5.3 How to Stay Invested When the World Feels Out of Control

We can't control markets, but there are things we can control which will help avoid falling back into the money trap

Confused and need the big picture of how to grow your wealth? See the full escape map here

“Markets can remain irrational longer than you can remain solvent”

John Maynard Keynes

We’ve all seen markets crash and misbehave — in real life or in the movies. Sometimes it’s stocks. Other times, it’s housing. Occasionally, it feels like everything is crashing at once.

And if you’re thinking of investing your way out of the money trap, this might be your biggest fear:

“I can’t take the risk. What if there’s a crash and I lose everything?”

It’s a fair question. No one wants to spend years building wealth, only to watch it disappear overnight.

But here’s the good news:

Crashes are not the end of the story.

In fact, they can be some of the most powerful opportunities in your journey — if you have the right systems and mindset in place.

The truth is, we can’t control markets.

We can’t stop crashes, or predict recoveries.

But we can control a few key things — and those things make all the difference.

Fees

We saw in “3.5 – Which Index Funds to Choose?” that even a 1% annual fee can dramatically reduce your returns.

That seemingly insignificant amount, over 30 years could cost you a big chunk:

£100,000 invested in a global index fund growing at a real rate of 6% per year, over 30 years grows to:

£570,000.

If that was given to a manager charging a 1% fee? Now the return drops to 5%, and becomes:

£430,000

You would hand over £140,000 in fees.

That’s an expensive way to get the average return.

That could be the difference between staying afloat or falling behind.

Here are the three main fees to watch for:

🏦 Platform Fees

Is your investing platform charging more than 0.2% per year?

Some providers offer no platform fee or flat fees that could save you hundreds (or thousands) over the long term — especially as your portfolio grows.

📊 Product Fees

Are you in an actively managed fund charging 1% or more?

Passive index funds can track the same market for as little as 0.1% — sometimes less.

Same market exposure. Fraction of the cost.

👨💼 Advisor or Wealth Manager Fees

Do you pay a wealth manager?

For some, it’s worth it — especially when dealing with complex tax, inheritance, or large financial planning needs.

But if they’re just putting you in index funds and collecting 1% — ask yourself:

Is this something I could manage with a bit of learning — and keep that 1% working for me instead?

How Diversification Shields You

When things go south, not everything crashes together.

In fact, when stocks fall, investors often flee to safer havens — like bonds, or sometimes gold — which can rise in value during turbulent times.

When markets are booming and interest rates are low, the opposite often happens: stocks fly, while bonds lag behind.

That’s the power of diversification.

By holding a mix of assets, you give your portfolio multiple levers — some may stall, others may thrive.

A well-diversified portfolio might deliver slightly lower returns on paper…

But it can also protect you from deep drawdowns of 50–60%. And that might just be the difference between staying on track — or panicking and bailing out at the worst moment.

You can also diversify within each asset class.

Instead of trying to pick a few stocks you think will go to the moon, buying a low-cost index fund spreads your bets across hundreds — sometimes thousands — of companies.

And an index fund beats even the best stock pickers, 90% of the time.

Hope is not a strategy.

Diversification is.

Take time to consider your risk appetite and your time horizon.

The longer your timeline, the more risk you can afford to take — and the more growth you might see.

The shorter your timeline, the more protection you may need from sudden drops, especially if you’re close to drawing down your assets.

We’ll explore this more in 5.3 – Investing as You Approach Escape, and again in Part 7 – Living Off Your Assets.

Now that we have some measure of control, let’s look at some home truths about market crashes, which might not make them seem so scary.

What Crashes Actually Look Like

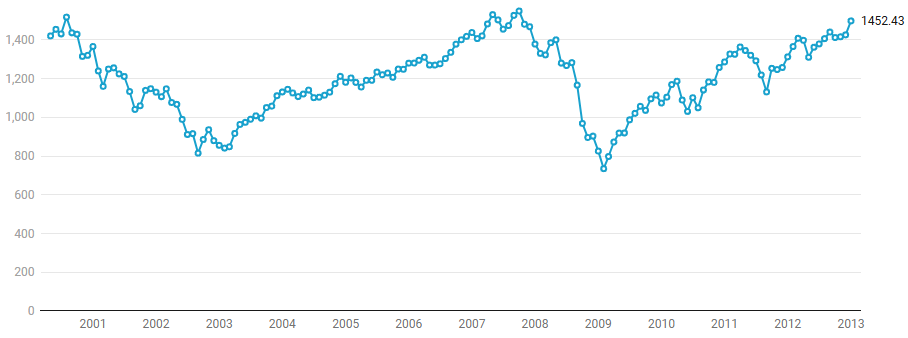

Take a look at this chart of US stock market crashes and recoveries1

The crashes are red,

the recoveries and ensuing bull markets are green.

crashes are often short lived

recoveries and subsequent bull markets last for longer, and produce much larger returns than the losses of the crash.

If you can weather the storm, the reward is often far bigger than the loss.

Markets crash fast. But they recover quicker and stronger — bull markets often run for years.

You may think “well I’ll just sell right before the crash, and then buy in at the bottom”.

Good luck, but remember:

The Myth of Market Timing

Timing the market is hard - it requires you to be right not once, but twice. You have to sell, and buy at the right time.

It’s so hard that 90% of fund managers can’t beat a strategy of buying and holding an index, despite all their technical and intellectual resources.

I don’t like those odds, so I don’t try to beat them.

Training yourself to not act during crashes; to hold on and keep buying may be the boring superpower that helps you beat the professional fund managers who are paid to try (and consistently fail) to beat the market.

Winning Even in a Losing Decade

What if you started investing at the worst possible time? And not only that - you just did the “dumb” thing: never sold and bought consistently all through it.

Imagine this:

You begin putting £500/month into an S&P 500 index fund starting in April 2000.

Immediately, the Dot-Com Bubble bursts. By October 2002, the market has fallen 48%.

Then just as recovery begins, the Great Financial Crisis hits in 2008 — and your investments drop another 60%.

It’s not until January 2013 that the market finally returns to where it was when you first started.

You’d think you’d have lost money — or at best, broken even. The diagram below shows the market during this period.

The dots just show the discipline of buying regularly.

But here’s what actually happened:

You invested: £76,500

Your portfolio value: £110,524.02

Total return: 44%

Your annual return: 5.57% (3.44% after inflation)

And all potentially tax-free inside an ISA or pension

5.57% is better than the rate on most cash savings accounts (even in that period). How did you beat cash - traditionally the safest asset class in one of the worst decades for equities in history?

Because you kept buying, and never sold, no matter how bad it got.

Each £500 bought more shares when prices were low. By the time the market recovered, those cheap shares had turned into massive gains.

You didn’t time the market. You didn’t need to.

You just showed up — consistently.

Even during one of the worst decades in market history, a regular investing habit beat all the money traps: inflation, tax and work.

Now that we’ve seen that crashes are:

often short lived and recover quickly

not as severe as how bountiful the ensuing bull markets are

can even help us to come out on top by buying consistently

let’s look at some mindset shifts that might change the way we view them

Crashes enable us to buy great assets on the cheap

Markets may crash due to technical, fundamental factors (valuations being high, tariffs, geopolitics). There may be good reasons for them. But markets are irrational.

What we are buying are good quality assets - profit making companies in a diversified low cost index fund.

High grade bonds with an almost guaranteed income.

Fantastic properties all over the world in a low cost REIT.

When the prices are slashed - it doesn’t make them bad assets, or loss making companies.

It makes them even cheaper, and better value. Warren Buffet once asked investors in a letter2:

If you plan to eat hamburgers throughout your life (and are not a cattle producer), should you wish for higher or lower prices for beef?

Crashes Can Boost Your Future Returns

A crash early on in your investing career gets you in on the ground floor. All those companies, bonds, REITs all at a great price, primed to grow longer and faster than the crash which gave you the opportunity to buy more.

If you can view them from this perspective, then they become a great opportunity, rather than a threat.

You Will Get Used to Crashes

Stocks crash more than you think. On average, the S&P 500 has experienced3:

a correction once every 2 years (10%+ drop)

a bear market once every 7 years (20%+ drop)

a crash once every 12 years (30%+ drop)

So you will get used to them. If you can go through a few without selling in a panic and realizing your losses, then you will slowly view them less fearfully.

In 2020 I freaked out when stocks fell 30%. Luckily I didn’t have the knowhow of how to sell, and what to buy. I froze and held on for dear life, and experienced a 36% gain during a global pandemic

In 2024, I was nervously looking at different index funds to invest in during a summer correction. I just couldn’t make my mind up and got analysis paralysis. This kept me in the game.

It’s now 2025, and as tariffs and volatility threaten the long term gains of all asset classes, I feel more relaxed, and look forward to buying more great companies at knockdown prices.

If you can ride out the first few, you too will be able to view them less fearfully, when you zoom out and realise that the history of markets is littered with crashes.

Yet markets continue to recover quickly and reward patience and discipline.

Don’t Read the News

A final word on financial news.

Just like regular news, it’s designed to trigger fear, outrage, or urgency — whatever keeps you watching. It’s not information. It’s entertainment.

“Keep calm and keep dollar cost averaging” doesn’t make a headline.

“The end is coming” does.

Think about it. You’ve definitely heard about:

The Dot-Com crash in 2000

The Global Financial Crisis in 2008

The pandemic crash in 2020

The tariff-driven crash in 2025

But did you ever see a breaking headline about:

A 340% rise from 2009 to 2020?

A 133% gain in just five years from 2020 to 2025?

The global economy growing 670% since 1985?

Those gains would have transformed your portfolio — yet they weren’t considered newsworthy.

Why?

Because “slow, consistent wealth building” doesn’t sell.

I try and avoid all news as much as possible. It encourages trading in and out with different strategies, and we’ve already seen how poorly that performs against a consistent, disciplined approach.

Recap: Staying Calm in a Crazy World

You can’t control crashes — but you can control fees, diversification, and your reactions.

Market crashes are short, but recoveries are long — and powerful.

Regular investing through a crash can still produce strong long-term gains.

Timing the market rarely works. Discipline wins.

Crashes aren’t a bug — they’re part of the system. And they create opportunity.

The more you go through, the calmer you’ll get.

And when in doubt? Turn off the news. Stay the course.

Next, we’ll look at how to reduce your risk of a crash depleting your escape fund as you get closer to freedom:

Up Next: Shifting Gears - investing more safely as you approach freedom

https://www.macrotrends.net/2324/sp-500-historical-chart-data

https://www.berkshirehathaway.com/letters/1997.html

https://awealthofcommonsense.com/2022/01/how-often-should-you-expect-a-stock-market-correction/