4.4 USA - How to Use Roth Accounts for 100% Tax-Free Growth; Everything You Need to Know

It sounds like there should be a catch..there kinda really isn't (much)

Missed last week? Read it here, or see the full escape map here

In the UK? Read the UK Article on ISAs here

TLDR:

Roth accounts let your investments grow and be withdrawn 100% tax-free — forever.

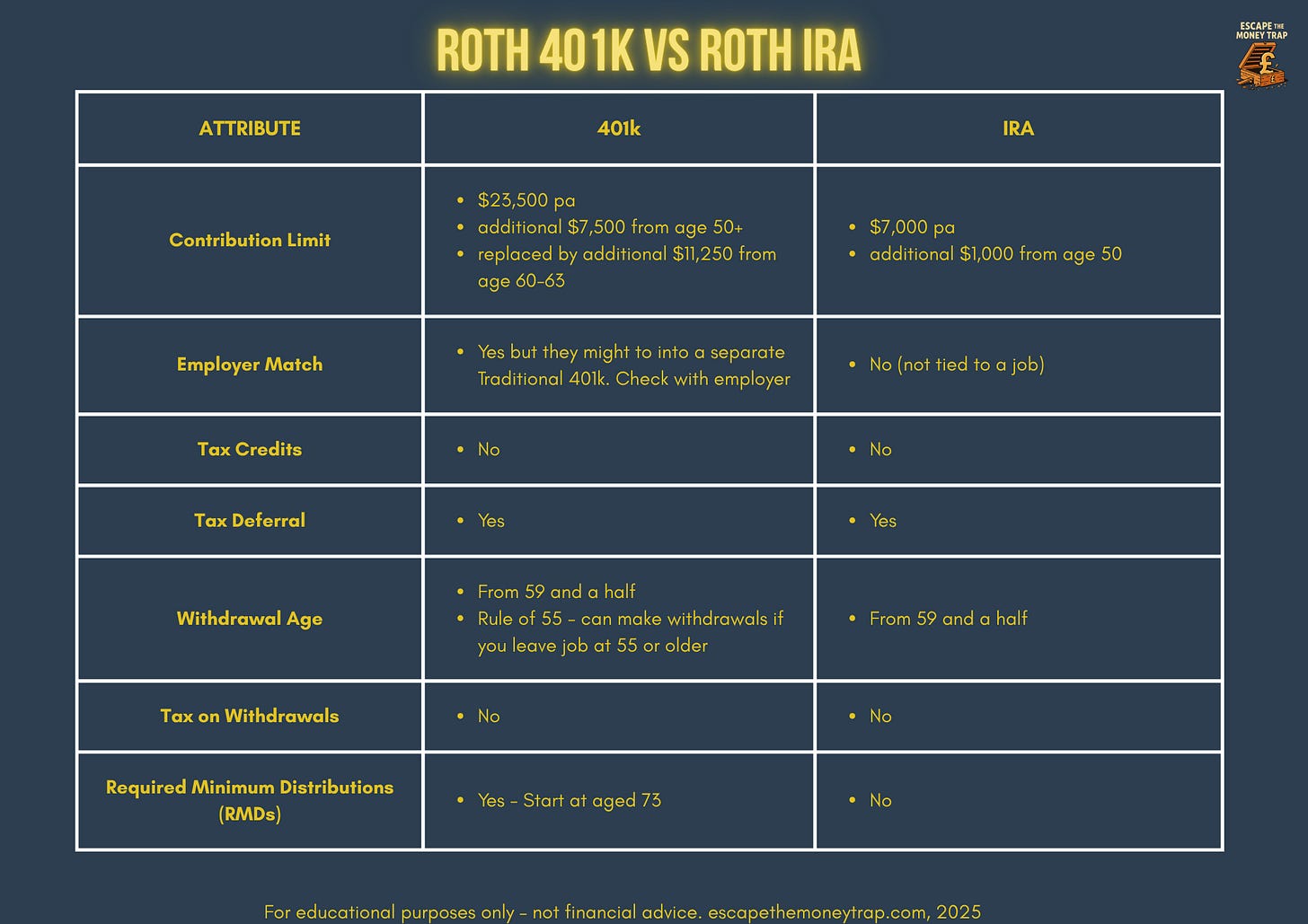

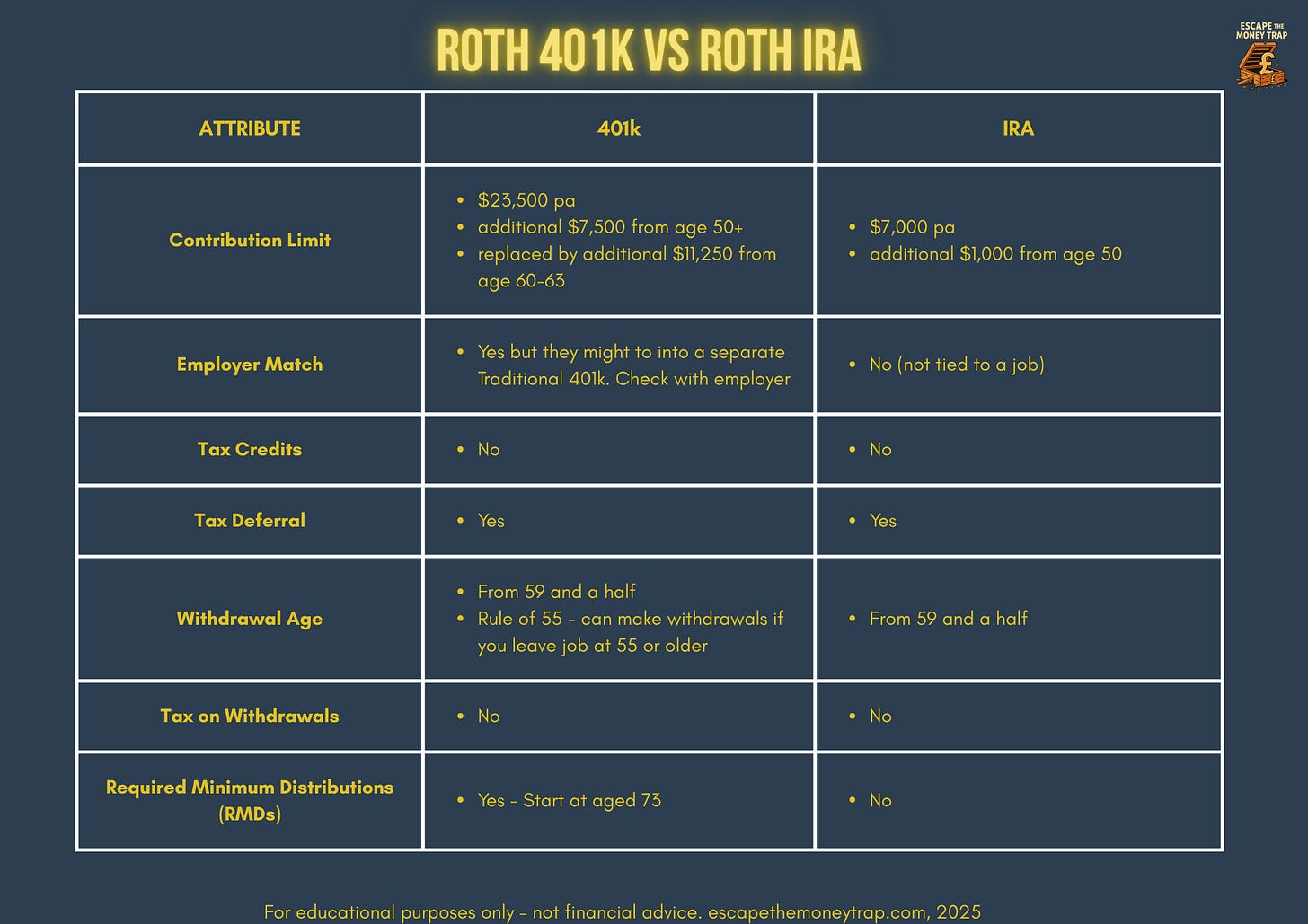

Roth 401(k): High annual limits, no income cap, employer match (taxable), and potential for Roth matching

Roth IRA: Lower limits, income-restricted, but no required withdrawals

Withdrawals are tax-free if the account’s 5+ years old and you’re over 59½

Unlike traditional retirement accounts, Roths are taxed on the way in - not on the way out

General investment accounts are taxed on growth, income, and gains - Roths aren’t

Get the summary Cheat Sheet here:

Tax-free savings and investments.

No tax on interest.

No tax on dividends.

No capital gains tax.

Sounds like a scam, right? Some shady internet hustle perhaps.

But it’s not.

It’s the Roth account - named after Senator William Roth of Delaware, who was instrumental in sponsoring the legislation that created these types of retirement accounts in the late 1990s.

Roth Accounts – Tax-Free Savings & Investments

A Roth account is a type of account that lets you save or invest without paying tax on your earnings and gains.

What you do with that money is up to you - keep it in cash, invest it in stocks and shares, or split it across different types. All tax-free.

That’s the magic of the Roth - simple, powerful, and totally legitimate.

The Different Types of Roth Accounts

There are two types of Roth Account, and they mirror the accounts we previously looked at:

Roth 401k

Your employer may offer you a Roth 401k. This is similar in general to a traditional 401k:

You can contribute up to $23,500 per year.

If you are aged 50+, you can contribute an extra $7,500.

If you are aged 60–63, you may be eligible to contribute an additional $11,250 in catch-up contributions, on top of the regular limit - depending on your income (needs to be less than $145,000). This replaces the standard $7,500 catch-up for that age group.

Any investments grow tax free. No capital gains tax, no income tax on dividends received in the account.

You can start to make withdrawals from aged 59 and a half.

You may be able to make penalty-free withdrawals from that employer’s 401k roth under the ‘Rule of 55’, if you leave the job at age 55 or older.

Employer Contributions

Your employer can offer to match some of your contributions, up to a % of your salary (just like in a traditional 401k)

By default, employer contributions go into a separate traditional (pre-tax) 401(k) account - even if your own contributions are Roth.

These matched funds will be taxed as income when you withdraw them in retirement.

This means you will have two 401(k) accounts under your plan:

Your contributions (after-tax) go into your Roth 401(k).

Employer contributions (pre-tax) go into your traditional 401(k).

New rule (Secure Act of 2023)

Some employers now allow you to choose to have the match deposited into your Roth 401(k) instead (if your plan offers this option).

You’ll pay income tax on the match in the year it’s made, but future withdrawals will be tax-free.

Not all employers offer this option - check with your HR department or plan administrator.

The Difference - No Tax Credits and Tax Free Withdrawals

In any Roth account there are two vital differences:

There are no tax credits (shame!) But….

You are not taxed when you withdraw the money to use.

Your money is yours, totally tax free. That is the power of Roth accounts.

The Roth (IRA)

Again this is similar to a traditional IRA:

You can contribute up to $7,000 per year. If you are aged 50+, you can contribute an extra $1,000.

For 2025, single filers with income above $150,000 (full) to $165,000 (none), and married filing jointly above $236,000 (full) to $246,000 (none), cannot contribute or can only make a partial contribution.

There is no employer match (it’s not tied to a job, it’s tied to you)

Any investments grow tax free. No capital gains tax, no income tax on dividends received in the account.

You can start to make withdrawals from aged 59.5.

No tax on withdrawals

The difference between Traditional Accounts and Roth Accounts

So in effect

Roth accounts are taxed on the way in (you get paid, get taxed, then can contribute. I.e no tax credits)

Traditional accounts are taxed on the way out (you get tax credits on the way in, you are taxed when you withdraw it)

This may seem like a catch, but remember some tax is unavoidable, and there are strategies to be extremely tax efficient. We’ll look at this in Part 7 - Reaching Freedom.

But for now, see it as a feature, not a bug.

The 5 Year Rule

Both Roth IRA and Roth 401(k) require the account to be open for at least 5 years for withdrawals to be tax-free.

Escape the RMD Trap

As we saw, traditional accounts (401k and IRA) required you to take minimum distributions from age 73 to avoid an extra tax charge.

This is where the power of the Roth account can really help you after this age:

Roth IRAs are unique in that they have no required minimum distributions at all - not at 73, not ever.

RMDs still apply to Roth 401k accounts at age 73 - unless you roll your Roth 401(k) into a Roth IRA, which has no RMDs. If you want to keep your money growing tax-free for as long as possible, this rollover is a smart move before RMDs kick in.

General Investing Accounts (GIAs)

If you’re investing outside of an 401k, IRA or the Roth versions, you’re probably using a General Investment Account (GIA).

These are flexible, accessible - and taxed.

Every gain you make, every dividend you earn, is potentially taxable. Unlike Roth accounts, GIAs don’t offer any tax shelter - but they are fully flexible and accessible at any time.

Still confused? Here’s the summary:

Recap: The Power of Roth Accounts

✅ Roth accounts grow tax-free and are withdrawn tax-free in retirement

✅ Roth 401(k)s allow high contributions and employer matches, but RMDs apply unless you roll to a Roth IRA

✅ Roth IRAs have no RMDs - ever - making them ideal for long-term planning

✅ You get no tax relief up front, but you avoid tax forever after

✅ General investment accounts offer flexibility, but every dollar of growth is taxable

✅ The Roth is a powerful tool in the freedom engine - especially when paired with your 401(k) or traditional IRA

We now have the assets - and the tools - to escape the money trap.

But how do we turn that into a system?

Something smooth, simple, and low-maintenance that quietly builds wealth in the background while we get on with living?

That’s what we’ll explore next.

I’ll show you how to set up the accounts, flows and platforms - including the exact system I use to grow my investments automatically, with minimal effort.

Up Next: Building the Engine - Accounts, Flow and Platforms

What are you using your Roth accounts and traditional accounts for? What have you learnt that you didn’t know from this post? Let me know in the comments!

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.