3.8 How to Buy Bonds: A Stress-Free Step-By-Step Guide

Bonds aren’t complex - they just speak fluent finance. Here’s how to decode the jargon and make them work for you

Missed last week? Read it here, or see the full escape map here

TL;DR - Buying Bonds Without the Headache

✅ Bond funds are easy, diversified, and great for most people

✅ Individual bonds give control and price certainty if held to maturity

✅ Yields matter - not just coupons, but what you actually earn

✅ Credit ratings flag risk - higher yields = higher chance of default

✅ Bond ladders spread risk and smooth income over time

✅ Money market funds are smart homes for short-term savings

✅ Cash ISAs and Premium Bonds are safer, but often underperform

If you want to include bonds as part of your portfolio, understanding the terminology will help you make the right choices.

Where to Buy Bonds

There are two main options here: individual bonds or bond funds.

Bond Funds (Easiest)

Buy them through the same investment platforms you use for index funds (Vanguard, Fidelity, AJ Bell, Charles Schwab, RobinHood etc.).

These are diversified, professionally managed, and beginner-friendly

As we will see - buying funds exposes you to the price change, something that you don’t have when you buy individual bonds, if you hold them to maturity.

Individual Bonds

Buy UK government bonds (gilts) via the Debt Management Office (https://www.dmo.gov.uk/) or authorized agents. Some online platforms also offer them (Interactive Investor, Hargreaves Lansdown)

Buy US government bonds via Treasury Direct (https://treasurydirect.gov/), or online platforms.

Corporate bonds can be purchased through investment platforms or brokers too.

You'll need to choose the maturity, coupon rate, and check the credit rating

Bond Naming Convention

Bond names can be a little cryptic, but normally contain some or all off

The type of bond

The Maturity Date

The Coupon

Here are three examples

4¼% Treasury Gilt 2049 (T49)

Issued by the UK Treasury (government)

Matures in 2049

Pays 4.25% coupon

US Treasury 2.75% 04/30/2027

Issued by the US Treasury

Matures April 30th 2027

Pays a 2.75% coupon

Aviva plc (AE57) 6.125% 2036

Issued by Aviva (a corporate bond)

Matures in 2036

Pays 6.125% coupon

Risk of Default

This is the risk that the issuer doesn’t pay you back.

With UK government bonds (Gilts) and US Treasuries, this risk is considered very low - the UK has never defaulted (and the US only twice).

But with corporate bonds (from companies), or government bonds from emerging markets, the risk is higher. If the company goes bankrupt, or the country runs out of money, you might lose part (or all) of your investment.

When you lend money, you’re trusting the borrower to pay you back.

That trust is what defines the risk.

Credit Ratings

Companies and governments are rated on their ability to pay their bondholders by several Credit Agencies, who will give scores. The major agencies are:

S&P

Fitch

Moody’s

Scope

They will give these scores, according to their calculated risk of default1:

It’s like school. The lower the grade, the higher the chance they will default on a payment.

Investment grade bonds are unlikely to default, but speculative grade bonds are more likely to.

For example, a government bond from Brazil (BB) has a much higher risk of default than one from the UK (AA), so it needs to offer a much higher yield to attract investors.

Make sure you check and are happy with the credit rating of the company/government you are loaning to. A simple online search of the company or government should tell you the credit rating.

We can summarize the risk of default of different types of bonds:

UK GILTS → Low Risk

US Treasuries/T-Bills/notes/bonds → Low Risk

Corporate Bonds → Medium Risk

Bond Funds → Low/Medium

Money Market Funds → Very Low

Yields

When you hear the word "yield", just think:

“What am I getting back, compared to what I paid?”

Let’s say you buy a bond for £100, and it pays you £5 a year in interest.

Your yield is 5% - simple.

But what if you buy that same bond for £95 (because it's being sold second-hand)?

You still get £5 a year, but now you only paid £95 for it.

Now your yield is higher, 5.26%:

So:

This tells you how good the return is right now, based on the price you paid.

Yield to Maturity (YTM)

This one sounds complex, but here’s the gist:

YTM is the return you’ll get if you hold the bond until it matures and reinvest each interest payment at the same rate.

It takes into account:

The interest you’ll receive by reinvesting all your coupons

The price you paid for the bond

And the lump sum you’ll get back at the end

If you bought the bond below £100, your YTM will be higher than the coupon rate, because you also make a gain when the bond repays you in full (capital gains), as well as earning interest on your interest (more compounding).

In practice, you might not reinvest the coupons - or might reinvest at a different rate - so your actual return could vary. But YTM is a solid way to compare different bonds quickly.

Why YTM Matters More Than Just Coupon Rate

You’ll mostly see YTM used when comparing bonds - it gives a fairer picture than just looking at the interest rate (Coupon) alone.

But for most people:

If the YTM is higher than the rate you’d get from cash savings, and you're happy to wait - it might be worth it.

And if a bond’s YTM is higher than its coupon, that means the bond is currently trading below its original price (called “par”).

That might be a good deal:

You’ll pick up regular interest payments - and make a gain when it matures and you get back the full par value.

Snakes and Bond Ladders - Steady Income over Time

If you want regular income or to cover fixed costs over time, you don’t need to guess when the perfect time is to buy a bond. You could build a bond ladder:

Buying a set of bonds that each mature at different times (say, one each year for the next 5 years).

As each one matures, you reinvest it into a new bond at the current rate. That way, you spread your risk, stay flexible, and always have some money coming back to you.

As each bond matures, it can be reinvested back at the top of the ladder. Or it could be invested elsewhere, or spent. 2

Bond Glossary: GILTs, Treasuries, and TIPS

These are terms you’ll see a lot - here’s what they mean, without the jargon:

🇬🇧: GILTs

GILTs are UK government bonds. The name comes from “gilt-edged,” meaning ultra-safe. They’re backed by the government, and considered one of the safest investments in the UK.

🇺🇸: Treasuries

US government bonds - the American version of GILTs. Treasuries are trusted globally and often used as the benchmark for “risk-free” returns.

🇺🇸: TIPS (Treasury Inflation-Protected Securities)

A type of US Treasury bond that rises in value with inflation. That means your money keeps its purchasing power - even as prices go up.

You don’t need to buy these directly - but understanding what they are helps you compare risk, returns, and the role bonds play in your portfolio.

Bond Funds

Many people invest in bonds through bond funds - pooled investments that hold lots of different bonds.

Think of them as index funds for bonds. But unlike holding individual bonds to maturity, you're along for the ride - prices go up and down, and there’s no maturity date to lock in a return.

They're convenient, diversified, and easy to access.

But there’s a catch: when you buy into a bond fund, you’re exposed to the price movements of the underlying bonds.

If interest rates rise, the price of those bonds can fall - and so does the value of your fund (if your bonds pay 3%, and interest rates rise to 4%, demand and price for your bonds in the fund fall).

So if you need to sell them and bond prices have fallen, you might end up taking a loss.

Unlike holding a bond to maturity (where you get back your original amount), bond funds don’t guarantee a return of your capital.

UK/US Bond Fund Examples

Download the free cheat sheet to get examples of Bond Funds & Money Market Funds in the US and UK here:

Money Market Funds

A Money Market Fund is a type of investment that’s designed to be safe, stable, and liquid.

It invests in very short-term, high-quality debt - usually government bonds, corporate bonds, and other low-risk instruments that are due to be paid back within a few weeks or months.

Because the loans are short and the borrowers are considered very reliable, there’s very little price movement.

That means your money doesn’t swing up and down like it might in a bond fund or with stocks.

It’s like the Goldilocks of investments: not too risky, not too exciting - just right for parking money you might need soon, while still earning a bit of interest.

Think of it as:

Higher interest than a savings account

Lower risk than a bond fund

Easier access than locking cash away

Perfect for short-term savings, parking cash while waiting to invest, or just sleeping better at night knowing your capital is steady.

For full disclosure: I find bonds too cumbersome to buy and manage. Some bonds may return slightly higher than money market, but for my purposes, a money market fund is fine for me, just for ease of use.

I also don’t like being exposed to bond prices rising and falling.

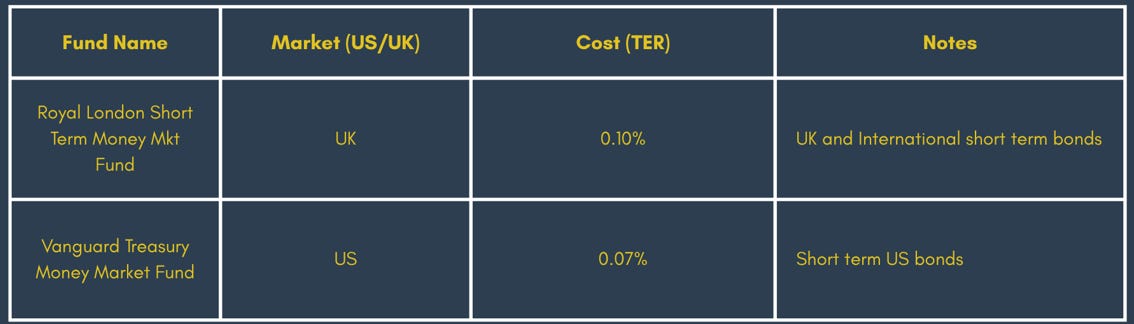

UK/US Money Market Fund Examples

Bonds vs Bond Funds vs Money Market Funds vs Savings accounts vs Premium Bonds

All of these options offer a way to earn interest safely - they sit in the low-risk corner of your portfolio. But which one is right for you?

Should you stick with your savings account? Are Premium Bonds worth it? And what’s the real difference between buying a bond fund and a money market fund?

Let’s break down the pros, cons, and use-cases - so you can pick the right tool for your needs.

🔍 “Should I Just Buy a Bond Fund?”

If you don’t want to spend time comparing individual bonds, managing ladders, or worrying about reinvestment timing - yes, a low-cost bond index fund is probably your best move.

It gives you:

Instant diversification

Professional management

Passive exposure to bond returns

Just remember: you don’t get the guarantee of capital return at maturity like with individual bonds. Bond funds go up and down in price - so they’re best for medium to long-term holding.

💷 Money Market Funds vs. Premium Bonds (UK only)

Premium Bonds (UK) offer a chance to win tax-free prizes (up to £100,000) rather than earning interest. But statistically, the expected return is low - currently around 3.3% (2025), and that’s not guaranteed. Many savers win nothing. And they are not inflation linked.

Money Market Funds offer a predictable, steady yield - currently often higher than Premium Bonds’ average returns. They’re not lottery tickets. They're low-risk investments in short-term debt, designed to keep your money stable and working.

For what it’s worth - I am not a big fan of premium bonds at all, especially with no guarantee of a return.

🏦 Money Market Funds vs. Cash Savings Accounts

Cash savings can offer good rates at times, so it’s best to shop around. However they often lag behind interest rate changes. Once you lock in a rate, you're often stuck.

Money Market Funds move with the market. As rates change, yields adjust. They’re flexible, liquid, and (when held inside a Stocks & Shares ISA) can also be tax-free.

Recap

1️⃣ Bond funds vs individual bonds

Bond funds offer simplicity and diversification, but come with price swings. Individual bonds give you fixed income and a known maturity value - if you’re willing to manage them.

2️⃣ Understand the risk-return trade-off

Higher yield often means higher risk. Always check credit ratings. Investment grade = safer. Junk bonds = more yield, more danger.

3️⃣ YTM beats coupon

Don’t focus just on the interest rate. Yield to Maturity tells you the real return you’ll earn, especially when buying bonds at a discount.

4️⃣ Bond ladders are smart

Buying a set of bonds that mature in different years gives you regular income and reinvestment flexibility. Great for retirees or anyone managing future costs.

5️⃣ Money market funds ≠ cash

They’re better. Flexible, steady-yielding, low-risk. A smarter way to park money than most savings accounts or Premium Bonds.

6️⃣ No single “best” choice - match the tool to the job

Short-term need? Go money market.

Want steady growth without thinking? Go bond fund.

Need income certainty? Go individual bonds or a ladder.

Don’t want to bother? Use a well-diversified passive bond fund and move on.

Next, we’ll cover the asset class so beloved by so many, you’d think it was as safe as houses.

Up Next: Property Investing 101: How Bricks & Mortar Build Wealth

https://www.wallstreetprep.com/knowledge/credit-rating/

https://russellinvestments.com/us/blog/bond-ladders

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.