4.4 UK - How to Use ISAs for 100% Tax-Free Growth; Everything You Need to Know

It sounds like there should be a catch..there really isn't

Missed last week? Read it here, or see the full escape map here

In the USA? Read the USA Article on Roth accounts here

TLDR:

An ISA (Individual Savings Account) lets you save or invest tax-free - no tax on interest, dividends, or capital gains.

You can contribute up to £20,000/year (plus £9,000 into a Junior ISA for each child).

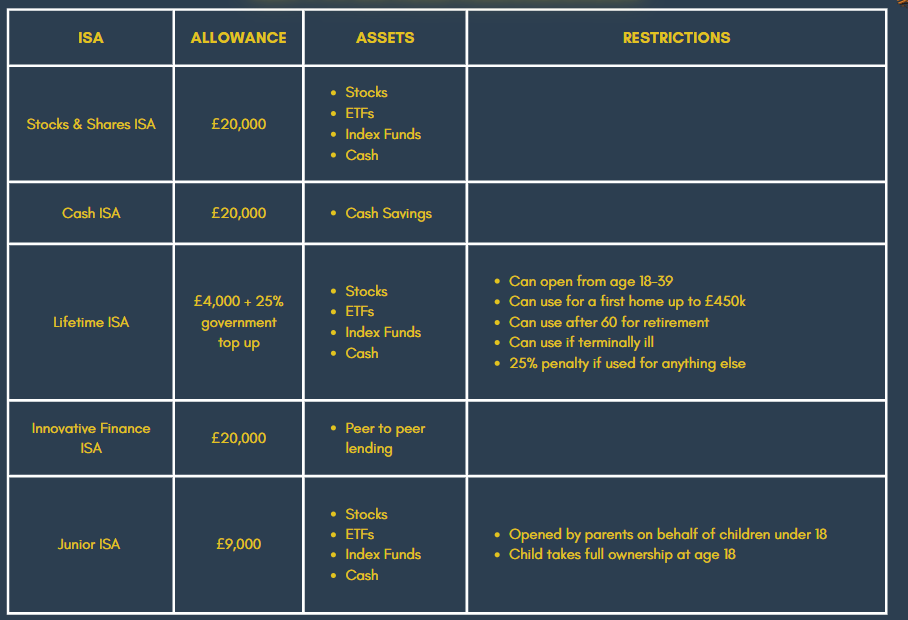

There are five types:

→ Cash ISA – for savings

→ Stocks & Shares ISA – for long-term investing

→ Lifetime ISA – for first homes or retirement (with a 25% bonus)

→ Innovative Finance ISA – for peer-to-peer lending (high risk)

→ Junior ISA – for tax-free saving for your childISAs are flexible, powerful, and often underused.

Used well, they can shelter tens of thousands of pounds from tax every year — for life.

Download the free ISA summary sheet here:

Tax-free savings and investments.

No tax on interest.

No tax on dividends.

No capital gains tax.

No Income Tax, No VAT.

Ever.

Sounds like a scam, right? Some dodgy internet hustle?

But it’s not.

It’s the ISA - the Individual Savings Account.

It’s real, and it’s extremely generous.

ISAs – Tax-Free Savings & Investments

An ISA is a type of account that lets you save or invest without paying tax on your earnings and gains.

For the 2024–25 UK tax year, you can put in up to £20,000 across all your ISAs.

What you do with that money is up to you - keep it in cash, invest it in stocks and shares, or split it across different types. All tax-free.

That’s the magic of the ISA - simple, powerful, and totally legitimate.

The Different Types of ISA

You don’t have to pick just one. You can have none, one, some, or all of the following - as long as you stay within the £20,000 total limit across all the accounts:

Cash ISAs

These will offer you a savings rate. Obviously it’s wise to go with one that gives you a rate that is higher than inflation (remember that trap).

Most are instant access, but some will offer a higher rate, and lock your money away for several months, or even over a year. Read the small print carefully.

Stocks & Shares ISAs

These allow you to invest. No taxes on dividends received. No capital gains tax.

Unlike a pension - you can access the money whenever you want.

Lifetime ISA

Designed for first-time homebuyers and retirement savers.

You can contribute up to £4,000 per year, and the government will top it up by 25% - that’s an extra £1,000 free every year.

But there’s a few caveats

You can only use it to buy your first home (worth up to £450,000) or access it after age 60. Withdraw it for anything else, and you’ll pay a hefty 25% penalty.

You can only open it whilst you are aged between 18-39

Innovative Finance ISA

This one’s a bit niche.

It lets you invest in peer-to-peer lending — essentially, you lend your money to individuals or businesses through a platform, and they pay you interest.

It’s tax-free like the others, but be aware:

It’s higher risk

There’s no FSCS protection if the borrower defaults

Returns can be attractive, but vary widely

Only for those who fully understand the risks — definitely not a beginner’s choice.

Junior ISA - Help your kids escape the money trap

A tax-free savings or investment account for children under 18.

You can contribute up to £9,000 a year (2024–25 allowance), and the money grows free from income tax and capital gains tax - just like an adult ISA.

This £9,000 is in addition to your £20,000 allowance.

There are two types:

Cash Junior ISA – like a savings account

Stocks & Shares Junior ISA – for long-term investing

Only parents or legal guardians can open one, but anyone can contribute — grandparents, aunts, friends.

💡 Important: The child can’t access the money until they’re 18, and once they do, it becomes theirs — no strings attached. So think carefully before handing over a lump sum.

Which ISA should I choose?

✅ Want to save safely? → Cash ISA

✅ Planning for retirement or a house? → Lifetime ISA

✅ Investing for the long term? → Stocks & Shares ISA

✅ Want to start growing wealth for your children? → Junior ISA

Strength in Numbers

If you have a partner, you both get your own ISA allowance — that’s £40,000 per year you can shield from tax as a household.

If you have children, they can have a Junior ISA (see below), with an allowance of £9,000 each.

It’s the tax-free gift that keeps on giving.

This is how entire families can build generational wealth — shielding tens of thousands from tax every year.

ISAs vs Pensions

ISAs and Pensions are both very efficient tax wrappers to help escape the tax trap. They have different features and rules. This table summarises them:

Pensions get tax relief, but ISAs do not. However when you withdraw from a pension, it’s taxed as income.

So in effect

ISAs are taxed on the way in (you get paid, get taxed, then can contribute)

Pensions are taxed on the way out (you are taxed when you withdraw it)

This may seem like a catch, but remember some tax is unavoidable, and there are strategies to be extremely tax efficient. We’ll look at this in Part 7 - Reaching Freedom.

But for now, see it as a feature, not a bug.

General Investing Accounts (GIAs)

If you’re investing outside of an ISA or pension, you’re probably using a General Investment Account (GIA).

These are flexible, accessible - and taxed.

Every gain you make, every dividend you earn, is potentially taxable. In 2024–25, you get just £3,000 of capital gains tax-free. After that? You owe HMRC a slice of the growth.

Escaping the Tax Trap: The Bed & ISA Strategy

There is a way out. It’s called a Bed & ISA.

Here’s how it works:

You sell your investments inside the GIA.

If you’ve made a gain above your allowance, you pay capital gains tax.

You then rebuy the same investments — but this time, inside your ISA, where future growth and dividends are tax-free.

Simple. Clean. Efficient.

Some brokers let you do this with a few clicks. Others may need a phone call.

You can do this bit by bit each year, using your ISA allowance, and over time move your portfolio into the tax-free shelter.

Because sometimes, growing your wealth is about earning more.

Other times, it’s just about losing less.

Recap: The Power of ISAs

ISAs are tax-free accounts for saving or investing - no tax on interest, dividends, or capital gains. Ever.

You can contribute up to £20,000 per year (2024–25 allowance), and choose between cash, stocks & shares, Lifetime, or Innovative Finance ISAs.

Junior ISAs allow up to £9,000 per child, tax-free - on top of your own allowance.

ISAs are taxed on the way in, but not on the way out - unlike pensions, which work the opposite way.

Used smartly, they’re one of the most generous and flexible tools in your escape kit.

We now have the assets — and the tools — to escape the money trap.

But how do we turn that into a system?

Something smooth, simple, and low-maintenance that quietly builds wealth in the background while we get on with living?

That’s what we’ll explore next.

I’ll show you how to set up the accounts, flows and platforms — including the exact system I use to grow my investments automatically, with minimal effort.

Up Next: Building the Engine - Accounts, Flow and Platforms

What are you using your ISA for? What have you learnt that you didn’t know from this post? Are you using a Junior ISA? Let me know in the comments!

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.