3.7 Understanding Bonds: How They Work and Why You (Might) Need Them

Bonds are great - but how could something so straight forward be so complex?

Missed last week? Read it here, or see the full escape map here

TL;DR — Bonds in Plain English

✅ Bonds = lending your money to a government or company

✅ They pay you interest (coupons), and return the full amount at the end

✅ Bonds are lower-risk than stocks, but usually grow slower

✅ Ideal for stable income, fixed future costs, or portfolio balance

✅ UK/US readers: Tax rules vary, but most coupon income is taxable unless inside an ISA, SIPP, IRA or 401(k)

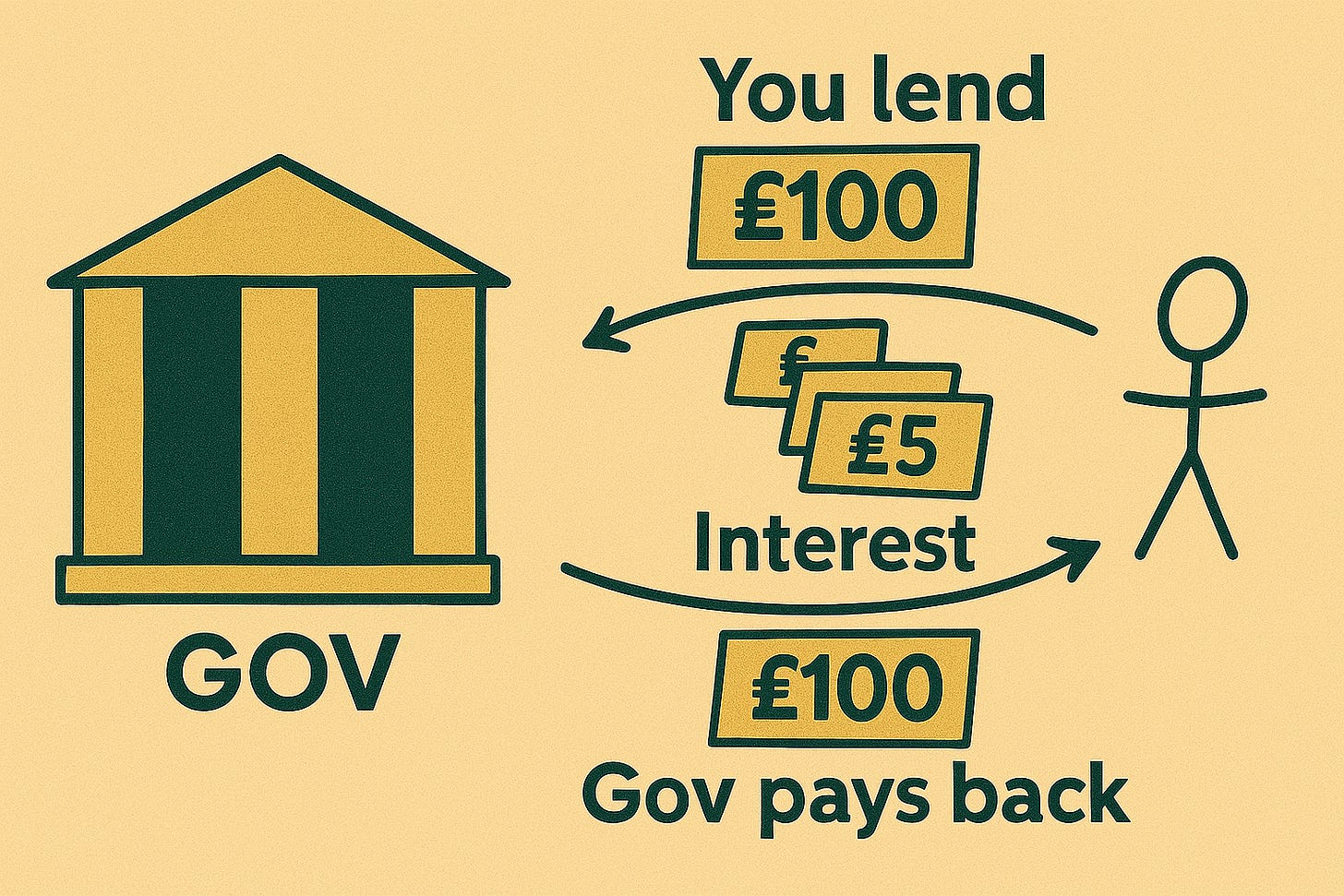

Imagine lending the UK government a crisp £100 note, or the U.S. government a crisp $100 bill, then strolling back a year later to get your original money back — plus a fiver (or a few bucks) for your trouble.

That’s a bond.

Out of all the asset classes, bonds have confused me the most. The jargon is relentless: “yield curves”, “gilts”, “TIPS”, “spreads” — and the tone is often condescending. But underneath it all, bonds are simple.

You’re the bank. They borrow from you. And you get paid interest. That’s it.

Bonds: You be the bank

Bonds are how governments and companies borrow money - from you.

You lend them money for a fixed period (the “Term” - anything from 1 month to 30 years). In return, they pay you interest. That interest is called the coupon.

Coupons are paid every 3, 6 or 12 months.

In the UK, most bonds are issued at £100 “par” value.

In the U.S., Treasury bonds often come in $100 or $1,000 denominations.

At the end of the term, they pay you back in full.

Want out early? You can sell the bond to someone else. They’ll receive the remaining interest payments and the final lump sum.

That’s it. You now understand how bonds work.

Why you might want bonds

Better Rates than Cash

Cash often struggles to beat inflation. Bonds can help you stay ahead.

UK: Gilts often offer better yields than savings accounts, and can adjust for inflation

US: Treasuries (especially Series I bonds and TIPS) adjust for inflation.

Bonds are Great for Upcoming Fixed Costs

If you know you’ll need £105 / $105 in a year…

Buy a UK GILT or U.S. Treasury Bill for £100 / $100 that pays 5%.

Over the year, you earn £5 / $5.

The bond matures, you get your original money back.

Job done - you now have exactly what you need, and it cost you less upfront.

You can see how this scales in retirement:

You can use bonds to cover yearly income, tuition fees, or any other fixed future expense.

Low Risk

UK Gilts and U.S. Treasuries are considered ultra-safe. The odds of either government not paying are extremely low.

The UK has never defaulted on its bonds.

The U.S. has never outright defaulted either, but:

In 1933, it changed the terms of repayment (gold clause).

In 1979, it briefly missed some payments due to a technical glitch.

These are rare and historic - but they happened. Still, both countries are considered among the most creditworthy in the world.

Volatility: Lower, But Not Immune

Bonds are bought and sold on the open market. Their price goes up or down based on interest rate changes, time left on the bond (time till maturity), and demand.

Prices swing less than stocks, which helps smooth out your portfolio.

When stock markets wobble, investors often flee to safety - and that’s usually bonds, causing their price to rise.

But in high inflation? Bonds can fall too.

Why? Because governments issue new bonds with higher rates to stay competitive. That makes your older, lower-rate bond less appealing - so its price drops.

In short: Bonds cushion the blow - they don’t eliminate it.

How Bonds are Taxed

Bonds can be taxed in two ways:

The coupon you receive is taxed at income tax rates. However UK GILTS are CGT free (see below)

If you sell the bond for more than you bought it for, your gain is taxed at Capital Gains tax rates (CGT)

However, if you hold the bond in an ISA, SIPP (UK), or Roth IRA or 401(k) (USA) then there is no income tax or CGT to pay

The Main Types of UK and US Government Bonds

Let’s break down the most common government bonds in both the UK and the US - what they’re called, how long they last, and any special features (like tax treatment) worth knowing.

UK Government Bonds

US Government Bonds

🔗 What Does “Inflation-Linked” Mean?

When a bond is inflation-linked (or index-linked), it means that either the interest (coupon), the repayment amount (principal), or both are adjusted for inflation.

In simpler terms: As inflation rises, your pay-outs rise too.

But how that works depends on the type of bond and the country.

UK: Index-Linked Gilts

Linked to RPI (Retail Prices Index).

Both the coupon and the final repayment amount are adjusted for inflation.

But the coupon rate itself stays the same — it’s the amount it’s applied to (the principal) that rises.

Example:

Let’s say you buy an Index-Linked Gilt with:

Par value: £100

Coupon: 1%

RPI inflation: 5%

Then, after a year:

Your adjusted principal becomes £105

Your coupon payment = 1% of £105 = £1.05

When the bond matures, you get back the inflation-adjusted principal (£105) - not just the original £100.

US: TIPS (Treasury Inflation-Protected Securities)

Linked to CPI (Consumer Price Index)

Works the same way:

The principal rises with inflation

The fixed coupon rate is applied to the inflation-adjusted principal

So again:

Higher inflation = higher coupon payments and bigger payout at maturity

But the coupon rate itself is fixed

Why You Might NOT Want Bonds

📉 Exposure to Rising Rates

Say you have a 20-year bond at 3.5%, but new bonds are now offering 4.5%.

Nobody wants your 3.5% bond anymore - so its price drops.

Want to sell? You’ll take a loss.

This is the interest rate risk of long-term bonds.

🐢 Growth

Bonds are slow and steady.

If you’ve got 20–30 years, equities will likely beat bonds for total returns.

Use bonds when you need stability, not maximum growth.

Recap

1️⃣ Bonds = Lending

When you buy a bond, you're lending money to a government or company in exchange for regular interest (coupon payments) and full repayment at the end of the term.

2️⃣ Lower Risk, Lower Return

Bonds are less volatile than stocks and offer more predictable income — but usually come with lower long-term returns.

3️⃣ Useful for Stability

Great for known future expenses, reducing portfolio volatility, or generating steady income in retirement.

4️⃣ Tax-Friendly (Sometimes)

UK Government bonds (Gilts) are exempt from Capital Gains Tax. Held in an ISA or SIPP, coupon income can also be tax-free.

Up Next: How to Buy Bonds: A Stress-Free Step-By-Step Guide

A one-stop guide on how to buy bonds safely

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.

As usual, Rohit. Great guide and great value!