3.11 Cryptocurrency Explained: What You Need to Know Before You Invest

The new ultimate store of value? We take a look at what it is, and if you need it

Missed last week? Read it here, or see the full escape map here

TL;DR — Crypto: Revolutionary… but Probably Not Your Main Escape Plan

✅ Crypto is digital currency & runs on blockchain: decentralised, secure, and speculative

✅ It’s volatile, difficult to store safely, and offers no income

✅ May belong in your portfolio (1–5%) if you understand the risks

✅ Bitcoin and Ethereum dominate - but outcomes remain uncertain

✅ Use apps or ETFs to gain exposure, and never go all-in unless you understand the risks

✅Crypto may offer a thrilling bounce - but it’s not yet a solid ladder to freedom.

A Digital Revolution or Digital Roulette?

In the early days of Bitcoin, the idea seemed wild: digital money that no one controlled, verified by a public ledger, created not by governments but by computers solving puzzles.

People laughed.

And then, some of those same people became millionaires.

Bitcoin, Ethereum, and other cryptocurrencies have exploded into the public eye. They promise freedom, decentralisation, privacy, and riches.

But are they the key to escaping the money trap, or just another glittering distraction?

What Is Cryptocurrency?

At its simplest, cryptocurrency is a form of digital money that doesn’t rely on a central bank or government.

Instead of being issued by a central authority, it’s created and verified by a network of computers that follow a shared set of rules.

These transactions are recorded on a blockchain - a kind of public digital ledger that anyone can inspect, but no one can change.

Every Bitcoin and other crypto-currency ever sent, received, or held is stored on that ledger - and once it’s recorded, it’s permanent.

The goal? To build a money system that’s decentralised, secure, and resistant to manipulation.

Crypto's Core Promise

Crypto is built on blockchain technology - decentralised, secure, and transparent.

Supporters argue that crypto is:

A hedge against inflation and fiat currency debasement (traditional currencies losing value over time)

A store of value (Bitcoin is often dubbed "digital gold")

A decentralised financial system, free from banks and governments

Demand is growing from governments, pension funds and ETF providers for more bitcoin.

Usage is growing, especially in emerging market economies.

Can Crypto Actually Become Mainstream?

At the moment (2025), there are several significant structural barriers that cryptocurrency needs to overcome before it becomes mainstream, and not just assets that are mainly speculated on:

It’s difficult to store & use safely

Initially, crypto had to be stored on a physical device (a USB drive or similar), and was protected by a passkey. If you lost your device, forgot your password, or worse someone managed to get your password, then you could lose all your crypto.

This was not practical.

Now you can buy and store crypto more easily on online wallets, or hosted platforms. But these platforms could be hacked, or go bust. And if they do…

It’s not protected from total loss

Fiat currency is broadly protected against fraud and the holding institution going bust.

If your credit card/bank account is hacked, your bank has the power to refund your money and go after the thief.

If the bank holding your cash goes bust, £85,000 of it protected by FCA in the UK, and the FDIC protects up to $250,000 in the USA.

If your crypto account is hacked, or you forget your password, or the custodian holding it goes bust, then there is no such protection, and you could be in legal battles for years trying to get hold of your crypto.

The only solution to this is to store your own crypto on your own device. But as we’ve seen, that has it’s own risks. It’s the same as storing cash under the mattress - vulnerable.

It’s volatile

As we’ll see below, the value of bitcoin (and other currencies) is still extremely volatile. Currencies that aim to be widely used can’t be relied upon if you don’t know how much of it you need to buy items from one day to the next.

Bitcoin has fallen 80% on multiple occasions. That is not the behaviour of a currency you can rely on.

Stablecoins (coins which are tied to the value of the dollar) are now starting to come into existence, but they suffer from the same issues of difficulty of usage and storage.

There are so many of them

Log into any crypto exchange and you will see absolutely thousands of currencies. Bitcoin, Etherium, Solana, XRP, Dogecoin. The list is almost endless. Most of them are worthless and unusable, created solely as speculation assets.

If cryptocurrency is to become mainstream, how many will there be? And will merchants and businesses be happy to accept any of these currencies, or will they only accept a select few?

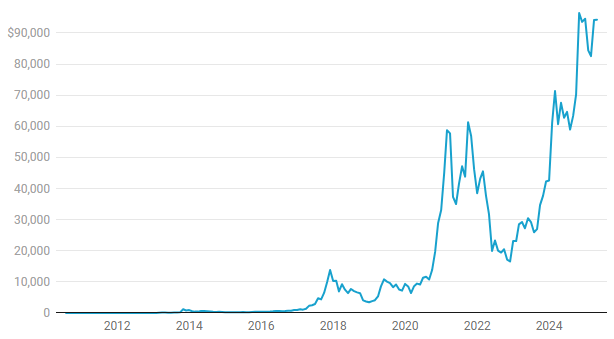

The Wild Ride

Take a look at the historical price chart of Bitcoin (the most popular cryptocurrency) and you’ll see what looks like the heart monitor of someone riding a rollercoaster during an earthquake1.

Yes, you might see 1000% returns. But you might also lose 50% very quickly.

Crypto is one of the most volatile asset classes in existence.

That’s fine if you’re speculating. Not if you’re building a plan for retirement.

Should Crypto Be In Your Escape Plan?

Maybe. But only if you:

Understand the tech and risks

Can stomach huge price swings

Keep it as a small % of your portfolio (e.g. 1-5%)

Are OK with the possibility of it going to zero

Crypto may be a ladder out of the money trap. At the moment it’s still like a trampoline: thrilling, unpredictable, and useful for a bounce - so perhaps not your main route to freedom. At least not until it becomes more stable and widely used.

Where Can You Actually Buy Bitcoin?

Buying Bitcoin isn’t as complicated as it used to be.

Here are a few of the most common ways:

1. Crypto Apps (Beginner-Friendly)

Apps like Coinbase, eToro, Revolut, or Kraken let you buy small amounts of Bitcoin in minutes. They're designed for beginners - you can connect your bank card, tap a few buttons, and boom - you’ve bought your first slice of Bitcoin.

Note: These apps often charge higher fees for the convenience. You're paying for the easy ride.

2. Crypto Exchanges (For the Curious)

If you want a little more control (and cheaper fees), you can try a proper crypto exchange like Binance, Coinbase Pro, or Gemini. You’ll need to verify your ID, and it takes a bit more effort - but you’ll often get better prices and more features.

3. Traditional Finance Apps (With a Twist)

Some investing platforms like Freetrade, Robinhood (in the US), or PayPal offer crypto now too. Handy if you already use them - but check whether you actually own the Bitcoin, or just a version of it that can’t be moved or spent elsewhere.

The Concentration Risk (Again)

Just like with stocks, betting everything on one cryptocurrency - even a big name like Bitcoin or Ethereum - exposes you to concentration risk.

No one knows which coins will thrive… and which will vanish into the digital void.

No one yet knows if excessive government regulation will yet reign in it’s seemingly inexorable rise.

The crypto world is still young, experimental, and unpredictable. That’s why some investors prefer crypto index funds or ETFs - which spread your investment across a basket of cryptocurrencies, rather than just one. These are available in the US, but not the UK at present.

It’s the same logic as buying an index fund in the stock market:

You reduce your risk of picking the wrong one.

You sleep better at night.

You still capture some of the upside, without going all in on a single bet.

You might not strike gold - but you’re also less likely to end up holding the digital equivalent of meme stocks or NFTs.

Recap:

Crypto is speculative and volatile - but built on fascinating tech

It may offer upside, but also downside, with no income or protections

Storage, custody, and platform risk remain major issues

Regulation and market adoption are still evolving

You can include it - but only if you’re willing to lose it all

Index-style exposure can help reduce concentration risk

We’ve now covered the major asset classes. Next: how to combine them wisely - because betting everything on one horse, even a fast one, can still leave you broke.

Up Next: How Diversification Protects Your Portfolio (And What Enron Taught Us)

https://www.investing.com/crypto/bitcoin/historical-data

Great article, Rohit. Of course there is much, much more to talk about when it comes to crypto. Anyways, this is a great place to start and I do believe that everybody should have at least some exposure to BTC, not necessarily memecoins, but BTC.