2.1 Build Your Escape Route: Why Assets, Not Income, Matter

Your key to escaping the money trap is owning, not earning.

Missed last week? Read it here, or see the full escape map here

The Janitor Millionaire

You’ve probably never heard of Ronald Reid. You have almost no reason to have heard of him. Born in 1921 in Dummerston Vermont, USA, he never went to college, and never had a high paying job. After serving in World War II he was a petrol station attendant and janitor back in his hometown.

By all accounts he lived modestly.

Unremarkably.

When he died in 2014, his passing should have gone totally unnoticed by the world at large.

Except for one thing.

Ronald Reid left $8m in his will.1 2

Despite working only in low-paying jobs, he somehow managed to accumulate a fortune that many people — earning many times more — never come close to.

And, as we will find out in the next chapter - that $8m would have allowed him to live off an income of $320,000 a year without ever needing to work another day of his life.

How did he do it?

How did he grow such a modest income into such a massive legacy?

Ronald Reid realised that it was not about what he earned, but what he owned.

Why Owning Assets Beats Earning a Salary Every Time

Sometime in his later life, Ronald Reid started investing in stocks of large US companies.

He started buying assets.

Those assets created wealth in two ways:

They grew in value over time

They produced their own income in the form of dividends

The specific names of the stocks aren’t as important as the principle: he owned assets that grew over time and paid him to wait.

What matters is that Ronald Reid escaped the money trap by owning things that made money — even when he wasn’t working. He shouldn’t have been incredibly wealthy, but somehow he was.

You may think this is obvious. If so, you’re ahead of the curve. But this was not obvious to me until very recently.

How Assets Break You Free

Assets beat all three money traps:

They can grow in value faster than inflation

They’re often taxed less than income

And they continue earning even when you stop working

With the right assets — plus time, patience, and a bit of discipline — you can reach a point where your money works harder than you do.

And this is what the rest of the series is about. Escaping the money trap is largely down to answering these questions:

How many assets do I need so that I can live off their income?

How many do I already own?

What different types of asset are there?

How much can I buy, and in what proportions?

How long will it take for me to own enough of them to live off?

How do I live off them once I escape the money trap?

Mapping Out Your Escape

You’ll get two tools to help you map and measure your escape:

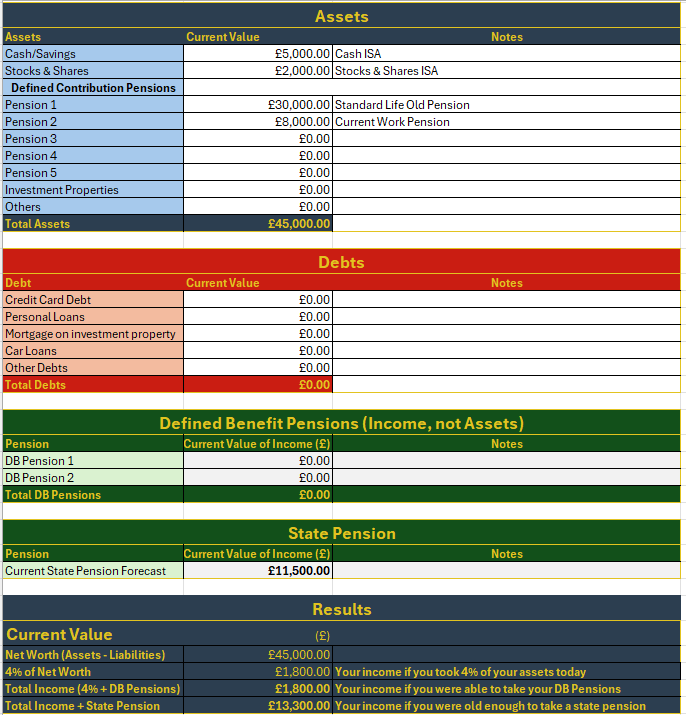

🔎 The Asset Map

Track what you already own — your pensions, savings, shares, property.

See your current position clearly, all in one place.

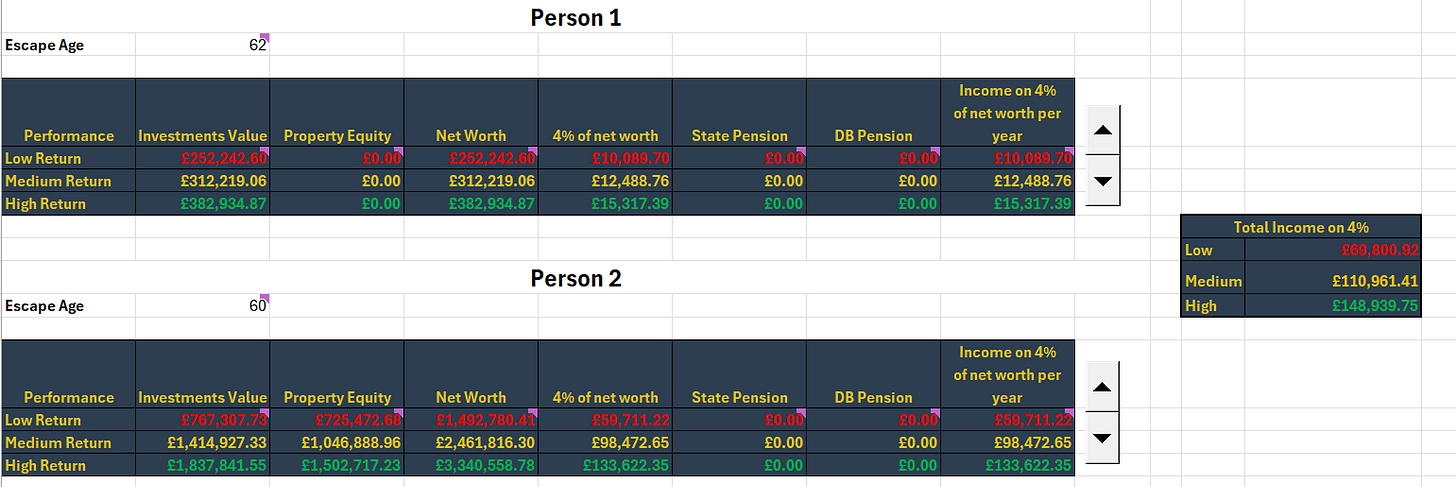

📈 The Escape Calculator

Plug in your numbers and project your escape date. See how much your assets might grow — and when they could set you free.

Coming up

In Part 2, you’ll build your Asset Map — and discover what you already own that’s working for you.

In Part 3, we’ll break down what to buy, in what proportions, and how to build a resilient portfolio from scratch.

In Part 4, you’ll use the Escape Calculator to project your freedom date — and learn how to invest safely, efficiently, and consistently.

Part 5 is all about mindset — investor psychology, staying calm in downturns, and the beliefs that help you stay on track.

In Part 6, we’ll explore how to protect your assets, your legacy, and your loved ones — so no one you care about stays trapped.

And in Part 7, you’ll learn how to live off your assets, with freedom, clarity, and peace of mind.

You’re not just reading a blog.

You’re building your way out.

You can see the full escape map here: The Escape Map

Recap

Ronald Reid didn’t earn millions — he owned assets that worked for him.

Wealth isn’t just about how much you earn — it’s what you do with what you earn.

Assets can grow in value over time and pay you income (dividends).

Owning assets breaks the traps: inflation, tax, and dependence on work.

The path to freedom begins when you stop thinking like an earner… and start thinking like an owner.

Up next: How Much Do You Really Need to Escape Work Forever?

Calculate Your Escape Number - How much do you need to never work again?

✨ I’d love to hear from you — what’s one money-earning asset you already own, or want to start owning? Drop it in the comments or reply to this email/post!

“What assets do you already own that might be working for you — even if you hadn’t thought of them that way before?”

“Did Ronald Reid’s story surprise you? Have you ever thought of wealth in terms of what you own rather than what you earn?”

“If you could own one thing that earns money for you, what would it be — and why?”

Enjoyed this?

Follow me on Instagram: rohit.trivedi.39 and LinkedIn: rohit.trivedi

Tools & Resources

Explore all tools here: Tools & Resources — calculators, mappers, and guides to help you escape the money trap.”

Looking Ahead

Shift from Earning to Owning

Take a few minutes and list all the things you own that generate money — or could. Not your job. Not your salary. Just the things working for you. For most people this could be:

A savings account

A pension (Do you know what your pension is actually invested in?)

Shares, Index Funds or ETFs

Rental property

Premium Bonds

Next, ask yourself:

What return does each of these generate? Do you know? How could you find out?

(Even a rough guess is fine — the point is to notice, or find out)

If you own any of these, congratulations — you're already on the path to escape.

If not, don’t worry. Just by asking this question, you’ve taken the first step.

You’ve started the shift from earning… to owning.

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.

https://finance.yahoo.com/news/janitor-built-8-million-fortune-012143208.html

I stay away from Government Debt for AAA Corporate Debt or Equities. The Crisis we see unfolding daily in the news is a crisis in Government and Government Debt. Governments are CHRONIC defaulters, and they love to hide their default as something else like the US did in 1933, a Default with holders of the Liberty Bond taking a 90% loss.

The Crisis is in Government and Government Debt and the Flight To Quality is Blue Chip Equities, Real Estate and other Real Assets, and yes, Corporate Debt and Blue Chip Stock are Real Assets.

Really interesting read so far Rohit, looking forward to seeing the spreadsheets.

I currently invest in rental properties mainly as I consider them a pretty safe haven that allows me to retain control over how that investment performs.

I hold ISA’s and high rate business savings accounts too.

I’ve avoided stocks and shares as my lack of market knowledge and the current state of the world make me nervous about them!

Great work, looking forward to the next bits.

Andy