly than all other asset classes over long periods.

Look at this chart, and see how resilient the real value of the S&P 500 index has been over all those financial disasters

Despite all these huge dips, recessions and crashes, indexes recover, rise and return on average 7-10% a year, depending on the index and the time period. If you can ride out these waves over multiple decades, then nothing else comes close to beating it. Cash, Bonds, Gold and even property cannot match it.

The easiest £7.5m you ever made (again!)

Remember, if you bought £100 of the S&P500 index in 1905 (the equivalent of £10,400 in today’s money)

In 2025 (120 years later), it would be worth a staggering £7.5m

And that is despite 2 world wars, 2 global pandemics, and dozens of crashes and recessions.

£7.5m from just buying everything.

Turns out, average is actually pretty good.

That’s what Ronald Reid understood. By owning shares in around 100 companies (in effect, his own index fund), he wasn’t just investing - he was hiring the world’s best employees in the world’s best companies.

Every single day, they showed up to work to earn him money. Whether they knew it or not.

📈 Index Returns Over 20 Years

To bring things back down to earth: if you invested the following monthly amounts into a global index fund (owning thousands of stocks from around the world), and it returned 8% per year over the long term - with your contributions increasing 3% annually to keep up with inflation - here’s what you might end up with after 20 years:

£200/month → £145,000 (~£80,000 in today’s money)

£400/month → £290,000 (~£160,000 today)

£1,000/month → £726,000 (~£400,000 today)

🏦 Cash Returns for Comparison

If you kept the same money in cash, earning 3.5% per year, you'd get:

£200/month → £92,000 (~£50,000 today)

£400/month → £180,000 (~£100,000 today)

£1,000/month → £460,000 (~£250,000 today)

⏳ Over 30 Years

With more time for compounding, the gap grows wider. For example, investing £400/month for 30 years yields:

Global Index Fund → £780,000 (~£320,000 today)

Cash Savings → £380,000 (~£155,000 today)

If you’re 30 years old today and aiming to stop working by 60, it’s very likely that investing in equities - through a low-cost global index fund:

will leave you £400,000 better off than holding your savings in cash.

That’s the reward for riding out the ups and downs of the stock market: far better long-term returns.

Despite contributing just £228,000 over 30 years, the global index could grow to £780,000.

That’s £552,000 of growth - money you didn’t have to work for.

It’s the equivalent of getting an £18,000 raise every year, purely from compound growth.

And as we’ll cover later, this could all be tax-free in the right investment accounts.

Index Funds: The Smart Money

Luckily, you don’t need to buy hundreds of individual stocks to get “the index”. You can buy them in a pre-packaged investment:

The Index Fund.

You buy one product, and it includes exposure to all the companies in the index, harnessing the wealth building power of equities in a single investment.

It couldn’t be simpler.

There are index funds that track thousands of markets. Three popular indices and some example funds include:

The S&P 500 Index Funds

These track the performances of the largest 500 companies in the USA:

UK fund: Vanguard S&P 500 UCITS ETF (VUSA)

US fund: Vanguard S&P 500 ETF

Global Index Funds

These track a global collection of large companies:

UK: Fidelity Index World; HSBC FTSE All World

USA: Vanguard Total World Stock ETF (VT), iShares MSCI World ETF (URTH)

Index funds are so popular, that even investing legends like them. Warren Buffet has instructed the trustee of his will that of the money he leaves to his wife:

10% of the cash go in short-term government bonds

90% in a low-cost S&P 500 index fund.2

What if You Want to Pick Your Own Stocks?

You absolutely can. No one’s stopping you - and for many people, it’s part of the fun.

Learning to pick individual stocks can be exciting, and it can give you more control over what you invest in. You might want to avoid companies you feel are unethical, or you might be convinced a particular company is undervalued and about to take off.

But here’s the thing: it’s very hard.

Even professional fund managers - the people paid full-time to do this - fail to beat the market. Over the long term, around 90% of them underperform the very index funds they’re trying to beat.

That doesn’t mean you shouldn’t do it. But it does mean you should do it with eyes open. If you want to pick your own stocks, go for it - just know the risks, stay diversified, and don’t confuse gambling with strategy.

Some people put the core of their portfolio (90% +) in index funds, then build a “fun” stock-picking pot around it (around 10%).

Do your own research. Know why you’re buying. And never bet the house on a hunch.

Recap

1️⃣Gambling vs Investing

Many people (like I did!) pick stocks without real research - it's closer to gambling than smart investing.

2️⃣ Even the Pros Struggle

Even pros - with all their tools, teams, and time - fail to beat the market 90% of the time.

3️⃣ Markets Are Unpredictable

Markets change their mind constantly

4️⃣ Index Funds Make It Easy

Why try to pick winners when you can own them all? Index funds offer average returns - which are actually excellent (7-9% per year over the long term).

But which index funds do we pick? Which give the best returns, for the lowest risk? Next, we’ll navigate the jungle of Index funds, and learn how to pick the long term winners.

Up Next: Selecting Index Funds: A Step-By-Step Guide to Your Best Options

How to beat the professionals, 90% of the time, and save £90,000 in fees.

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources — calculators, mappers, and guides to help you escape the money trap.”

https://www.apolloacademy.com/roughly-90-of-active-equity-fund-managers-underperform-their-index/

https://finance.yahoo.com/news/warren-buffett-reveals-instructions-invest-163624653.html

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.

Great content, Rohit! Love to read your newsletter.