3.10 Gold Investing: Your Guide to the Ancient Hedge

What place does everybody's favourite shiny metal have in your plan?

Missed last week? Read it here, or see the full escape map here

TL;DR - Gold: The Seductive Survivor

✅ Gold is a fear hedge - it shines when markets fall or inflation spikes

✅ It doesn’t produce income or grow like equities - it preserves, not compounds

✅ Before 1971, gold was stable; since then, volatile and emotionally driven

✅ Useful as “insurance” in retirement portfolios, but weak in bull runs

✅ Index-linked bonds may offer better inflation protection, with more stability

✅ Physical gold is tangible - but comes with storage, theft, and liquidity risks

✅ Buy gold via low-cost ETFs (e.g. SGLN, GLD) - avoid miner funds unless intentional

✅ Governments have historically restricted gold ownership - it’s not immune to politics

The Midas Touch

King Midas thought he was asking for wealth.

What he got was a curse.

After showing hospitality to the wine-loving satyr Seilenos, Midas was granted a wish by the god Dionysus. He chose what so many dream of - that everything he touched would turn to gold.

At first, it was magic. Then his food turned to metal.

His drink, undrinkable.

His daughter - lifeless.

Desperate, Midas begged Dionysus to reverse the gift. He was told to bathe in the River Pactolus. He did - and the power left him. But the river? Its sands shimmered with gold forevermore.

Gold is seductive. But is it the ultimate asset, or a blessing and a curse together?

The Ultimate Store of Value

Throughout history, gold has been seen as the ultimate financial anchor.

In war, recession, revolution - it keeps its appeal.

It’s beautiful, portable, durable - and universally wanted. Whether it’s turned into jewellery or buried in treasure chests, gold has always whispered the same promise:

“When everything else fails, I’ll still be worth something.”

That’s why people turn to gold in uncertain times.

Not because it earns interest. Not because it grows.

But because in a crisis, you can still sell your gold and survive.

Gold doesn’t produce an income, or grow in size, but it does act as a “fear hedge” - people rush to gold when markets crash.

But on the flip side - people tend to sell it when markets rise, so it does fluctuate in value.

Gold can be used for inflation protection – gold tends to rise when currency weakens (you’re money is worth less, so store gold instead).

Gold - value over time

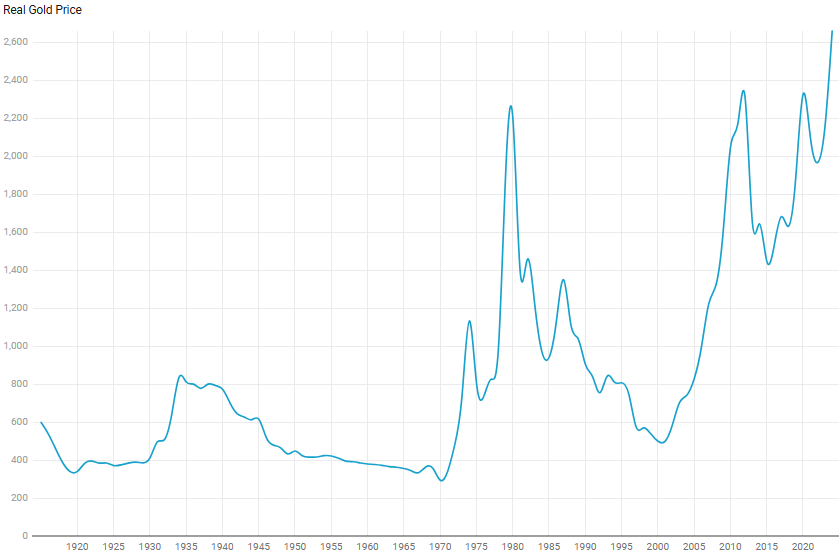

Here’s the inflation adjusted value of gold over the period 1915-20251. “Inflation adjusted” means that all values are in today’s money.

When the value of paper money (the US dollar) and the price of gold were linked, there were long stretches of stability - where gold holds steady around $500 per ounce (that’s the “store of value” doing its job).

However those were de-linked in 1971, and since then it’s been a wild ride:

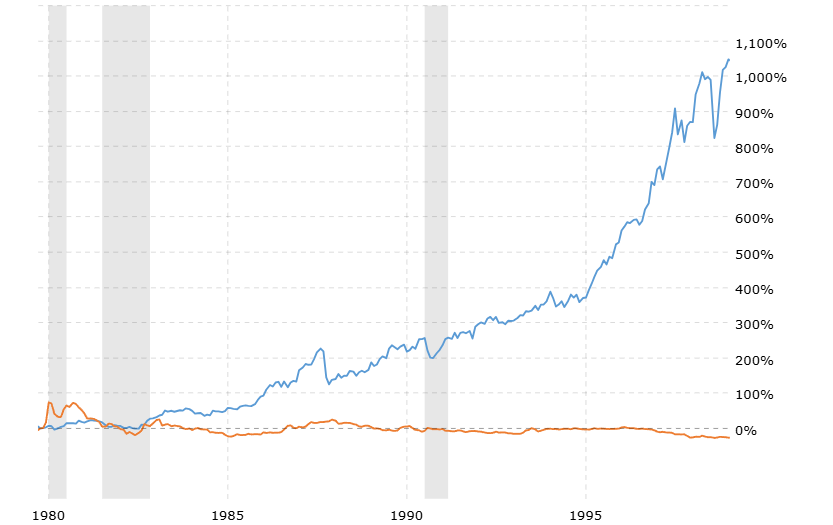

Blue is the S&P 500

Gold is gold2:

Pre-1971: “Money as Gold” Era

Stable Real Price (~$500/oz) when dollars were pegged to gold—true “store of value.”

Post-1971: Floating Regime:

1970s Surge: Oil shocks, high inflation, recession fears → gold spiked as a safe haven.

1980–2000 Decline: Massive equity bull market, low inflation → gold languished.

2000–2011 Rally: Tech crash and Great Financial Crisis → fear drove gold back up.

2011–2020 Pullback: Stocks rebounded, calm markets → gold cooled off.

2020–Present Resurgence: Pandemic, geopolitical tension, CPI spikes → gold back in demand.

When Might Gold Make Sense?

If you're close to retirement and want to hedge against market downturns, then having a small allocation to gold may suit your risk appetite.

However If you are still building towards your escape plan and want the full upside of equities, then gold will dampen your returns in bull markets, as its real value tends to fall.

A better hedge against inflation during that period may be index linked government bonds, which give guaranteed returns that account for inflation, and will be less of a rollercoaster if you hold them to maturity.

UK Index linked GILTS will give you that protection more reliably than Gold.

Where to Buy Gold

It is easiest to get access to the price of gold via Gold Index Funds & ETFs, for example:

Buy them on the same investment platforms used for stocks and funds.

These track the price of physical gold, without needing to store or insure anything yourself - the provider holds the gold securely for you.

⚠️ Some funds invest in gold miners, not gold itself - such as:

VanEck Gold Miners ETF

iShares MSCI Global Gold Miners ETF (GDX)

These give exposure to gold mining companies, not just the price of gold — so their performance depends on business operations as well as gold prices.

Make sure you know which one you’re buying.

Buying Physical Gold

Some investors prefer to own physical gold — coins, bars, or jewellery you can hold in your hand. It’s the oldest form of wealth preservation. No third parties, no digital systems. Just you and the metal.

But while it feels secure, physical gold comes with unique risks, costs, and complications.

🇬🇧 UK: Where to Buy Physical Gold

Royal Mint – royalmint.com (VAT free)

Baird & Co. – bairdmint.com

Atkinsons Bullion – atkinsonsbullion.com

In the UK, Gold incurs no VAT.

🇺🇸 US: Where to Buy Physical Gold

APMEX – apmex.com

JM Bullion – jmbullion.com

SD Bullion – sdbullion.com

⚠️ Risks of Owning Physical Gold

While tangible gold gives you sovereignty, it also exposes you to:

Storage Risk

Keeping gold at home (under the bed, in a safe) is convenient - but vulnerable.

Consider a bank safety deposit box or a professional vaulting service (offered by dealers or third-party custodians).Theft

Gold is compact, valuable, and untraceable once stolen. If you're storing at home, insure it under your home contents policy - but many policies don’t cover high-value metals.Liquidity & Selling Hassles

Unlike ETFs or funds, you can’t click and sell. You’ll need to find a dealer, get it appraised, and possibly accept a lower price (especially for jewellery).Premiums & Spreads

You’ll pay over the “spot price” (often 5–10% or more). When selling, you may receive below spot. The bid-ask spread can eat into your returns.Legal Risk (Yes, Really)

Gold ownership has been criminalised in the past:USA, 1933: Executive Order 6102 made it illegal to own most forms of gold. Citizens were forced to sell to the government at a fixed price.

Other examples: India, Australia, and various European countries have had restrictions at different times in history.

While such actions are rare today, they show that even physical gold isn’t immune to government intervention during crises.

Should I Own Physical Gold?

Owning physical gold can be a store of value and hedge against system risk, but it’s not always practical for modern investing. Consider your reasons carefully - and ensure you have secure storage and insurance if you go this route.

If you want gold’s diversification benefits without the hassle, ETFs and funds remain the simpler, safer path for most people.

🔁 Recap: Gold in Your Escape Plan

1️⃣ Gold Preserves, Doesn’t Produce

It doesn’t pay interest or dividends. In bull markets, it may fall behind equities.

2️⃣ A Crisis Hedge, Not a Growth Engine

Gold shines in recessions, crashes, and high inflation. It’s financial insurance, not fuel.

3️⃣ Physical vs ETF Exposure

ETFs offer low-cost, liquid access. Physical gold is ownable but risky (storage, theft, bid-ask spreads).

4️⃣ Buy Smart, Avoid Miner Confusion

Gold miners ≠ gold price. Make sure your fund tracks bullion, not companies.

5️⃣ Legal and Historical Risks Exist

Gold bans have happened - even in democracies. While rare, it reminds us that no asset is truly untouchable.

Just as King Midas found, gold can be a blessing when all else is failing around you, but a curse when markets rise, and gold is falling.

Are there any other newer stores of value that we can consider? Next we look at the newest game in town, crypto:

Up Next: Crypto - All that Glitters, is not Gold?

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

https://www.macrotrends.net/2608/gold-price-vs-stock-market-100-year-chart

Disclaimer: This content is for informational and educational purposes only. It does not constitute personal financial advice. Everyone’s situation is different — if in doubt, speak to a qualified, regulated financial adviser.