3.13 Asset Allocations - Picking Your Path to Escape

Which allocation suits you at your stage and risk appetite?

Missed last week? Read it here, or see the full escape map here

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.

TLDR? Download the 1 page guide on 3 possible asset allocations here:

Once you understand your risk appetite and tolerance, you can finally choose an asset allocation that fits. But there’s one more critical factor that should shape your plan:

Time.

Time & Risk in Asset Allocation

Your escape plan is important — but it’s not the only thing in your life.

You have other goals. Other dreams. Other needs.

Some of those will require money in the short term.

Maybe it’s:

Saving for a home

School fees

A major trip

Health costs

A wedding, a car, or just a financial buffer for peace of mind

And here's the key:

High volatility assets like stocks, gold and crypto are usually not a good place for money you need in the next 5 years

A crash at the wrong time could derail your plans entirely — even if the long-term return is strong

Short-term money is usually better in low-risk, stable assets like:

Cash

Bonds

Money Market Funds

It might not feel exciting - but it gives you something better than returns:

Peace of mind.

Your Portfolio Is a Tool - Not a Trophy

Your goal isn’t to win an investing contest.

Your goal is freedom. Not performance. Not bragging rights.

A portfolio that supports your life is better than one that keeps you awake at night.

This is about escaping the money trap - not walking into another one disguised as “performance.”

That also means as you get closer to the point where you want to start living off your assets, your allocation may shift.

Less risk. More stability. More control.

You’ll likely move a larger chunk into safer assets - like bonds and cash to protect what you’ve built.

We’ll explore how that shift works in later posts.

And I’ll tell you my own plan right here in this one.

3 Possible Asset Allocations

Depending on how you scored in the quiz in the previous post “What kind of investor are you?”, here are three possible asset allocations.

You can have any allocation you want - the choice is infinite, and is not limited to the 3 below.

For each, we’ll look at the possible real returns (taking into account inflation), and the risks, including possible maximum drawdowns (how far it could drop in a crash)

If you are in any doubt then seek professional advice from a qualified, regulated financial advisors.

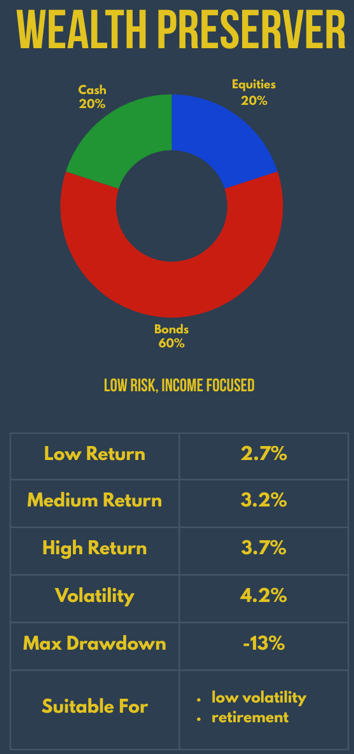

Wealth Preserver (Conservative)

How it performs

This low-risk portfolio barely beats inflation. But its strength is stability:

Volatility is low, meaning it rarely swings more than 4–5% in either direction

Max Drawdown is modest at just 13% - so even in a crash, losses are manageable

For someone with a low risk tolerance, or a short timeline before needing their money, this mix prioritises peace of mind over explosive growth.

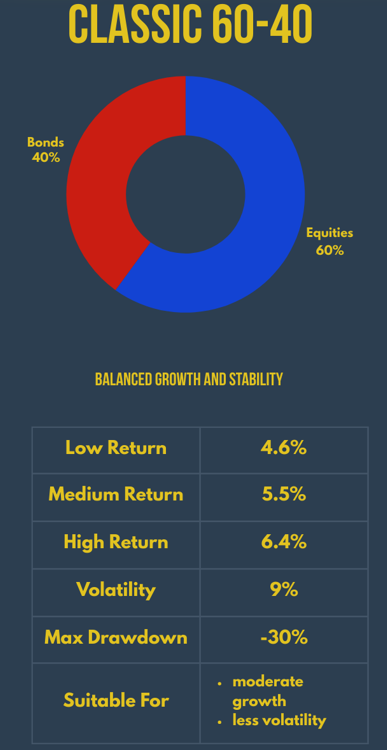

Classic 60-40 (Balanced)

How it performs

The 60/40 mix - 60% equities, 40% bonds - is a time-tested classic, used by investors for decades.

Returns: It consistently beats inflation, even in poor outcomes. A strong foundation for long-term growth.

Volatility: Higher than low-risk portfolios - around 9% - meaning wider swings in value.

Max Drawdown: At its worst, this portfolio could fall 30%. Could you stay invested during that kind of crash?

For long time horizons (20–30 years), this allocation gives a healthy balance: it captures equity growth while bonds help smooth the ride. A great fit for investors with moderate risk tolerance.

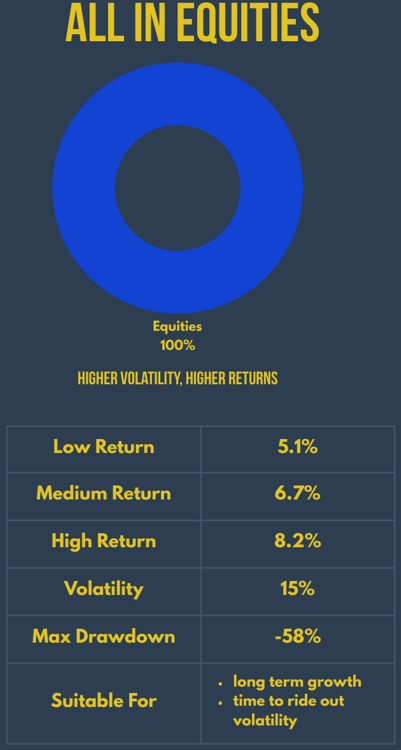

All in Equities (Growth Oriented)

How it performs

Going for 100% Equities is a popular allocation for those with a long time horizon (20 years+) and strong risk tolerance.

Returns: Consistently beats inflation - even in poor outcomes. Offers some of the strongest long-term growth potential.

Volatility: High - around 15%. Expect big swings in value, both up and down.

Max Drawdown: Could fall 50% or more in a severe crash. You’ll need emotional discipline not to panic and sell at the worst time.

If you can stay the course for 20–30 years, this allocation has historically delivered the best returns. But remember - the price of high returns is volatility, and you need the stomach for the ride.

For many people - 1 single global index fund for the majority of their escape plan is the gold star strategy.

What I do

I have gone with All Equities.

With a 20 year horizon, I buy a single global index fund (simple, low cost and well diversified across the world) and keep a cash buffer for emergency expenses.

However if any upcoming costs present themselves (school fees, weddings), then that will make me rethink.

But what is right for me may not be right for you, seek professional advice regarding your own circumstances if you think it will clarify things for you.

Methodology & Monte Carlo Simulations

I generated the returns using a Monte Carlo Simulation on

https://www.portfoliovisualizer.com/monte-carlo-simulation

A Monte Carlo simulation is a way to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables (i.e financial markets and economies).

It is used to understand the impact of risk and uncertainty. Monte Carlo simulations can be applied to a range of problems in many fields, including investing, business, physics, and engineering.1

I used the following asset classes to model the allocations, and simulated 60 years worth of data. I recommend having a go yourself with different asset classes to see different outcomes.

Equities → 65% US Stocks, 35% Global Ex-US Stocks (typical for a global index fund)

Bonds → Intermediate Term Treasuries

Cash

Don’t sweat the small stuff

You should have a better idea of an asset allocation that you think is right for you at whatever stage of live you are at.

It’s tempting to complicate your allocation - chasing an extra 0.5% by tweaking weights or adding more funds or asset classes.

But remember - these are probabilistic models. They are not telling you exactly what you will get.

There is beauty in simplicity, and trying to over-optimize is a fools’ errand.

We can’t predict the markets, and you can’t predict your return with that level of accuracy.

I once spent 3 days on an excel spreadsheet, and was convinced that I’d found a difference between three index funds, and that actually I needed to switch to a different one to get an extra 1% a year.

When I showed this to a financial strategist, expecting him to be blown away by my analysis, he said

“I think what this is shows is that it doesn’t really matter what you pick”.

The reason? The returns of all three funds were within the margin of error of each other. Any one of them could be the winner over 20 years.

So don’t sweat the small stuff. Keep it simple, and just get started.

Recap: Picking the Right Portfolio for You

Match Your Mix to Your Risk Tolerance

Whether you're conservative, balanced, or adventurous - your asset allocation should reflect how much risk you can truly handle, not just in theory, but emotionally too.Time Horizon Shapes Everything

Money you’ll need in the next 5 years should be in low-risk assets (like cash or bonds). Long-term money (10–30 years) can handle more volatility for higher returns.The Sleep Factor Matters

A high-return portfolio isn’t worth it if it keeps you up at night. Your portfolio should help you sleep better, not stress more. Peace of mind beats perfect performance.Simple Beats Perfect

You don’t need the “perfect” asset mix. You just need one that works well enough - consistently. Avoid over-optimizing. Get in. Stay in. Let compounding do the heavy lifting.

Planning for escape

We’ve reached the end of Part Three - congratulations!

Up next is Part Four, where we’ll start putting your plan into action: how to begin investing and, just as importantly, how to elegantly beat our old friend, the tax trap.

We’ll also introduce the Escape Calculator - a tool to help you map out your path using real-world assets like:

ISA and SIPP contributions in the UK (

Defined Benefit pensions in the UK

IRA and 401k contributions in the US

Investment properties

You’ll be able to assign these to one of the three example portfolios and see how they might help you reach your escape number.

Up Next: Your First Step to Financial Freedom: Budgeting, Debt Repayment & Emergency Savings

https://www.investopedia.com/terms/m/montecarlosimulation.asp

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.

Each individual is different. We all have different goals and different risk tolerance. Picking the right asset allocation strategy is key and there is no ONE-FIT-ALL asset allocation. Great piece, Rohit. You are creating an excellent roadmap.