Investing Accounts in the UK

How to invest in cool Britannia, tax free or tax deferred

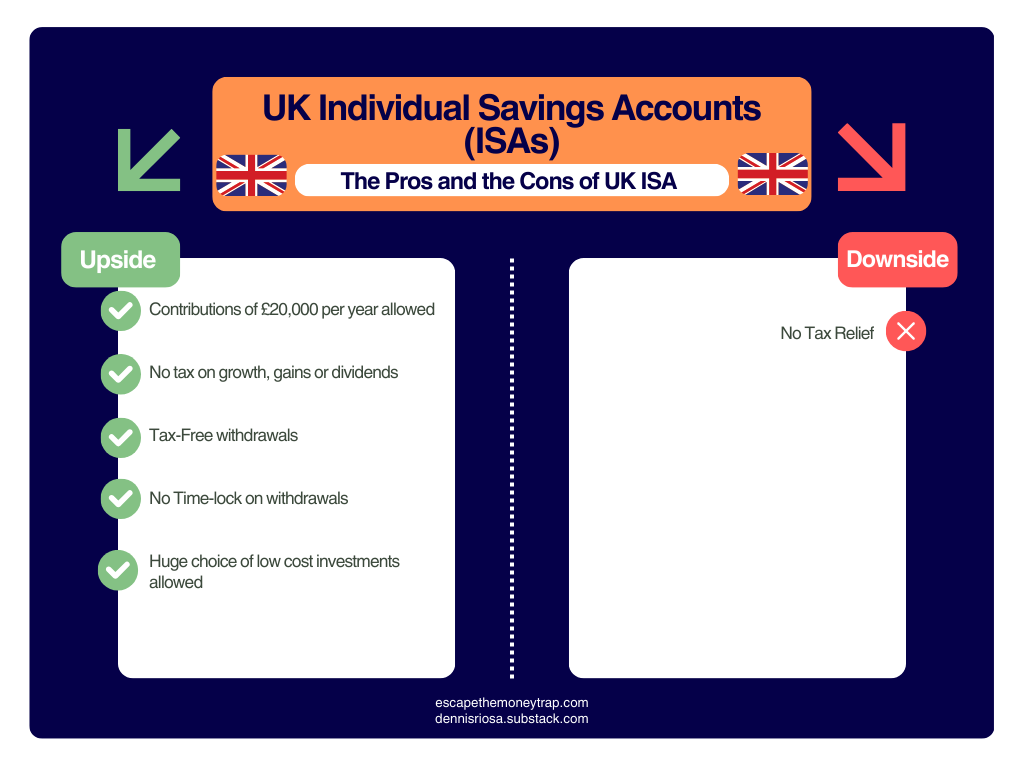

Individual Savings Accounts (ISAs)

An ISA is the UK’s most generous tax shelter for savers and investors. You can put in up to £20,000 per year (2024–25 allowance), and once money is inside, it grows completely tax-free - no income tax, no dividend tax, no capital gains tax. Ever.

Types include:

Cash ISA - Tax-free interest.

Stocks & Shares ISA - Tax-free gains/dividends.

Lifetime ISA (LISA) – Up to £4,000/year; 25% government bonus. Use for first home or retirement.

Junior ISA – £9,000/year per child. Grows tax-free.

Innovative Finance ISA – Peer-to-peer lending. Higher risk.

Tax treatment:

Taxed on the way in (from net income), but tax-free on the way out. No minimum age for withdrawals.

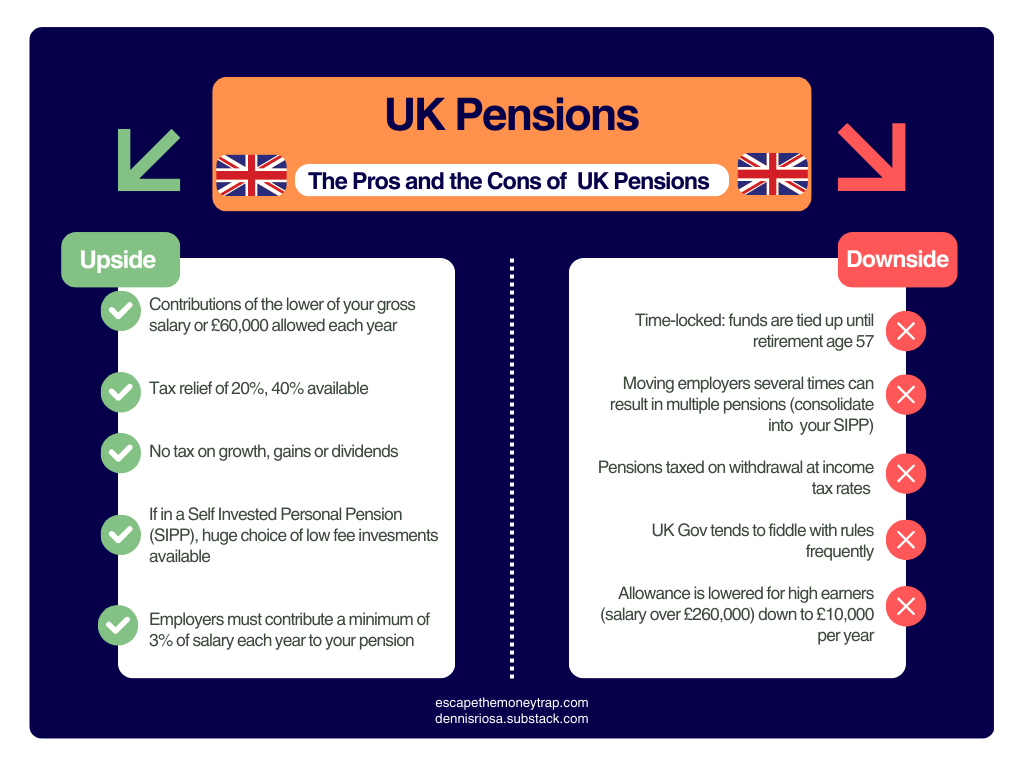

Self-Invested Personal Pensions (SIPPs)

SIPPs are private pensions that give you full control over your investments - from index funds to individual shares. Unlike ISAs, pensions are locked until age 55 (57 from 2028), but come with heavy tax incentives.

Contributions get tax relief (20% added automatically; higher earners reclaim more)

Investments grow tax-free

At withdrawal: 25% is tax-free, remainder taxed as income

Annual limit: £60,000 (tapered for high earners).

Carry forward unused allowance from the last 4 tax years.

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.