5.2 Dollar Cost Averaging - how to not time the market perfectly

Buying whenever you have the cash might just be the best timing strategy there is

In the opening scene of A Good Year (2006), Russell Crowe plays Max Skinner — a ruthless, high-flying trader for a London hedge fund. The movie begins with Skinner orchestrating a massive dump of bonds onto the market, crashing the price.

“The secret to riches, is timing” he says wisely. And then..

“SELL.”

And just as the price craters, he flips:

“BUY”

The market obeys. His firm makes millions in minutes.

The message? The game is rigged. The players at the top control the board — and the rest of us? Just slow, clueless pawns.

It’s a thrilling scene. But it’s also a myth.

Real-world investing doesn’t work like the movies.

You’re not battling hedge fund titans in real-time. You’re battling your own instincts.

The truth is, markets don’t ruin most people’s portfolios.

People ruin their own portfolios.

Trying to outsmart the system. Jumping in when prices are high. Panicking when they fall. Overthinking. Under-planning.

Investing isn’t about timing.

It’s about temperament.

And having a system that protects you from...you.

Let’s learn how to stay steady through market storms — and chart a course that keeps you on track, no matter what the headlines say.

Regular Investing

What happens if you just... invest, every time you have the money to do so? Without trying to time the market? Without guessing when the next dip or surge will be?

At first glance, it feels foolish. Buying high? Isn’t that how you lose money?

But markets rise, fall, and rise again.

Over time, regular investing turns that chaos into consistency.

When prices are high, you buy fewer shares.

When prices are low, that same money buys you more.

Over time, your average cost smooths out — and you avoid the stress (and usually the failure) of trying to guess the perfect moment.

This is called pound-cost averaging (or dollar cost averaging, DCA).

It’s not flashy. It won’t win headlines.

But it’s one of the most effective investing strategies ever devised.

Because escaping the money trap doesn’t rely on prediction.

It relies on discipline.

Investing money either regularly, or as soon as you receive it gives you the average market return in the long run (5 years and up).

But remember - the average return is pretty good. 9% on equities per year, for example.

90% of Active fund managers, with all their resources and strategies - fail to beat this.

And you can get it without even thinking about it.

Just Keep Buying

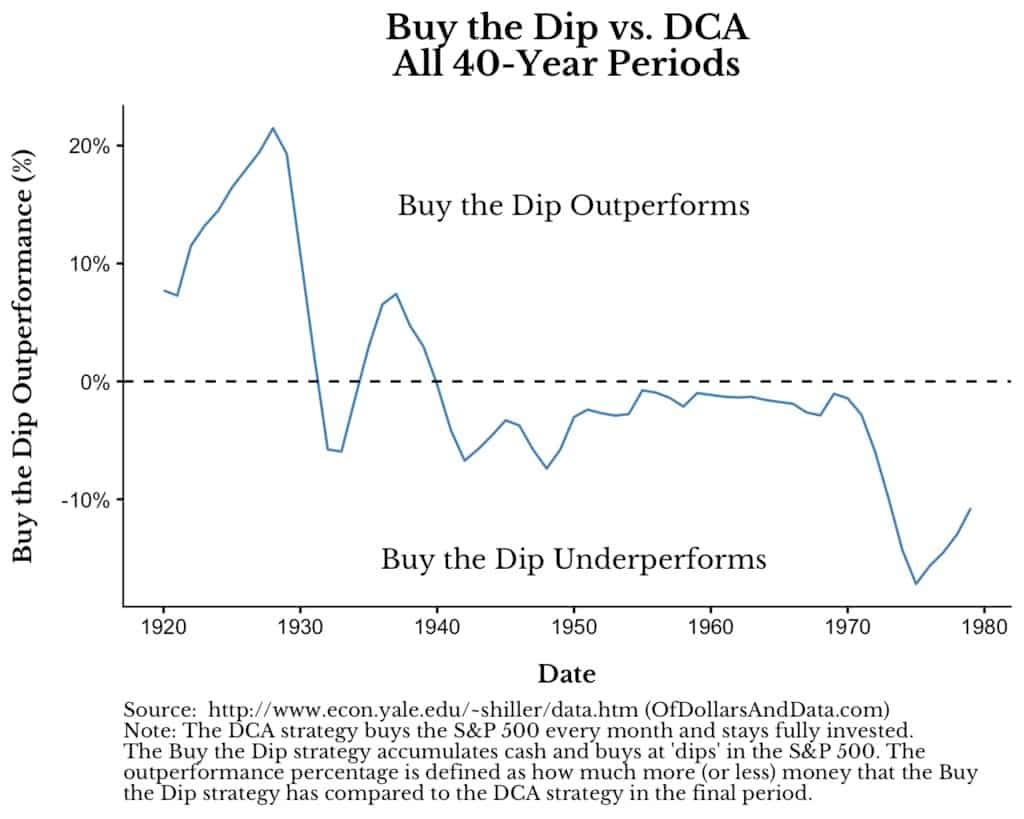

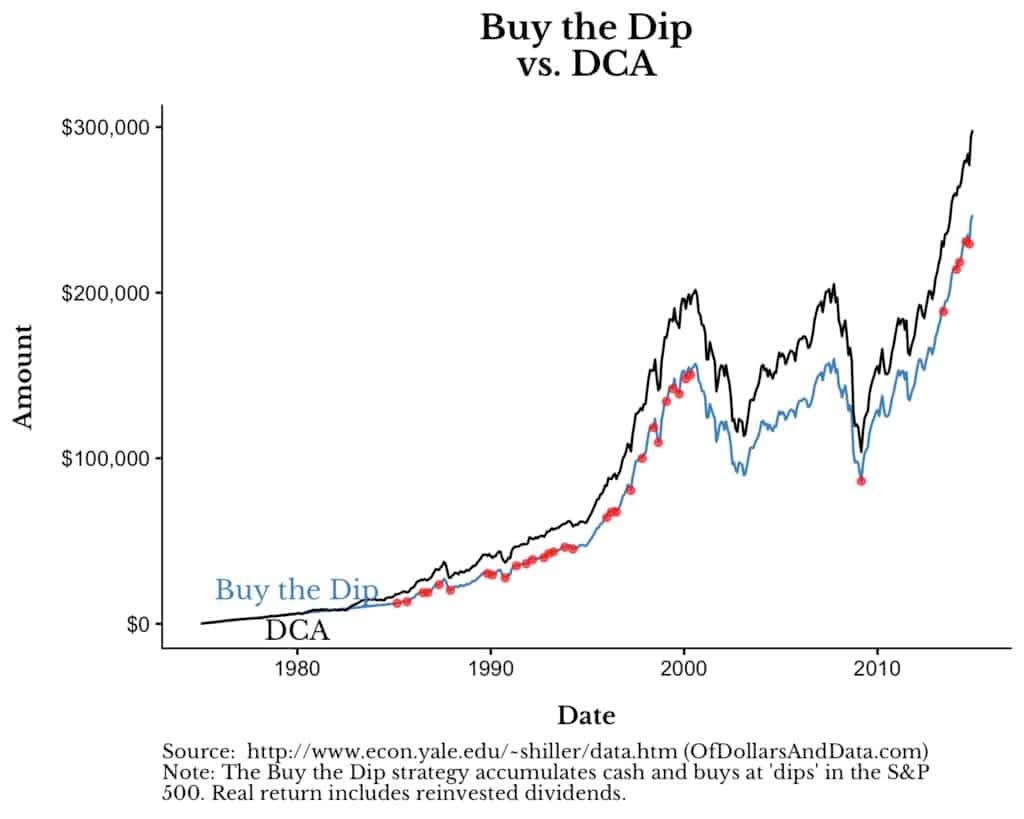

In “Just Keep Buying”1, Nick Maggiulli tested this idea.

He asked: What if you waited patiently and only bought at the exact bottom after a crash — every time?

Even with perfect hindsight, that strategy still underperformed pound-cost averaging 70% of the time.

And in the real world — where we don’t know where the bottom is — it underperforms 97% of the time.2

Why?

Because while you’re waiting for a drop… markets usually go up.

They’re like a yo-yo on an escalator.

Zoom in? Wild swings.

Zoom out? A steady climb. That’s business. That’s capitalism.

If in doubt, zoom out.

Graphs courtesy of: https://ofdollarsanddata.com/even-god-couldnt-beat-dollar-cost-averaging/

Automated Investing

Pound-cost averaging works best when you take yourself out of the equation.

And thanks to modern investing platforms, you can automate the whole process.

Most platforms let you set up regular investing via direct debit — straight into your ISA, SIPP, or general investment account.

Personally, I invest in the same global index fund every month — on the same day — through a direct debit in both my ISA and SIPP.

It’s not exciting.

But it’s consistent.

I pound cost average.

Whenever I get a lump sum — money from private tutoring, a tax refund, interest, dividends — I’ve trained myself to invest, straight away. No waiting. No second guessing.

The index fund I buy is the “Accumulation” version, which reinvests all dividends.

So Even my index funds just keep buying themselves. [LINK to post]

Even my workplace pension is set up to do the same thing: money goes in automatically, every month, buying assets behind the scenes.

I don’t think about it. I just keep buying.

Because the less emotional energy I spend trying to outsmart the market, the more time I have to let it work for me.

I’ve got better things to do with my life than try and beat the market with a 10% probability.

And so have you.

Can you beat the market?

Of course, and many people do. It just takes a lot of hard work, and a large dollop of luck and good fortune.

And it won’t always work.

Most day traders lose money, due to fees, and the market going against them.

Many investors suggest having a small allocation around 10%, which can be used to try and time and beat the market. It’s small enough that it won’t harm the other 90% if it doesn’t go your way, but it scratches the itch to try and beat the market.

I once spoke to someone who told me he’d invested and traded between 2012-2018, and doubled his original investment.

I didn’t have the heart to tell him that he could have gotten the exact same return from just buying an index fund tracking the S&P500 - without any of the work or stress.

Recap

The biggest threat to your investments isn’t Wall Street, market crashes, or the headlines — it’s your own behaviour.

Fortunately, a few simple systems can protect you from yourself:

Dollar Cost Averaging (DCA): Invest consistently through the highs and lows. Over time, this smooths volatility and builds steady, reliable returns. It can even make money in crashes.

Automated Investing: Take emotions out of the equation. Set it up once, let it run, and let time do the compounding.

Don’t Try to Time the Market: Even with perfect hindsight, most strategies underperform DCA. The odds are stacked against timing.

Scratch the Itch — Safely: Want to play the market? No problem. Keep it to 10% or less of your portfolio so the other 90% keeps growing, uninterrupted.

The market doesn’t need you to be brilliant. It just needs you to be consistent

Up Next: How to Stay Invested When the World Feels Out of Control

We all want a smooth ride to freedom. But that’s the one thing markets will never give us.

So how do we stay disciplined when things get rocky?

Maggiulli, Nick, Just Keep Buying, Harriman House, 2022

https://ofdollarsanddata.com/even-god-couldnt-beat-dollar-cost-averaging/