4.5 UK - Automate Your Wealth: Building a “Set-and-Forget” Investing Engine

Take your hard work, your tools and your strategy—and turn them into a set-and-forget system that quietly grow your escape fund in the background.

Missed last week? Read it here, or see the full escape map here

TL;DR:

Build a low-maintenance “investment engine” in 7 steps. Download the checklist and follow it through!

Choose Platforms: Compare fees and pick a flat-fee or no-fee broker for your ISA + SIPP.

Open Core Accounts: Emergency Fund, Savings Fund/Cash ISA, Stocks & Shares ISA, SIPP.

Consolidate Pensions: Transfer old workplace pots into your SIPP and update beneficiaries.

Select Funds: Use the same global index funds/ETFs across all accounts to match your chosen asset allocation.

Automate Contributions: Set standing orders each month (increase by ~3% yearly) to ISA, SIPP, and emergency buffer.

Monitor & Adjust: Annually bump contributions, revisit after life changes, and lightly rebalance.

Rebalance Yearly: Sell the overweight asset and buy the underweight one to keep your target split (e.g. 60/40).

You now have the tools to escape the money trap.

You’ve budgeted. You’ve tracked down your old pensions.

You’ve thought about your risk tolerance and chosen your asset allocation.

You know which tax-efficient accounts to use.

But how do you put all of this together - into a system that’s easy to manage, low-maintenance, and quietly powerful?

A system that runs in the background like a well-oiled engine - steadily growing your wealth and fuelling your escape from the traps?

Let’s map out what you have, and look at some ways to build that engine.

1. Choose and Compare Platforms

There are dozens of online broker platforms that you can use. Most fall into one of three categories:

Large institutional investment firms (Aviva, Standard Life, Vanguard, Fidelity, Hargeaves Lansdown),

High Street banks offering investment services

Newer app- or web-based platforms (e.g. InvestEngine, Trading212, Interactive Investor)

Many of these offer the core accounts you’ll need: Savings Accounts, Cash ISAs, Stocks & Shares ISAs, SIPPs, and General Investment Accounts.

And all of them will charge some kind of fee.

Fees: The One Thing You Can Control

Fees are one of the few variables in investing that you have complete control over.

And they matter — a lot.

Even a small fee, like 1%, can cost you tens or even hundreds of thousands of pounds over the long term.

Types of Fee Structures

Here’s how most platforms charge:

1. Assets Under Management (AUM)

You’re charged a percentage of the total value of your investments.

For example:

A 0.2% fee on a £10,000 portfolio = £20 per year.

But after 20 years, if that portfolio grows to £1,000,000 — you’re now paying £2,000 a year.

Fair for beginners. Expensive in the long run.

2. Flat Fees

Some platforms charge a fixed monthly or annual fee (e.g. £10/month).

This model favours larger portfolios.

£1,000,000 invested = still just £120/year — far cheaper than £2,000 under an AUM charging model.

3. No Platform Fee

Many modern platforms (like InvestEngine, Trading212) offer no platform fee at all.

How do they make money?

Primarily through foreign exchange (FX) fees when you buy non-GBP assets.

💡 Tip: If you’re buying index funds or ETFs, stick to ones in your local currency (e.g. GBP) to avoid hidden FX charges.

This gives you a huge edge: with a little setup and fee awareness, you can keep more of your money growing for you — not your provider.

2. Set Up Your Core Accounts

Emergency Fund – 3–6 months of living costs in a high-interest savings account or Cash ISA.

Savings Fund - a savings account for long term savings goals (house, car, university or school fees etc). This could also be a Cash ISA

Stocks & Shares ISA – your flexible, tax-free wrapper for investments you may want to access before retirement.

SIPP (Self-Invested Personal Pension) – your long-term, tax-relief-boosted retirement vehicle.

Workplace Pension – ensure you’re contributing at least enough to capture any employer match.

Old Workplace Pensions – track them down with the Pension Mapper and get ready to consolidate.

3. Consolidate Your Pensions

Open your SIPP (if you don’t have one already).

Transfer old workplace pensions into that SIPP - many providers offer free, guided transfers. See the previous post for more on this.

Remember that not all SIPP providers will transfer old pensions - so if you intend to consolidate - check with the provider before you start an account with them.

Confirm your beneficiary designations on every pension (SIPP, workplace, annuities) so your will and pension nominations align.

4. Pick Your Funds & Asset Allocation

Decide your asset allocation. It could be one from post 3.12, or your own mix based on your risk tolerance and timeline.

Select matching index funds or ETFs in both your ISA and SIPP, and if possible your workplace pension:

Use the same funds across accounts to keep rebalancing painless.

5. Automate Your Contributions

Set up standing orders on your bank account:

ISA: £X/month

SIPP: £Y/month (plus your workplace pension contributions)

Savings: £Z/month

Emergency Fund: small amount until you hit your buffer, after which it could go to long term savings, or your ISA/SIPP.

When you use money from the emergency fund, be sure to replenish it ASAP.

6. Monitor & Adjust Lightly

Annual increase: Bump your contributions by your inflation estimate (e.g. 3%).

Life changes: After major events (new job, marriage, inheritance), revisit your target allocation and pension nominations.

7. Annual Rebalancing

Once a year - it’s important to ensure your portfolio is broadly in with your asset allocation. If you picked a 60% equity, 40% bond allocation, then make sure you stick to it.

You don’t need to do this every week, or every month, once a year is fine.

Rebalancing Example

Alice wants a 60-40 equities/bond mix. Here’s what could happen over the course of a year, and how she could rebalance:

She invests £60k in a global index fund (equities), and 40% in a bond fund.

After 1 year, the equities has grown to £75k, and bonds has remained at £40k. (total of £115k)

Her allocation is now 68% equities, 32% bond. It’s too high on the equities side

out of £115k total value:

60% = £115k × 0.6 = £69k

40% = £115 × 0.4 = £46k

Alice is £6k over allocated to equities and £6k under allocated to bonds.

So she sells £6k of her equities index funds and buys more bonds with it.

She could do this in either her ISA or her pensions without paying any capital gains tax.

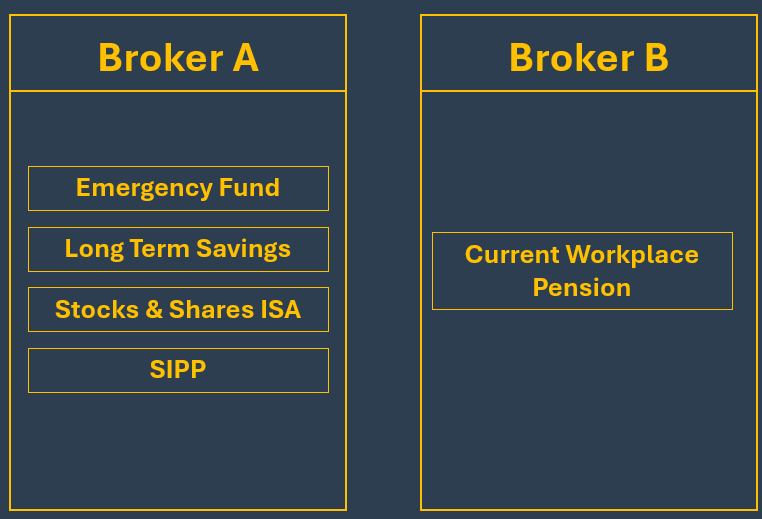

Possible Structures

The way you build your system depends on what’s available — and what keeps your costs low.

Here’s how I’ve set mine up.

It may not be the most fee-efficient model, but it’s simple, clear, and works for me.

My Structure

Account A

A high-interest savings account with instant access. This is my safety net — no risk, full liquidity.

Account B

I use Interactive Investor, a flat-fee platform that offers both a SIPP and a Stocks & Shares ISA.

It’s not the cheapest, but having both accounts in one place makes life easier.

They also transferred an old workplace pension (from Standard Life) into my SIPP - for free.

Account C

This one is dictated by my employer. I have no choice - it’s with a separate provider and comes with a 0.5% fee (ouch).

But they contribute monthly, which is the most important thing.

Simpler

For maximum efficiency, you could:

Use a Cash ISA for your emergency fund

Find a single brokerage offering all three: SIPP, Stocks & Shares ISA, and Cash ISA

Look for flat-fee or no-fee options

If you can centralise everything in one low-cost platform, that’s both clean and cost-effective.

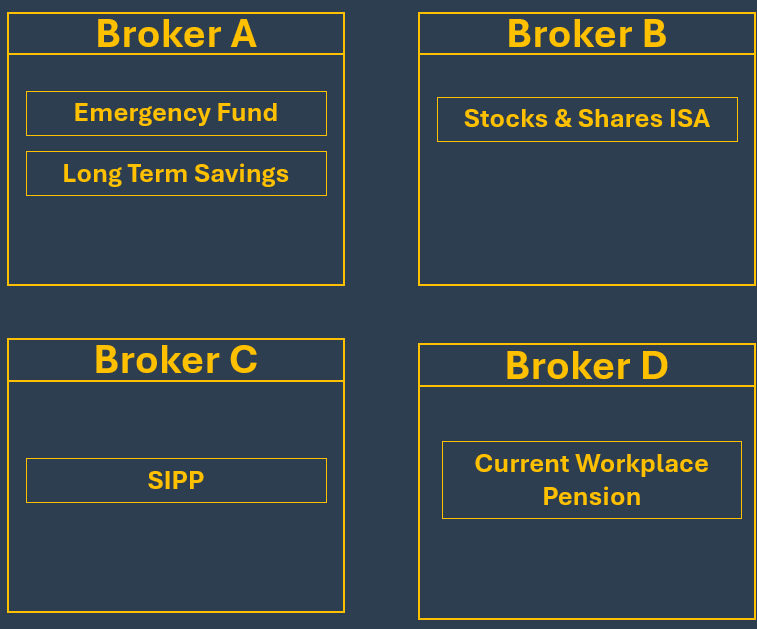

Split

Alternatively, you might find the lowest fees by spreading your accounts across different providers:

One for your ISA

Another for your SIPP

A third for your emergency fund & savings

A split structure could be any mix of these. That’s totally fine — as long as you’re happy managing the logins, interfaces, and statements.

Contributing to an ISA vs Pension

Remember the features and benefits of each:

When an ISA Might Be Better:

You want flexibility — to access funds before retirement

You’re already maxing your pension contributions

You’re planning for medium-term goals

You don’t want to think about withdrawal taxes later

When a Pension Might Be Better:

You’re in the higher tax bracket (40–45%) and want to reduce your income tax now with tax relief

Your employer offers contribution matching (free money!)

You’re not planning to access the funds before age 57

You want to lock money away for long-term growth

The Balanced Approach:

Many people do both.

Use a pension for long-term, tax-efficient compounding

Use an ISA for flexible, tax-free access along the way

The right mix depends on your income, your freedom timeline, and your comfort with locking money away.

Use the Escape Calculator (out next week!) to model different contribution amounts across different accounts.

🛠 The key is not to find the “perfect” structure — it’s to build one that works for you, and stick with it.

Recap

Open & consolidate your Savings + ISA + SIPP + workplace pensions.

Automate equal monthly buys of the same index funds in each account.

Stay the course—ignore headlines, let compounding and time do the work.

In the next post, we’ll look at how to project your journey using your actual numbers — and see how close you might already be to financial freedom.

You’ve built the engine.

Now it’s time to check the dashboard.

Up Next: Investor Psychology - Spot the traps that keep you returns low and you poor

Plug in your assets, income, and goals, and see when you might reach financial freedom. It’s not theory anymore. It’s your timeline.

Looking Ahead

Investigate what is on offer in the market place in terms of:

Fees

ability to transfer old pensions into a SIPP

savings rates

What did you find, what did you decide to do? Let me know in the comments or chat!

Are you stuck? Confused? I’m here to help - so ask in the comments and I will try and help

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.