4.2 UK - The Hidden Power of Pensions: Escape Tax and Inflation

Workplace and Personal Pensions help you claw back taxes and invest tax free

Missed last week? Read it here, or see the full escape map here

Living in the USA? Read the USA version here

TL;DR:

Pensions aren’t boring. They’re tax-deferred growth machines.

No tax on capital gains or dividends inside a pension

You get tax relief on the way in (20–45%) - the government returns the tax they took from you when you contribute to a personal pension

Many employers match your contributions - free money

Money put in a workplace pension by you or your employer is not taxed

SIPPs give you control; workplace pensions give you boosts

25% tax-free withdrawal at retirement; the rest is taxed as income

Download the free cheat sheet here!

When I used to hear the word ‘pension’, my eyes would glaze over, with thoughts of old age, garden centres and carriage clocks.

But it doesn’t need to be that way.

Pensions are one of the most powerful weapons in the quest to escape the tax trap.

Let’s start with the basics.

What is a Pension?

At its core, a pension is just a long-term savings or investment plan designed to support you when you stop working - or work less.

It could include:

A workplace pension (defined benefit or defined contribution)

A SIPP (Self-Invested Personal Pension)

A government/state pension

In this post, we’ll focus on the kind that helps you escape both tax and dependency: the tax-advantaged pension wrappers like SIPPs and workplace pensions.

Workplace Pensions

In the UK, all employers must provide a workplace pension under The Pensions Act 2008.

Employers must contribute a minimum of 3% of your salary.

You’ll need to contribute at least 5% yourself to unlock this benefit

Bringing the total to 8%.

But here’s the key:

That’s a 3% tax-free, invisible pay rise every year.

And some companies offer even more - 10%, 15%, even 20% in some cases.

That’s free money to invest in a wide range of assets (depending what is offered by the brokerage firm your employer uses (mine uses Aviva, but others could use Nest, Legal & General and others). You can choose passive index funds, bond funds, money market funds, REITs, or a blend of them all.

You just smashed through the inflation trap without even trying.

SIPPs - Freedom to Choose Your Investments

In addition to a workplace pension, you can open your own private pension - and invest in whatever you want.

These are called SIPPs (Self-Invested Personal Pensions).

Think of it like a pension + freedom. You choose what to invest in: index funds, Bond funds, individual stocks, cash, etc.

Opening one is as easy as opening a bank account.

Most online investing platforms (and many banks) offer SIPPs, giving you full control over your investment choices - from index funds to individual stocks.

These two accounts can both be used to escape the tax trap in two powerful ways:

1 - Tax Deferred Growth

Any investments inside a workplace pension or SIPP can grow tax deferred. That means:

No capital gains Tax when you sell

No dividend Tax when you receive dividends

Boom. Putting any assets in a workplace pension or SIPP just smashed through the tax trap.

But there’s even more:

2 - Tax Relief

When you put any of your take home pay into a pension:

the government gives back the income tax you already paid on that money.

At 20% for basic rate taxpayers

Or even 40% if you're a higher-rate taxpayer

It’s like rewinding the tax deduction and redirecting it into your future.

💡 The tax trap has been well and truly escaped — and the government helped you do it.

For example:

Out of £100 of salary, you only take home £80

The other £20 is taken in tax (at the 20% basic rate).

If you put that £80 into a pension, the government returns the £20 they took in taxes, and puts it back into your pension.

That’s tax relief.

Once I understood that I paid no income tax on money I put into my pension (apart from National Insurance, which isn’t refunded), my whole perception shifted.

What I used to see as a crusty, stale investment suddenly became a tax-busting cheat code (but legal) - something that could accelerate my escape from the money trap.

It was game-changing.

How to claim tax relief

Your pension provider (workplace pension, or SIPP account broker) will automatically reclaim the basic 20% tax relief for you.

Every few months money will appear in your pension account as cash. Make sure you allocate this to an asset - buy something with it!

If you are in the 40% or 45% tax bracket - you’ll need to claim back the extra 20% tax credit by either:

Submitting a Self-assessment return online: https://www.gov.uk/self-assessment-tax-returns

Using this form (as of February 2025): https://www.gov.uk/guidance/claim-tax-relief-on-your-private-pension-payments

you can claim pension tax relief which you hadn’t claimed for up to 4 previous tax years under the carry forward rule.

You Qualify If You:

Are between 22 and state pension age

Earn at least £10,000 a year

Normally work in the UK

If that’s you - you’ve already got a head start.

Missed Out on Tax Relief? You Can Claim It Back

If you realise you didn’t receive full tax relief on your pension contributions — don’t panic.

You can claim backdated pension tax relief for up to 4 years after the end of the relevant tax year.

This often applies to:

Higher-rate (40%) or additional-rate (45%) taxpayers who didn’t submit a Self Assessment

People whose pension scheme didn’t apply relief properly (it happens more than you’d think)

Those who switched jobs or pension providers and didn’t notice the error

💡 Example: If you missed out on claiming higher-rate relief for contributions in the 2021/22 tax year, you have until 5 April 2026 to fix it.

How to Claim Backdated Tax Relief

You don’t need to be in Self Assessment to claim:

Use the HMRC online form: Claim tax relief on your private pension payments

Or call/write to HMRC with your contribution details, income, and pension provider

Even if it’s just a few hundred pounds, it compounds massively over time.

Don’t leave government money sitting on the table.

Limits on Contributions

You can contribute your entire salary up to £60,000 per year across all your pensions combined, and it will have tax relief applied.

Any contributions above that will not qualify for tax relief.

But because of tax relief, you only need to contribute £48,000 - the government tops up the rest.

That’s £12,000 in free money every year — just for saving for your future.

High Earner Note:

If you earn more than £200,000, the £60,000 limit starts to taper down.

For every £2 you earn over £250,000, your limit drops by £1 — to a minimum of £10,000.

This won’t apply to most, but it’s worth knowing if you're in that bracket.

And beware - contributing more than your maximum amount can draw a hefty Annual Allowance Tax Charge of 45%.

Tax on Withdrawals

Once your money is in a pension, it’s locked away until age 55 (rising to 57 from April 6, 2028).

But when that time comes, here’s what happens:

25% of your pension pot is tax-free

(Up to a maximum of £268,275 as of 2024–25)The remaining 75% is taxed at your regular income tax rate when you withdraw it

So yes - you’ll pay tax later on some of it.

But thanks to tax-deferred growth, upfront tax relief, and employer contributions, the tax trap has been well and truly trampled all over.

Workplace Pensions vs SIPPs

The correct answer to which account you should have is both! Your workplace must contribute to a pension and open one for you. This is free money so you should never turn that down.

But you can also have your own SIPP - independent of your workplace, and a place to make your own contributions to whatever assets you like.

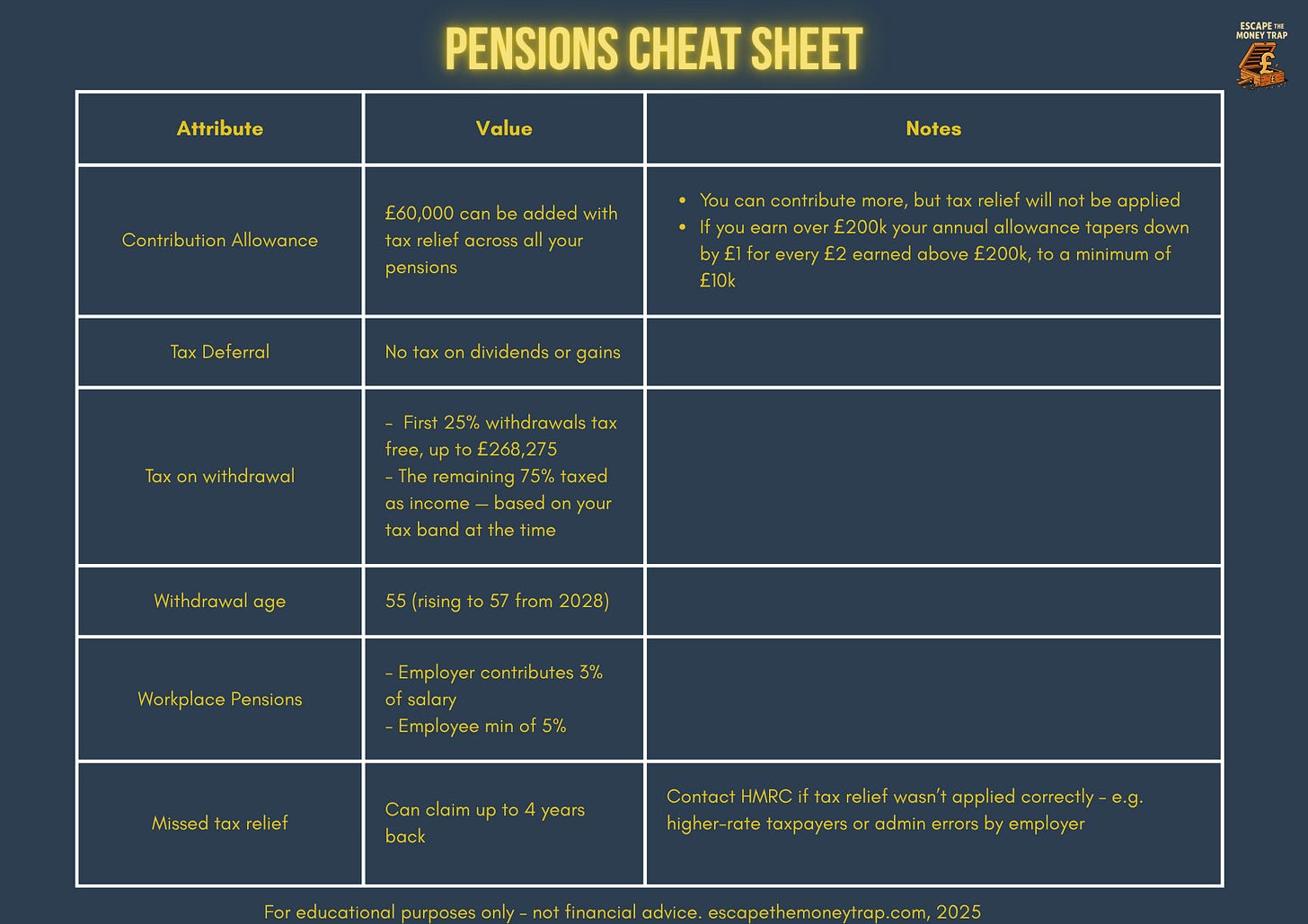

Cheat Sheet

Still confused? Here’s the cheat sheet - with a link to download

Recap

Pensions aren’t boring - they’re a tax-busting, inflation-shielding rocket booster for your financial freedom.

Investments inside a pension grow completely tax-free - no capital gains tax, no dividend tax.

You get tax relief on the way in - 20%, 40%, even more. That’s the government refunding your future.

Employer contributions are like a hidden pay rise - free money you only get if you’re in the game.

SIPPs give you control - choose your investments, keep fees low, and take charge of your future.

You can contribute up to £60,000 a year, and 25% of your pension is tax-free when you withdraw it.

The rest is taxed like income - but by then, your money has already grown and multiplied inside a tax shelter.

What Comes Next

You may have several old pensions scattered around.

It’s messy. And chances are, they’re not working as hard for you as they could.

The good news?

You can take total control.

Up Next: UK - Pension Consolidation Made Easy: Transfer Old Pots & Dump High-Cost Default Funds

Find out what you have, and take back control of your investments and future.

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.