3.6 Selecting Index Funds: A Step-By-Step Guide to Your Best Options

How to beat the professionals, 90% of the time, and save thousands in fees

Missed last week? Read it here, or see the full escape map here

TL;DR?

Feeling overwhelmed by all the index fund options? Here’s what you need to know.

✅ A low-cost, diversified global fund like MSCI World, FTSE All World, or S&P 500 is a great option to get exposure to the wealth building power of equities

✅ Passive funds (0.05%–0.2% fee) are cheaper and often outperform active ones (1% fee)

✅ Choose between Accumulation (reinvests income) or Distributing (pays cash)

✅ Ignore hype. Focus on low cost, high diversification, and time.

🎯 [Download the Cheat Sheets] to find the right fund for you.

Overwhelmed by Choice

If you do any amount of research, you’ll see that there are thousands of funds on any given online platform to choose from.

The choice is overwhelming.

So which one should you choose? Do you need more than one?

Where can I buy Index Funds?

The easiest and most cost-effective way to buy index funds is through investment platforms or online brokers. These are websites or apps where you can open an investment account (like a Stocks & Shares ISA or a SIPP in the UK) and buy funds directly.

UK Platforms

Vanguard UK – Simple, low-cost, and lets you invest in their own range of index funds

Hargreaves Lansdown, AJ Bell, Interactive Investor – More choice, a bit pricier, but flexible

Trading apps like Trading212, Freetrade and InvestEngine – Easy to use, often with lower fees

US Platforms

Vanguard USA, Fidelity, Charles Schwab – Established names - Simple, low-cost, and lets you invest in their own range of index funds

Robinhood, M1, Sofi - newer low cost options - have app functionality

How Index Funds are Designed

When choosing an index fund, there are several factors to take into account which will determine what you buy:

Which index it’s tracking

Diversification - how many companies and what kind of companies it holds

Fees & Management Style

Weighting

Distributing vs Accumulation

Currency

Which Index It’s Tracking

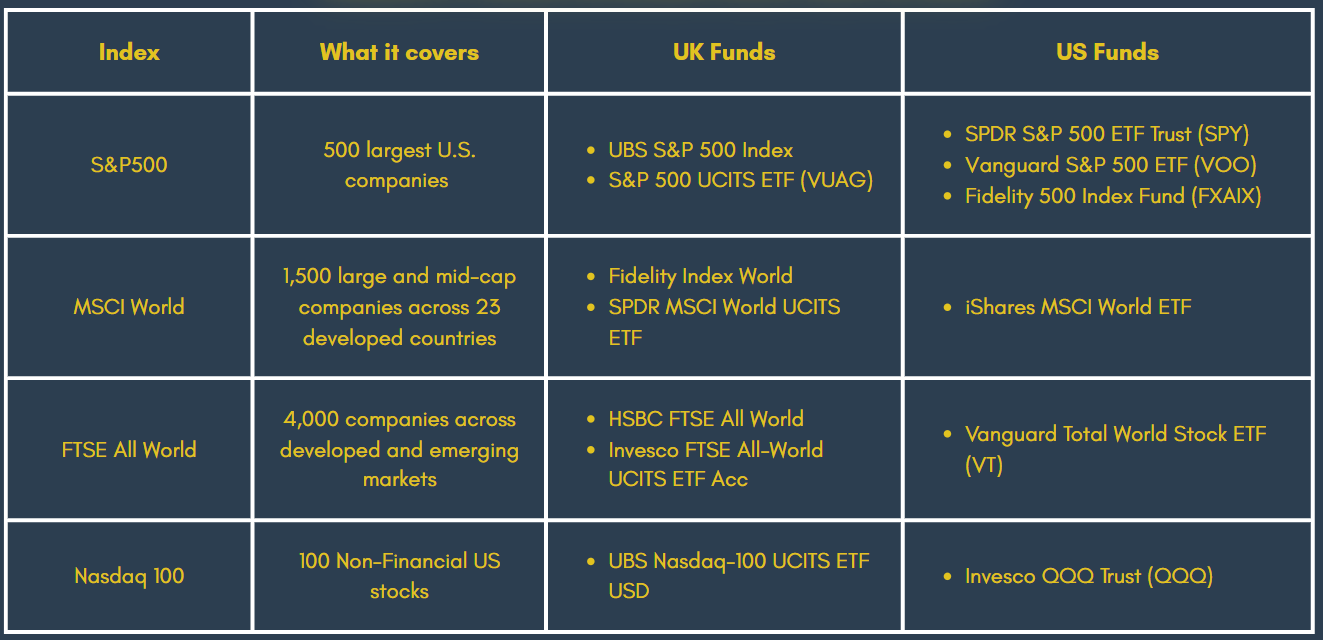

There are lots of stock market indices that funds track. Here are just a few of them as examples.

Any of these should be fine for the core of any portfolio. They are diversified across companies, sectors and regions.

Diversification

There are lots of different ways to achieve diversification:

Number of companies

Number of countries/regions

Number of sectors

If you are diversified enough across these three aspects, you will have minimized your risk, without reducing your return.

Fees & Management Style

Active Management

Some funds are actively managed by a fund manager who will charge a fee - normally this fee is around 1% of the amount you invest (or, Assets Under Management - AUM)

Passive Management

Some funds are passively managed, which means it just tracks the index, with minimal intervention from the manager.

These are cheaper, and cost between 0.05% and 0.2% of AUM.

Just for perspective, that’s an 80%-95% discount on an active fund. And as we saw, active managers don’t have a great track record of beating the index.

The Fees Trap

Money traps are everywhere — and the 1% fee is one of the most dangerous, because it doesn’t feel dangerous.

At first glance, a 1% fee for a manager seems fine. Reasonable, even. You get a point of contact, a coach, someone to guide you. And there is value in that — if it matches your needs.

But everything has a price.

Let’s run the numbers:

You invest £400 a month into a fund that returns 7% per year over 30 years.

With a 1% fee, your return drops to 6%.

The result?

Active fund → £400,000

Passive fund → £490,000

That’s £90,000 (over $100,000) gone - to a fee you barely noticed.

It’s not just expensive - it’s almost 20% of your growth, erased.

That’s compounding in reverse - quietly and permanently working against you.

I’ve seen this personally. An acquaintance recently moved some investments from a 1.2% fee managed account to a self-managed platform. The fee savings over 20 years?

£265,000 ($360,000). The price of four Tesla Cybertrucks. Or three Lamborghinis. Or their entire future luxury travel budget.

Weighting

Market Weighting: Let the Winners Run

Most index funds use market cap weighting - meaning the bigger a company is, the bigger its slice in your portfolio.

If Apple or Microsoft grow, your fund automatically holds more of them. You don’t need to guess the winners - they find their way in.

It’s self-adjusting, low-maintenance, and highly effective for long-term growth.

Equal Weighting: More Balance, More Work

In an equal-weighted index, every company gets the same share - no matter how big or small.

That can sometimes boost returns if smaller firms outperform.

But it also means more trading (to rebalance constantly) and often higher costs. You're also betting that the underdogs will beat the giants - which doesn’t always happen.

Distributing vs Accumulation Funds

Distributing

If an index fund is labelled as “Distributing”, or “Dist”, then any dividends from the underlying stocks will be paid to you as cash, and you can decide what to do with that money

Distributing funds are useful if you want income from your investments (e.g. in retirement).

Accumulation

If an index fund is labelled as “Accumulation”, or “Acc”, then it means any dividends from the underlying stocks will be reinvested back into the fund.

Accumulation funds are great for long-term growth, as your dividends are automatically reinvested.

Most funds have both types, so you can choose your preferred type.

Currency

💷 Local Currency Funds: Simple, but still exposed to FX

If you're a UK investor, buying GBP-priced index funds is often the easiest option. You invest and withdraw in pounds - no FX conversion fees from your broker.

But if the fund holds US or global stocks (like an S&P 500 tracker), it's still buying those assets in dollars. That means:

You're still exposed to currency movements (USD↔GBP)

But you don't pay any direct FX fees - it's all handled inside the fund

This makes GBP funds simpler to manage, easier for tax reporting, and more intuitive for tracking performance in “real” money.

💵 USD/EUR Funds: Watch for Hidden Costs

Some funds (especially ETFs on foreign exchanges) are priced in USD or EUR. If you buy these on UK platforms, you might be charged an FX fee by your broker — both when buying and selling.

These fees are often 0.25–1% per trade, and can eat into returns if you're investing regularly or with large amounts.

Cheat Sheet: How to Pick the Right Index Fund

Want the key takeaways in one place? Here’s 2 visual summaries you can download to help you pick the right fund for you (for free!)

How to read the name of a fund

Fund names often pack in a lot of info - if you know what to look for. Here’s a quick breakdown:

Example 1

🟩 HSBC FTSE All World Index Class C - Accumulation(GBP)

HSBC → Fund provider

FTSE All World Index → Tracks the FTSE All World Index (developed and emerging markets)

C → Share class (e.g. Platform) - don’t stress about this too much

Accumulation → dividends are automatically reinvested in the fund

GBP → Priced in British pounds

Example 2

🟦 iShares MSCI World UCITS ETF USD (Dist)

iShares → Fund provider (owned by BlackRock)

MSCI World → Tracks the MSCI World Index (developed markets only)

UCITS ETF → Complies with EU standards, exchange-traded fund

USD → Priced in U.S. dollars

Dist → Distributing — dividends are paid out as cash

The Key Information Document (KID)/Factsheet

All funds should come with an information document or a factsheet.

In the UK, currently this is known as the KID (Key Information Document).

In the USA, use the factsheet.

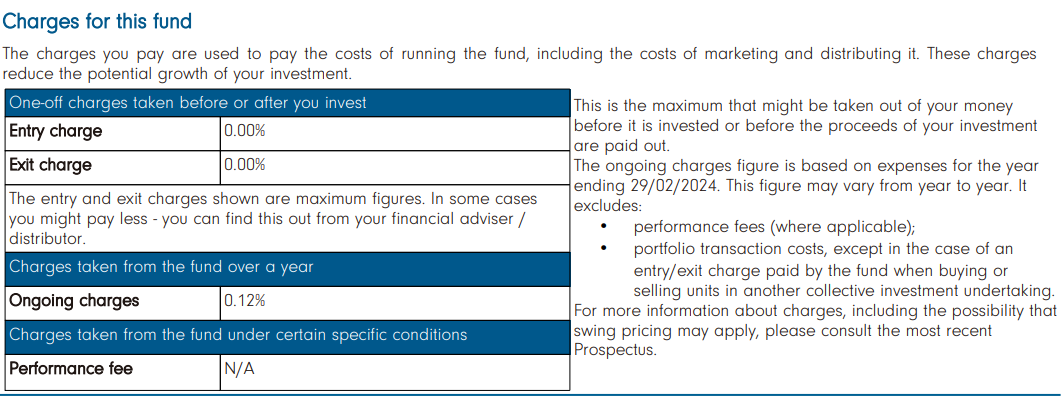

Where to find the Fees

The price, or total expense ratio (TER), should be in “Charges” section1:

This fund has an ongoing charge of 0.12% per year. That means on an investment of £10,000, the annual fee is just £12.

And you don’t physically pay this - the fund manager will take it from the value of the fund. It’s so small you won’t notice it, and don’t need to worry about it.

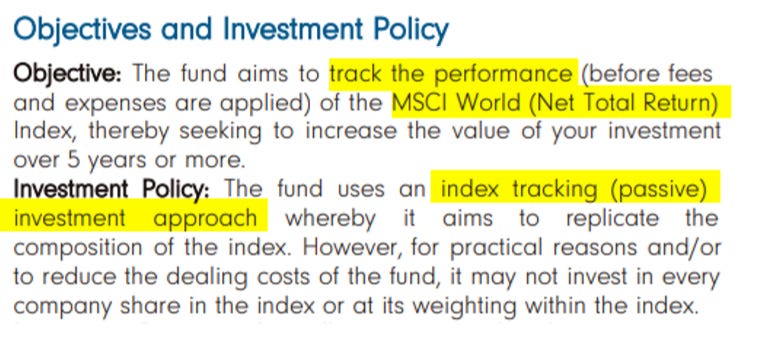

Where to find if it’s Active or Passive

This should be in the “Objectives section”:

Where to find which index it tracks

The objectives section also shows that the fund passively tracks the MSCI World Index.

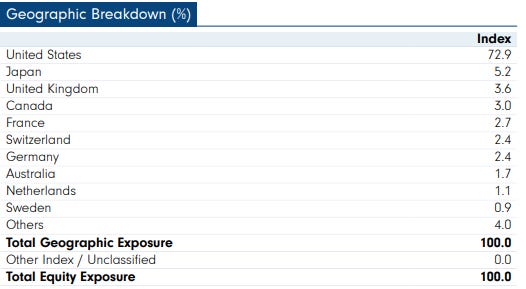

Where to find diversification

This is not always in the KID, but can often be found in a supplementary factsheet document. The factsheet for this fund shows 2 types of diversification:

Sector Diversification

It invests in companies in all the major business sectors, with a lean towards technology companies and financials.

Country Diversification

This fund is heavily weighted towards the USA. You may or may not want this, and lots of funds will have more balanced weightings across countries and regions.

Three Indexes to Start With

That’s the big picture. But there are still thousands of cheap, diversified indexes to pick from. Which one do you go for? A good place to start looking would be funds that track these Indexes:2:

FTSE All World Index

A global stock index that includes over 4,000 companies across 50 developed and developing countries (Emerging Markets)

Example fund: HSBC FTSE All World Index

Returns: ~9% pa (2003-2024) REF

MSCI World Index

A global stock index that includes over 1,500 companies across 23 developed countries

Example fund: Fidelity Index World

Returns: ~9% pa (1978-2025)

S&P 500

A list of the 500 largest companies in the USA

Example Fund: UBS S&P 500 Index Fund

Returns: ~10% pa (1957-2025)

By tracking these sorts of global indexes you are getting exposure to the returns of all the major global regions.

You don’t need to guess which country or sector will outperform.

You are literally ‘buying the global economy’, and not missing out on the growth of any region or industry.

Index Funds and ETFs

Index funds and ETFs (Exchange Traded Funds) are two sides of the same coin. Both track a market index (like the FTSE 100 or S&P 500), both offer broad diversification, and both have low fees.

ETFs

ETFs trade like stocks - you can buy and sell them instantly during market hours

Index Funds

Index funds are priced just once a day. Your buys or sells will take a few working days to process.

That’s it. Pick the one that suits your platform and preference — they both do the same job: low-cost exposure to the market.

Don’t Chase Performance

It’s tempting to pick the fund that’s “up 50% in the last year.” But here’s the catch:

That growth already happened.

It might be heavily tilted towards 1 country or sector (concentration risk)

Higher past returns = higher current price = likely lower future upside.

90% of these funds won’t beat a globally diversified, market weighted index fund in the long term. Buying the haystack has been remarkably successful.

Boring often beats flashy.

Recap: What You’ve Learned

Broad, global indices like MSCI World, FTSE All-World, or the S&P 500 are simple, cheap, diversified and have given historically hard to beat returns

Look for passive, low-fee funds (0.05%–0.2%) - they often outperform active funds long term.

Check the fund name and Factsheet/Key Info Document (KID) to understand what it tracks, fees, and income style (“Acc” vs “Dist”).

Ignore hype — past returns aren’t a future guarantee. Focus on diversification, low fees, and staying power.

Up Next: Understanding Bonds: How They Work and Why You (Might) Need Them

Looking Ahead

Use https://www.trustnet.com or https://www.justetf.com/

or the search feature of your online broker and try and find some funds that passively track the indices above. Compare the fees, and the returns. Ask yourself:

Is this diversified across sectors, geography and companies?

How much is the fee? Anything above around 0.2% per year starts to eat a little more into returns. Is there a cheaper fund that does the same thing?

Are there any other indices you can find out about? Are they similar in their objectives, and their historical returns?

If you would like to ask about a fund - post it in the comments and discuss!

https://www.fidelity.co.uk/factsheet-data/factsheet/GB00BJS8SJ34-fidelity-index-world-fund-p-acc/charges-and-key-documents

https://curvo.eu/

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.

Excellent. Very clear and understandable

Well researched and comprehensive. Good job on this one ~