4.2 USA - The Hidden Power of Retirement Accounts: Escape Tax and Inflation

401Ks and Individual Retirement Accounts (IRAs) help you claw back taxes and invest tax free

Missed last week? Read it here, or see the full escape map here

Living in the UK? Read the UK version here

TL;DR:

Retirement accounts aren’t boring. They’re tax-deferred growth machines.

401(k)s lower your tax bill now and often include free money from employer matches

IRAs let you save for retirement outside your job, with tax advantages

Both accounts shelter your investments from capital gains and dividend taxes

Withdrawals start at age 59½ and are taxed as income

Use them right, and you’re not just saving — you’re escaping tax, inflation, and dependency.

Download the free cheat sheet here!

When I used to hear the word ‘retirement account’, my eyes would glaze over, with thoughts of old age, sitting on the front porch in a rocking chair shooting raccoons with a beebee gun.

But it doesn’t need to be that way.

Retirement accounts are one of the most powerful weapons in the quest to escape the tax trap.

Let’s start with the basics.

What is a Retirement Account?

At its core, it’s just a long-term savings or investment account designed to support you when you stop working - or work less.

In the USA, the main accounts are:

The 401k workplace retirement account

The IRA: Individual Retirement Account

Social Security (State pension)

In this chapter, we’ll focus on the kind that helps you escape both tax and dependency: the tax-advantaged wrappers of 401Ks and IRAs.

The 401k Workplace Retirement Account

If you are in paid employment (i.e don’t work for yourself), your employer may offer a 401k account, that both you and they can contribute to, so that you can invest:

You can contribute up to $23,500 per year.

If you are aged 50+, you can contribute an extra $7,500.

If you are aged 60–63, you may be eligible to contribute an additional $11,250 in catch-up contributions, on top of the regular limit - depending on your income. This replaces the standard $7,500 catch-up for that age group

Your employer can offer to match some of your contributions, up to a % of your salary e.g:

“50% of the first 6% of salary you contribute” - meaning you get a 3% match.

E.g If you earn $100,000 salary, your employer will match 50% of the first $6,000 you put in - that’s $3,000.

That’s tax-free money: a 3% pay rise, which keeps you up with inflation without even trying

Any money you contribute is tax deductible - meaning you get a reduced tax bill at the end of the year.

E.g.

Say you earn $100,000 and normally pay 15% ($15,000) in taxes.

If you contribute $10k to a 401k, then you only pay 15% on the remaining $90k.

So your tax bill would now only be $13,500 (effectively only 13.5% of $100,000)

Any investments grow tax deferred. No capital gains tax, no income tax on dividends received in the account.

You can start to make withdrawals from aged 59 and a half.

When you do, they are taxed at income tax rates.

You may be able to make penalty-free withdrawals from that employer’s 401k under the ‘Rule of 55’, if you leave the job at age 55 or older.

The 401k is a money trap superpower, which helps you escape the traps of inflation, tax and work all in one account.

The Individual Retirement Account (IRA)

If you're not covered by a workplace plan - or just want an account not tied to your job - you can open an IRA:

You can contribute up to $7,000 per year. If you are aged 50+, you can contribute an extra $1,000.

There is no employer match (it’s not tied to a job, it’s tied to you)

If you are not covered by a retirement plan at work, your IRA contribution is fully tax-deductible, no matter your income. That means you pay no tax on your contribution.

If you are covered by a workplace plan (or your spouse is), the tax deductibility depends on your income and filing status. See https://www.irs.gov/retirement-plans/ira-deduction-limits for up to date allowances.

Any investments grow tax deferred. No capital gains tax, no income tax on dividends received in the account.

You can start to make withdrawals from aged 59.5. When you do, they are taxed at income tax rates. If you withdraw earlier than this, there can be a 10% additional tax penalty.

Even though it's sometimes limited by having a 401k, the IRA remains a powerful escape hatch - helping you beat tax, inflation, and dependency on work.

How To Open an IRA

Most popular online brokerages offer IRAs:

Fidelity

Vanguard

Charles Schwab

Betterment / Wealthfront (robo-advisors)

E*TRADE, SoFi, Ally, etc.

It’s easy. Go online, open up an account, and your all set.

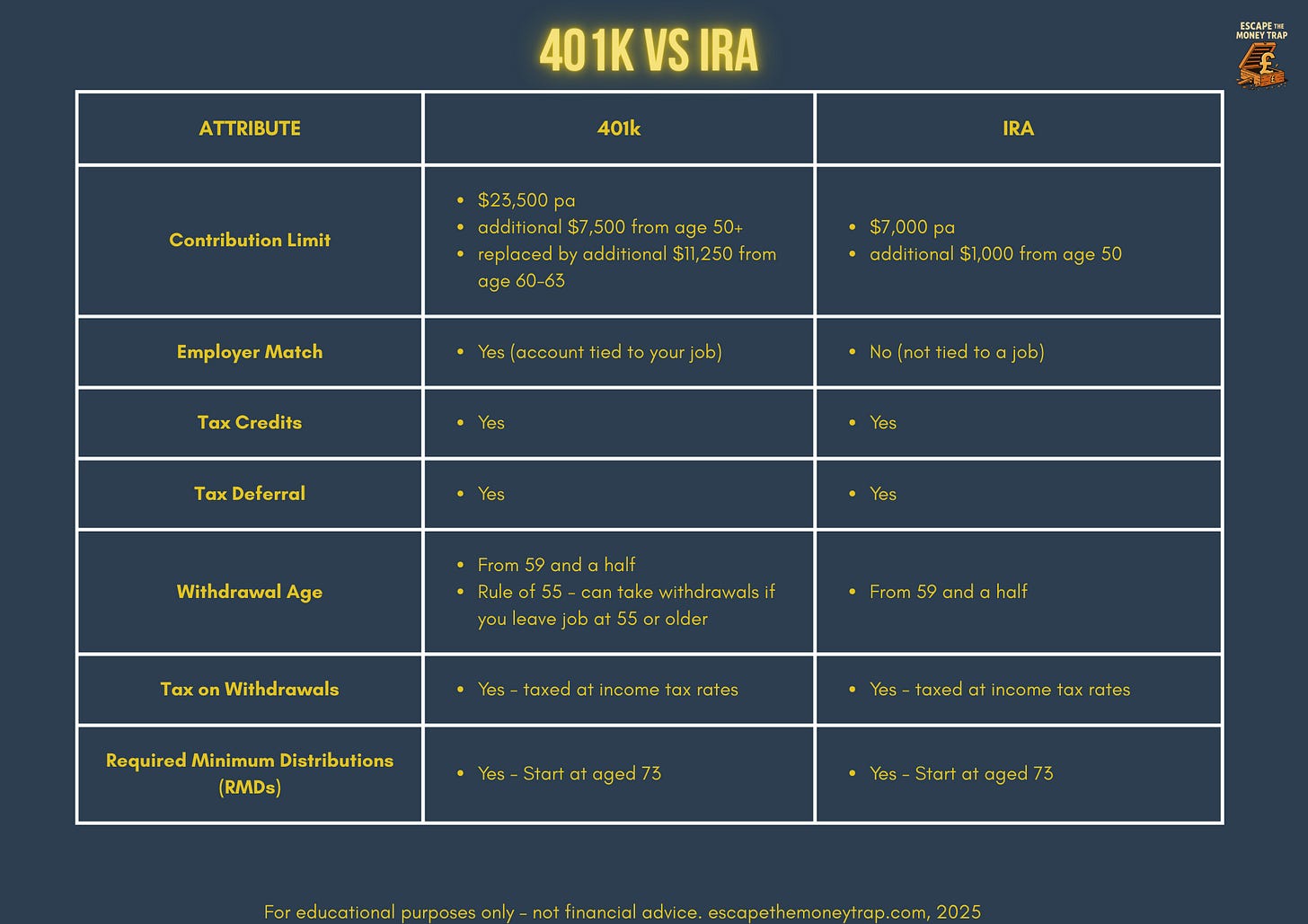

401k vs IRA

The correct answer to which account you should have is both! Your 401k provides you with free money from your employer so you should never turn that down.

But you can also have your own IRA - independent of your workplace, and a place to make your own contributions to whatever assets you like.

Required Minimum Distributions (RMDs)

These two accounts are tax-deferred, meaning you didn’t pay tax when you put the money in - so the IRS eventually wants its cut. That’s why, starting at age 73, you must begin taking Required Minimum Distributions (RMDs) each year, based on your account balance and life expectancy. These withdrawals are taxed as ordinary income, and failing to take them results in a hefty penalty (25% of the amount you should have withdrawn).

This is a sneaky catch, and not ideal. But it’s the law so just something we have to deal with and try and factor in.

Summary of Differences between the 401k and IRA

Confusing? It can be, but here’s the summary table and free downloadable cheat sheet

Recap

The 401k lets you contribute up to $23,500 per year, with potential employer matches and tax-deferred growth

IRAs offer a personal retirement account option with similar tax benefits and more control

Both accounts are legal tax shelters that protect your investments and help you escape the money trap

Start now, stay consistent, and you’re building a future where you work by choice, not necessity

What Comes Next

You may have several old 401k accounts scattered around.

It’s messy. And chances are, they’re not working as hard for you as they could.

The good news?

You can take total control.

Up Next: USA - 401k Consolidation Made Easy: Transfer Old Pots & Dump High-Cost Default Funds

Find out what you have, and take back control of your investments and future.

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.