7.1 Safe Income from Your Portfolio: A Guide to Living on Your Assets

How to safely live of your assets, and minimize the chances of a wipeout in a crash

Missed last week? Read it

here, or see the full escape map here

TL;DR — How to Live Off Your Portfolio

Have a plan and stick to it - this is not the time for improvisation.

Target-Date Funds: Automate de-risking, ideal for simplicity.

Bucket Strategy: Cash (0–2 yrs), Bonds (3–7 yrs), Equities (7+ yrs) – rebalance with discipline.

Cash Buffer: Simple 1–5 years of expenses in cash to ride out crashes.

Annuities: Trade capital for guaranteed lifetime income.

State Pension/DB: Treat as income floors when planning drawdown needs.

Tax Strategy: Start with ISAs, draw from pensions up to allowance, keep income under higher-rate band.

Talk to a Planner: Customisation is critical – especially with mixed pensions, inheritance goals, or care costs.

(In 5.4 – From Growth to Preservation: Seamless Portfolio Shifts as You Near Freedom, we discussed sequencing risk and the danger that a large market crash can decimate your nest egg. As you approach your “escape date,” de-risking at least part of your portfolio—whether via target-date funds, buckets, cash buffers, or manual reallocation—shields you from having to sell equities at rock-bottom prices.)

Living off your assets - the spending phase - can be more complicated than building them up. The single most important rule is: have a plan, and stick to it.

At this point, consulting a qualified financial planner is often wise. No one can predict the future, but an experienced adviser can help tailor a withdrawal strategy to your circumstances.

Target Date Funds

A target-date (“glidepath”) fund automatically shifts its asset mix from equities toward bonds and cash as it approaches its target year. If you buy a single T-date fund and set your retirement date inside it, that fund will gradually de-risk on your behalf. In practice, you simply sell units each year to cover expenses. If the market crashes, the fund’s bond/cash sleeve cushions your withdrawal.

Pros

Fully automated de-risking, minimal decisions.

Cons

You can’t customize the exact timing of each equity→bond shift, and fees tend to be slightly higher than the DIY approach.

Buckets

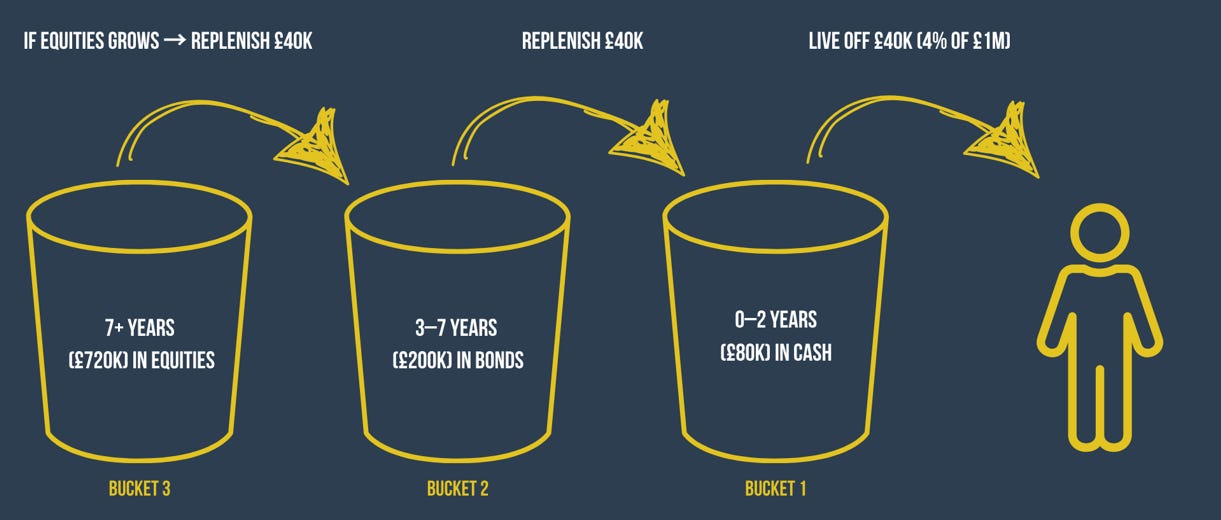

A three-bucket approach divides a portfolio based on time horizons. Because many retirees follow a 3–4 % safe withdrawal rate, we’ll illustrate this with a £1m portfolio, where 4% → £40k.

Bucket 1 (0–2 years, £80k in cash/money-market).

Bucket 2 (3–7 years, £200k in short-term bonds or conservative bond funds).

Bucket 3 (7+ years, £720k in global equities/growth assets).

But how would you live off this? Here’s 1 approach:

Live off £40k (4% of £1m) from bucket 1 in the first year

Replenish #1 from #2 at the end of the year with £40k.

If #3 grew (growth assets did well), refill #2 from #3

If #3 declined, don’t refill #2 and wait for a recovery

Why it works

Because Bucket 1 holds 2 years of cash and Bucket 2 is 3–7 years of bonds, you avoid selling equities at market bottoms.

Meanwhile, Bucket 3’s equities have up to 7 years to recover any dips, and you don’t have to sell any assets at a loss (sequencing risk).

The “rules-based” refill schedule removes emotion from each withdrawal decision.

Cash Buffer

The cash buffer strategy is very simple:

You set aside 1-5 years worth of expenses in cash or near-cash assets.

This buffer is separate from your core portfolio and acts as a financial shock absorber.If markets are up, then you can sell and live off your core portfolio (equity index funds for example).

If there is a crash, then live off the cash buffer until markets recover.

When markets recover - replenish the cash buffer

This is practically a two-bucket version: cash (bucket 1) and “everything else” (bucket 3). You skip the mid-horizon bonds (bucket 2) for simplicity.

Pros

Easy to implement - no annual rebalance.

Cons

If markets stay down for 5+ years, your buffer will run dry and you may be forced to sell equities at lower prices.

Annuities

A life annuity is a financial contract: you hand over a lump sum, and an insurance company promises a guaranteed pay-out every year until you pass away (and sometimes extends to your spouse). As of June 2025, guaranteed rates range roughly from 4 – 9 % depending on:

Your age (older buyers receive higher pay-outs).

Your health (if less healthy, the insurer expects a shorter pay-out period and thus pays you more per year).

Whether the annuity is escalating (rising with inflation) or level (flat annually).

If you want a joint-life option (continues paying a survivor).

Example: A £1m purchase might guarantee £40k – £90k per year. If you choose an inflation-linked annuity, your payments climb each year to preserve purchasing power.

Pros

True guaranteed income; no market risk; “set-and-forget.”

Cons

Illiquid—if you need a large, unexpected expenditure (e.g., health bill), you can’t easily tap your annuity. Once you buy it, that capital is gone from your portfolio.

Annuities and sudden large costs

As attractive as rates of 4-9% look - an annuity can’t help you if you have a large unexpected costs (healthcare bill, social care, new car etc) that is more than the annuity will pay you.

Having a mix of an annuity plus assets you can draw on in emergency would solve that. Diversification still has a role to play.

This mix is up to you - and one area where talking to an advisor would definitely be worth it.

UK State Pension & Defined Benefit (DB) Pensions

The UK State Pension (age 68 in the UK as of 2025) is a guaranteed baseline income. Once it kicks in, your withdrawal needs from market-linked assets drop.

Some DB pension schemes let you take benefits at 55 or 60, which may reduce pressure on your ISA/pension withdrawals in early retirement. Others restrict you until State Pension age—check your scheme’s rules.

Both of these count towards taxable income past the £12,570 tax free allowance.

Tax-Efficient Withdrawal Order

It’s generally considered prudent to put off paying taxes - i.e. deferring them till later. This gives your assets time to grow faster than inflation, without being hit by constant tax bills.

Remember in the UK:

Selling assets and withdrawing them from an ISA is tax free

Selling assets from a pension is tax free (no capital gains), but withdrawing them incurs income tax.

There are many ways to live off ISAs and Pensions to be tax efficient - here are just three:

ISA first

Live off your ISA for as long as possible, and drain it to zero.

Only then start living off money in Pensions.

This way you have deferred any tax for potentially many years whilst you live off your ISA, allowing your assets in your pension to grow.

Pension Tax-free allowance then ISA

Draw from pensions up to your tax-free personal allowance (e.g., £12,570 in 2025). Your state pension or DB pensions may cover this, so that you don’t need to sell assets in any private or DC pensions.

Then draw your remaining needs for the year from your ISA

This strategy eases the pressure from your ISA a little, whilst still allowing you to live tax free for potentially many years.

Higher income Strategy: Pension First

Currently the threshold for the higher rate tax band (40%) is £50,270. If you need to live off more than this, and you don’t want to drain your ISA too early, you could:

draw down £50,270 from pensions (the first £12,570 is tax free, the rest taxed at 20%). Remember if you qualify for the state pension or have any DB pensions you can use these and don’t need to sell assets.

anything above that amount draw down tax free from your ISA

This way you never pay 40% on any income. In fact you would only be paying £7,540 tax on £50,270 of income (effectively 15% tax, or less the more you draw down from your ISA).

There are many ways to live your income, and it’s possible to get very creative in order to minimise tax. So that’s why:

You Should Talk to a Financial Adviser

By the time you reach the “spend” phase, your situation is unique:

You may have multiple pensions (defined contribution + DB) each with different rules.

You might need to balance legacy costs (e.g., paying off a mortgage) alongside living expenses.

Tax planning, health spending, inheritance goals, and Social Care risk can all affect how much you can sustainably withdraw each year.

A qualified adviser will run “what-if” scenarios (e.g., crashes & sequences of returns risks, tax changes, inflation spikes) so you can feel confident you won’t outlive your money. Withdrawing 3–4 % of your portfolio may look fine on paper - until a 2008-style crash cuts your account in half. A planner helps calibrate bucket sizes, annuity allocations, and withdrawal rates for your exact age, drawdown needs, and risk tolerance.

Recap

Have a Plan & Stick to It: Decide in advance how you’ll draw income so you don’t panic when markets fall.

Target Date Funds: One fund does the “glidepath” de-risking for you—sell units each year, regardless of market ups & downs.

Bucket Strategy: Use 0–2 yrs cash, 3–7 yrs bonds, 7+ yrs equities. Refill cash from bonds annually; refill bonds from equities only when markets recover.

Cash Buffer: Keep 1–5 yrs of living costs in cash. If equities crash, live off the buffer until stocks rebound.

Annuities: For guaranteed lifelong income - trade away liquidity in exchange for a fixed pay-out you can’t outlive.

DB & State Pensions: Treat these as “annuity-like” income streams.

Tax-Efficient Drawdown: Use ISAs first, pensions up to your personal allowance next, then taxable accounts.

Financial Advice: This phase is more complex than accumulation. A planner can build a withdrawal system that matches your goals and risk tolerance.

Which approach will work best for you?

If you crave simplicity, a single target-date fund or a straightforward cash buffer may be ideal.

If you want control and are comfortable running your own spreadsheet, the bucket strategy offers robust sequence-risk protection.

If you prize certainty, consider using an annuity (or a mix of annuity + liquid assets for large emergencies).

Whichever path you choose, having a clear, rules-based system - and following it through both bull & bear markets - is the surest way to turn your nest egg into a dependable income “machine” for life.

Next Up: The Money Masterclass: Key Lessons from History’s Top Financial Minds

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.