Investing accounts in the USA

IRAs, 401(k) and Roth accounts, all explained

Guest author Dennis Riosa breaks down the different account types available to US residents

U.S. Retirement Accounts: The Smartest Tax Shelter You’re Not Fully Using

If you’re 25 years old and earning around $40,000 per year, there’s a financial strategy with massive long-term benefits that most people either ignore or misunderstand: retirement accounts.

While Social Security might provide some support in retirement, it won’t be enough to maintain your lifestyle. The real path to financial independence lies in individual retirement accounts (IRAs) and employer-sponsored 401(k) plans. These aren’t just savings accounts, they are tax-optimized wealth machines and if used properly, they can set you up for a six- or seven-figure portfolio by the time you hit your 60s.

What Are Retirement Accounts?

In the U.S., there are two major retirement vehicles available to individuals:

401(k): Typically offered through an employer; lets you contribute pre-tax income.

IRA (Individual Retirement Account): Opened independently; comes in two types: Traditional and Roth.

Each has its own tax rules, contribution limits and strategic advantages. Choosing the right one or a mix can save you tens of thousands in taxes over your lifetime.

Tax Advantages Explained

Retirement accounts are designed to delay or eliminate taxes in specific ways, giving you more money to grow and compound.

1. Traditional 401(k) and IRA: Pre-Tax Contributions

Contributions are deducted from your taxable income.

If you contribute $4,000 to a Traditional IRA or 401(k), your taxable income drops from $40,000 to $36,000.

You pay less in income tax now and your money grows tax-deferred.

At an income level of, let’s say, around $40k, you’re likely in the 12% or 22% tax bracket, so a $4,000 contribution saves $480–$880 in taxes.

This tax deduction improves your net savings power immediately.

2. Roth IRA: Tax-Free Growth

You contribute after-tax money but never pay taxes again. This mean you don’t pay taxes on gains or on withdrawals (if rules are followed).

This account is perfect for younger earners in lower tax brackets, since taxes paid now are minimal.

The more time you have, the more powerful the Roth becomes.

A $5,000 annual Roth IRA contribution starting at age 25 could grow into over $1 million by age 67, all 100% tax-free.

3. Employer Match = Free Money

If your employer offers a 401(k) match, always contribute enough to get the full match. It’s an instant 100% return on your contribution.

For example: If your company matches 100% of the first 3%, and you earn $40k, that’s $1,200 free per year.

Matched contributions grow just like yours, which means they are tax-deferred.

4. Tax-Deferred or Tax-Free Compounding

Just like in Italy, U.S. retirement accounts allow your investments to grow without yearly taxation.

No capital gains tax each time your stocks grow.

No tax on reinvested dividends or interest.

Over decades, this can lead to significantly more wealth than taxable brokerage accounts.

I’ve put together three scenarios for someone starting to contribute at age 25. The three scenarios take into consideration a 5% annual returns and continuous contributions up until age 67.

Scenario 1: $1,200/year into a Roth IRA

Total Contributions: $50,400

Estimated Value at 67: ~$145,000

Tax-Free Withdrawals

No deduction now but full exemption later = great for younger savers.

Scenario 2: $2,500/year into a Traditional IRA

Total Contributions: $105,000

Estimated Value: ~$302,000

Tax Savings Now: ~$13,000–$23,000 over time

Withdrawals taxed as income but likely at a lower bracket post-retirement.

Scenario 3: Max out 401(k) + Roth IRA (~$25k/year combined)

Total Contributions: ~$1,050,000

Estimated Value: ~$2.6M

Massive tax-deferred or tax-free growth

Only realistic with income growth over time but a worthy goal.

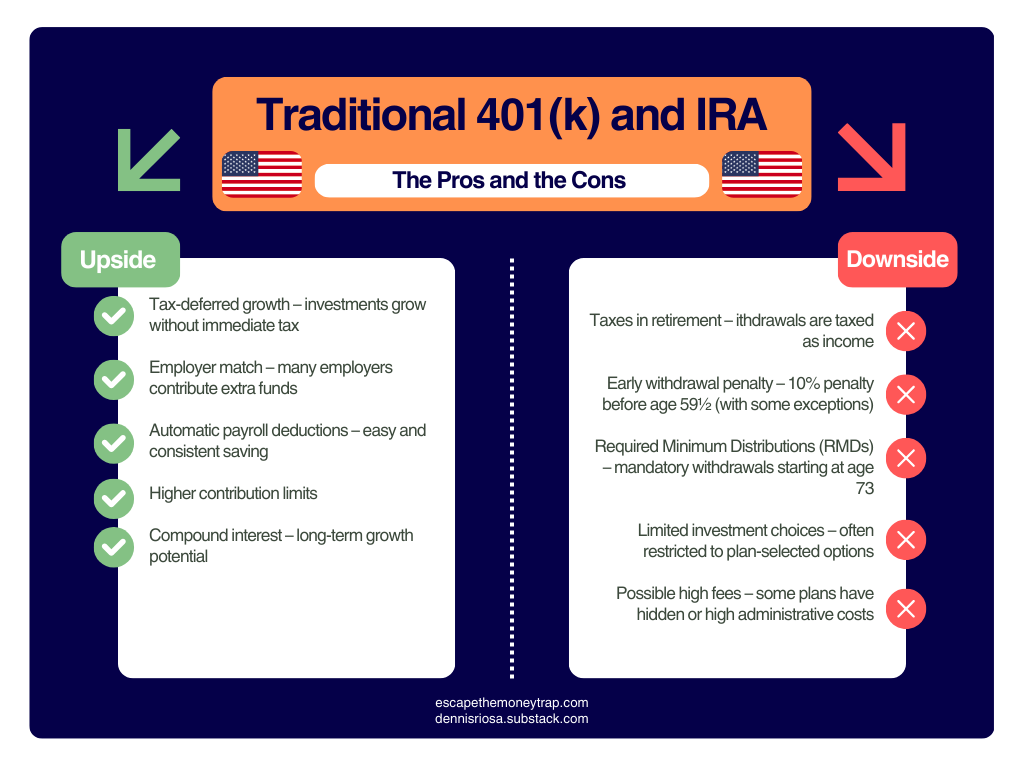

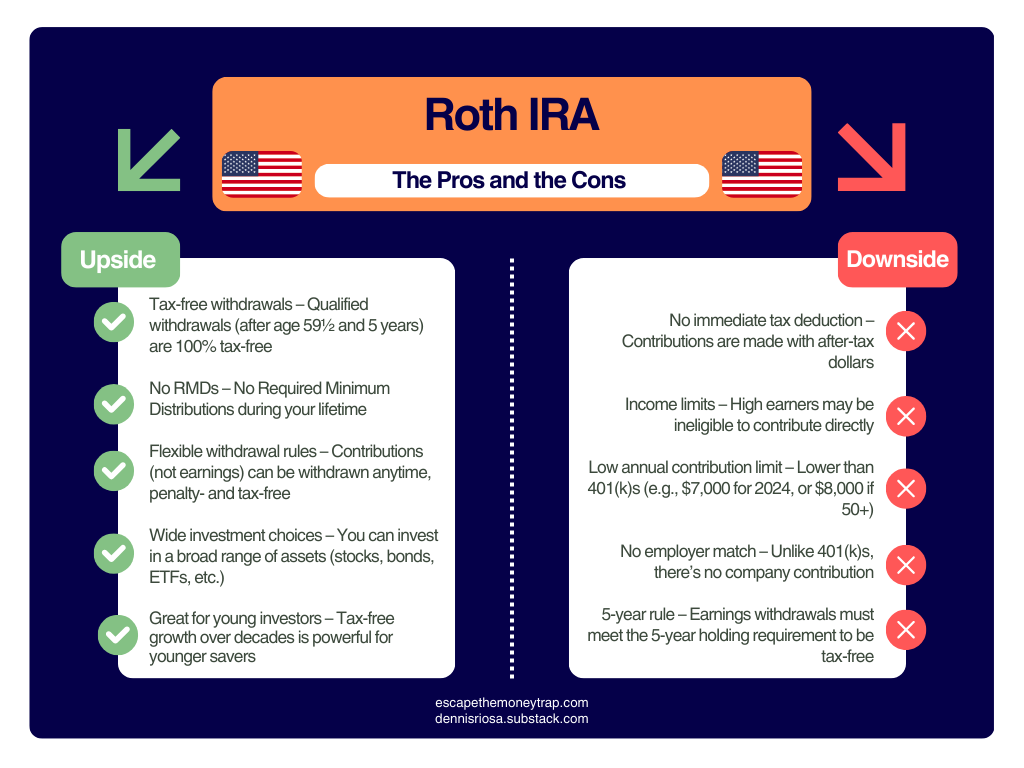

As with anything il life there are advantages and disadvantages to anything. Same goes for retirement

accounts. Here are the lists of pros and cons for all types of retirement accounts:

Last question to take into consideration. Should you pick a traditional IRA or a roth IRA?

If you’re earning under $50,000 and currently fall into a lower tax bracket, a Roth IRA is often the smarter choice. Why? Because you can lock in tax-free growth by paying taxes on your contributions now, when rates are low and then enjoy completely tax-free withdrawals in retirement. This is a major benefit if you expect your income (and tax rate) to increase in the future.

On the other hand, if your priority is to reduce your taxable income today, then a Traditional IRA may be

more advantageous. Contributions to this account is tax-deductible, meaning you’ll pay less in taxes this

year and potentially reinvest those savings to boost your long-term returns. This strategy is especially

useful in high-income years or if you have side income you want to offset.

Conclusion

For a 25-year-old making $40,000, retirement accounts in the U.S. offer incredible tax savings, flexibility

and compounding power. Whether you prefer immediate tax deductions (Traditional) or long-term tax freedom (Roth), both are massively superior to leaving cash in a savings account or worse, doing nothing at all.

Even small contributions add up fast and thanks to compounding and tax-deferred growth, the best time to start was yesterday. The second-best time is right now.

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.